Raising the Ides of March US Debt Ceiling Limit

Interest-Rates / US Debt Mar 14, 2017 - 08:22 AM GMTBy: BATR

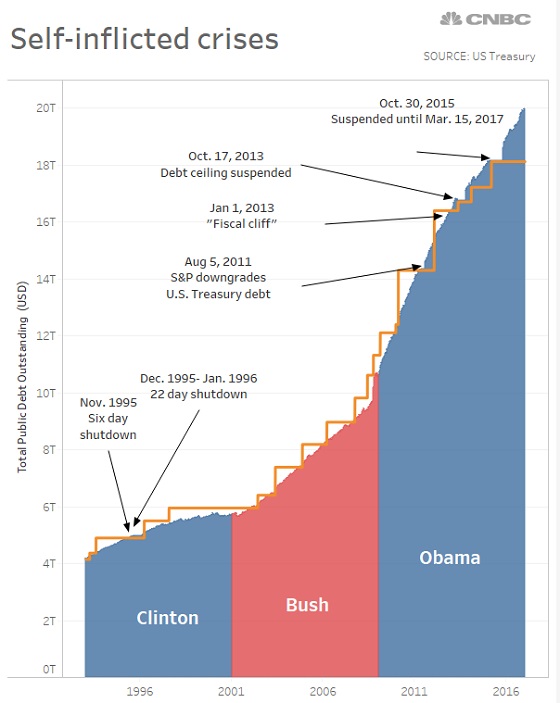

One of the most played out scenarios in the rarified air of Washington life support is keeping the debt balloon inflating without blowing. Dismissing all the drama from the Kabuki theater that relies upon passing another continuing resolution to raise the debt limit seems to be one of the most reliable predictions that can be made about Congress. Come hell or high water, the borrowing ceiling goes up. So when Mnuchin calls on Congress to raise debt limit as deadline approaches, all seems ready to follow the familiar pattern of kicking the can down the road.

One of the most played out scenarios in the rarified air of Washington life support is keeping the debt balloon inflating without blowing. Dismissing all the drama from the Kabuki theater that relies upon passing another continuing resolution to raise the debt limit seems to be one of the most reliable predictions that can be made about Congress. Come hell or high water, the borrowing ceiling goes up. So when Mnuchin calls on Congress to raise debt limit as deadline approaches, all seems ready to follow the familiar pattern of kicking the can down the road.

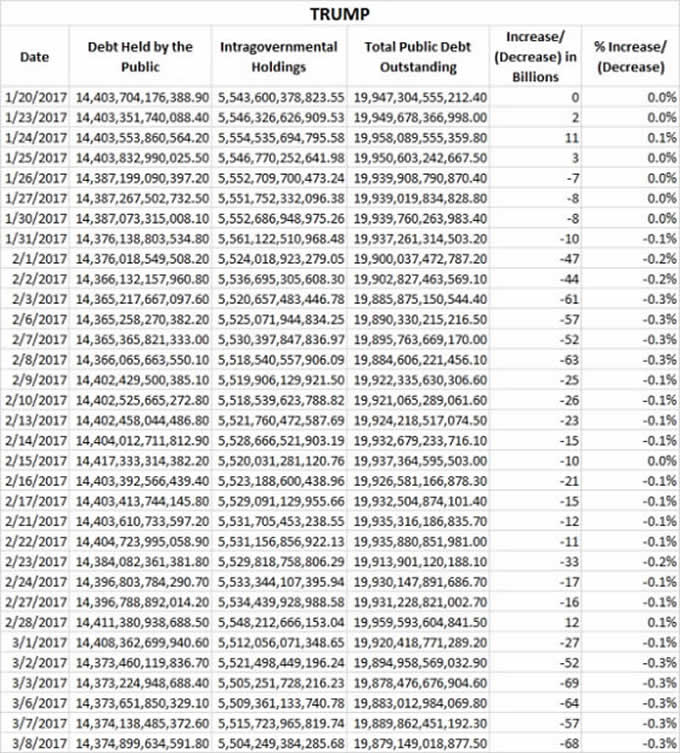

Since the election of Donald Trump as President, the confidence level and equity markets have soared. Positive economic sentiments, while not reported in most of the controlled media, has pivoted to be the most optimistic in decades. So when an account states that the US Debt Decreased by More Than $60 Billion Since Trump Inauguration, you can hear the roar from red state supporters.

"On January 20th, the day of the Trump Inauguration, the US Debt stood at $19,947 billion. On March 8th, more than a month later, the US Debt load stood at $19,879 billion. Trump has cut the US Debt burden by $68 billion and 0.3% in since his inauguration!"

Well, this bit of encouraging news is only part, a snap shot in change of direction and cannot be taken as a long term trend. Another seasonally adjustment adds to the federal coffers. CNSNEWS announces that the Treasury has taken in $611,318,000,000: Individual Income Taxes Set Record Through February.

"The federal government collected a record of approximately $611,318,000,000 in individual income tax revenues through the first five months of fiscal 2017 (Oct. 1, 2016 through the end of February), according to the Monthly Treasury Statement released today.

That is about $6,733,300,000 more than the $604,584,700,000 in individual income taxes (in constant 2017 dollars) that the federal government collected through the first five months of fiscal 2016.

Despite collecting a record amount in individual income taxes, the Treasury still ran a $348,984,000,000 deficit in the first five months of this fiscal year."

The abrupt good news of a reduction in indebtedness, just does not negate the harsh reality that the yearly national deficit keeps growing at rates that defy any reasonable way to reverse. It must be stipulated that the Trump administration has placed a low emphasis on tackling the debt juggernaut.

With the immediate prospects that the Federal Reserve will embark on a sustained interest rate increase, the task of dampening down future obligations looks remote. The case for stating the risks is energetically made by David Stockman, former Director of the Office of Management and Budget under President Ronald Reagan. Note that his consistent anti-establishment voice, who has enraged the antagonism of the Beltway culture, is dismissed as a mere alarmist. However, if you take the time to read his arguments, it is very difficult not to be horrified.

Zerohedge offers this analysis of Stockman: "After March 15 Everything Will Grind To A Halt" sets the stage as the deadline to increase the borrowing limit approaches.

"Trump is inheriting a built-in deficit of $10 trillion over the next decade under current policies that are built in. Yet, he wants more defense spending, not less. He wants drastic sweeping tax cuts for corporations and individuals. He wants to spend more money on border security and law enforcement. He’s going to do more for the veterans. He wants this big trillion dollar infrastructure program. You put all that together and it’s madness. It doesn’t even begin to add up, and it won’t happen when you are struggling with the $10 trillion of debt that’s coming down the pike and the $20 trillion that’s already on the books.”

Add into the equation the even more problematic condition that reasons, Stockman: Trump's in a Giant Debt Trap.

“They need a budget resolution for the next fiscal year. They have to have a debt ceiling increase before then. It is a chicken and egg conundrum. The debt ceiling freeze is in and right now it is on holiday. On March 15 it will freeze in. There will be $200 billion on the balance sheet which will dissipate by the day with no borrowing authority. Then where do they get a majority? The Freedom Caucus, Tea Party Republicans are not going to vote for a multi-trillion debt ceiling increase before they repeal Obamacare. The Democrats are not going to help Trump as long as he is slamming their constituencies and putting up walls at the border.”

“The market is totally missing the fact that the tax cut isn’t going to happen. That instead there is going to be this terrible showdown on the debt ceiling. This will create a panic and sell-off like we haven’t seen before. Yesterday was “Tulip Time” and irrational exuberance on steroids. Once it becomes clear that a clock is ticking it will become a massive time to sell.”

Such a conclusion would instill panic into the system, if Stockman is correct. Yet, most will simply ignore the warning of this day of reckoning and assume that business as usual will emerge. The public debt jumps from about $19 trillion + this year to over $29 trillion in 10 years by 2026, according to appropriate budgetary levels for fiscal years 2018 through 2026. Will the Freedom Caucus faction of the GOP capitulate to the pressures of avoiding default? Or will the bitter feud over the repeal and replacement of Obamacare leave an anger that destroys any disposition to up the ceiling? Surely, Democrats in Congress may see this crisis as an opportunity to let the U.S. go into technical default.

So much for the prospects, Trump Promised to Eliminate National Debt in Eight Years. Good Luck With That. "Donald Trump told the Washington Post he would get rid of the national debt “over a period of eight years.” It may have been the boldest promise he’s ever made, considering the U.S. hasn’t been debt-free since 1835."

The careerist politicians are far less fearful of defaulting on the official debt ceiling, because the off budget and total unfunded obligations is so enormous that the entire international monetary system would have to be re-invented to rescue world commerce. For the end reality is that the current debt cannot and will never be paid and the principle retired.

Just maybe this March 15, 2017 deadline might become the impetus to end the charade of maintaining a debt ceiling at all and eliminate the pretense of fiscal responsibility. If the Treasury was serious about creating financial breathing room to the burden of unsustainable current interest payments, the short term national debt should be substituted for 30 or even 50 year bond obligations while interest rates are so low. However, this strategy was never used, because the moneychangers have no intention of even providing a temporary relief to the taxpayer.

While a Trump tax cut, both corporate and personal will certainly drive economic growth, the absence of any discussion, much less a commitment to cut spending guarantees the sink hole of financial oblivion will only intensify.

An example that illustrates this certainty Once Again, Raising the Debt Limit Emerging as a Flash Point, comes from one of the usual and familiar suspects.

"In a meeting with reporters Thursday, House Democratic Whip Steny H. Hoyer said Democrats would be “inclined” to vote for a debt limit increase as long as the bill is clean, meaning it would raise the debt limit without any conditions. But the Maryland lawmaker added that if conservatives insist on a trade-off for raising the borrowing ceiling, “that’s a different question.”

Partisan brinksmanship is the order of the day in this dysfunctional and surreal club for power elites. Any sincere patriot is soon confronted with compromise or outright sell out of principle in order to maintain their seat in Congress. As long as debt created money is issued by the private Federal Reserve, there can be no way out of this dilemma.

Robert Romano offers up this cheerful thought:

" After 20 years of excessive borrowing — all but guaranteed as Baby Boomers fully receive their Social Security, Medicare and Medicaid benefits — the national debt would be $93 trillion.

And if the economy continues at its current anemic rate, the GDP would only be $40 trillion — a debt to GDP ratio of 232 percent.

If that happens, Trump will almost have certainly failed to get the U.S. economy moving again. In a very short span of time, the U.S. could be left with a debt that can never possibly be repaid."

If this is the fate that befalls us, eliminating the debt limit ceiling becomes immaterial. Trump may well have to resort to directly issuing Treasury bonds and by pass the Federal Reserve note legal tender laws. In any event, the looming Ides of March, day of reckoning may well be the death nil for the American Caesar Imperial Empire.

Source: http://batr.org/autonomy/031417.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2017 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.