An Analog for the Gold Stocks Correction

Commodities / Gold and Silver Stocks 2017 Mar 11, 2017 - 05:27 PM GMTBy: Jordan_Roy_Byrne

The gold stocks bounced strongly today after the February jobs report confirmed the Federal Reserve will hike interest rates next week. While precious metals rallied strongly following the previous two hikes, I’m not so sure today marks the start of a big rebound. For one, the Federal Reserve could hike rates again in July. Second and more important, the technical setup argues for more back and forth action in the weeks and months ahead. While the current price action in the gold stocks is different from that in the previous cyclical bull markets, we do think we have found one viable comparison for the current correction.

The gold stocks bounced strongly today after the February jobs report confirmed the Federal Reserve will hike interest rates next week. While precious metals rallied strongly following the previous two hikes, I’m not so sure today marks the start of a big rebound. For one, the Federal Reserve could hike rates again in July. Second and more important, the technical setup argues for more back and forth action in the weeks and months ahead. While the current price action in the gold stocks is different from that in the previous cyclical bull markets, we do think we have found one viable comparison for the current correction.

Although the gold stocks may rally for a few weeks in the short-term, I see them testing the December lows or close to those lows before retesting their February peaks. If this occurs and the correction that began last summer remains in effect, then what does that mean for the larger picture?

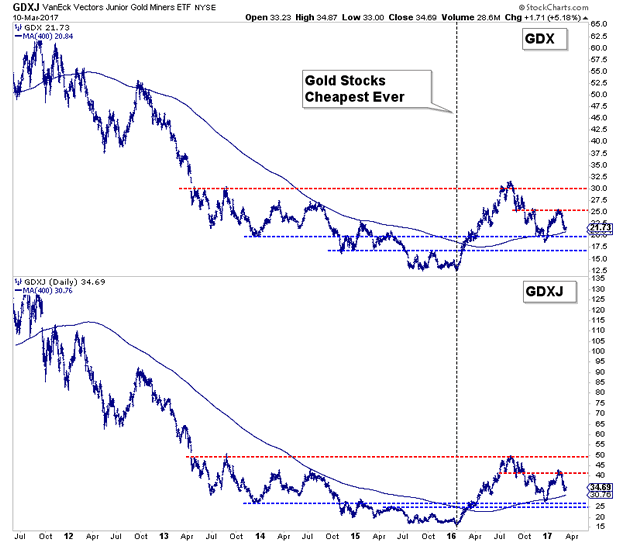

Put simply, the gold stocks formed a historic low in January 2016 and are undergoing a sizeable correction (in price and time) to the record advance that took place in the first half of 2016. A long and deep wave 2 correction, though not typical has a few historical examples.

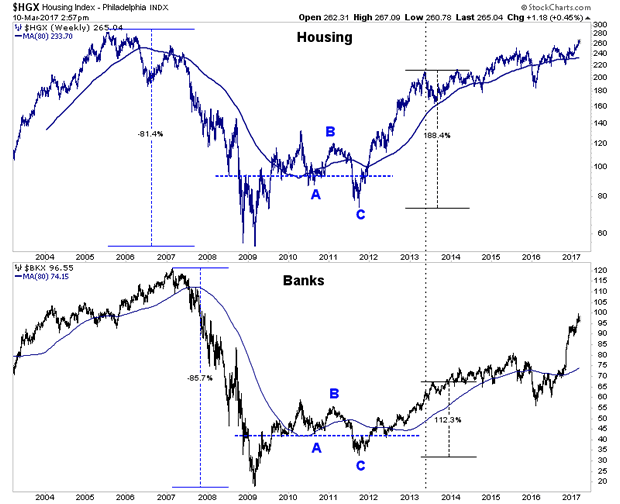

In the chart below we plot the housing and banks sectors, which endured a sizeable wave 2 correction (in price and time) in 2010-2011 before exploding higher from late 2011 to early 2013.

These two sectors share several key similarities to the gold stocks at present. They endured a devastating bear market of more than 80%. (It was the worst bear market in over 80 years). They rebounded strongly from their historic 2009 bottoms. In particular, the banks surged 250% in 12 months. Then both sectors corrected 44% in a correction that lasted 17 months and longer than the initial rebound. Finally, note that the banks and housing sectors experienced a technical breakdown (C leg) in late 2011 that effectively served as a massive bear trap and a tremendous buying opportunity.

With respect to the gold stocks, the point is additional technical weakness and a breach of support will likely be a great buying opportunity and not a sell signal. Gold stocks in January 2016 were the cheapest they had ever been. Going forward over the next few months, the closer they trade to those levels, the better buying opportunity it is. Given the historical context, one should not overreact if the miners lose their 400-day moving averages or temporarily break their December lows. Due to the gold stocks being only 15 months removed from such a historic bottom, there simply aren’t enough new sellers to drive the sector that much lower.

The gold stocks appear to be following a rare but viable example of a lengthy bull market correction. Unless they can rally back to their February highs soon then the analog to the housing and banks sectors remain in play. That aligns with our outlook of the spring and summer being a grind. As we noted last week, the way to play this setup is to buy weakness and avoid chasing strength. We are actively looking for bargains that we can buy and hold through this period into the next big move higher.

For professional guidance in riding the bull market in Gold, consider learning more about our premium service including our favorite junior miners for 2017.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.