European Elections and Gold

Commodities / Gold and Silver 2017 Mar 17, 2017 - 10:44 AM GMTBy: Arkadiusz_Sieron

The most commonly cited bullish arguments in favor of gold right now are the problems faced by the Old Continent, mainly the elections in certain countries. So let’s analyze them individually to consider their potential impact on the gold market.

On March 15, the general election in Netherlands will be held. The fear is that the right-wing Party for Freedom might win. The party is anti-immigration, anti-Islam and it could try to withdraw the Netherlands from the EU. Geert Wilders, the leader of the party, is ahead in most polls, but the lead is narrowing. Anyway, the Netherlands’ exit from the EU is highly unlikely. First of all, even if the Party for Freedom wins, it will probably be unable to form a government (due to its proportional system, no political party has ever won an outright majority in Netherlands – and other parties declared that they will not form a coalition with the Party for Freedom). But even if it is does win and organizes a Nexit referendum, it would probably lose, as most of the Dutch are in favor of the membership within the EU (and it is noteworthy that referenda are not binding under the Dutch constitution). Hence, although the Dutch elections will be closely watched, their significance should not be overstated, especially given the small size of the Dutch economy. However, these results could help set the stage for EU elections later in 2017. Hence, the victory of the Wilders could boost the safe-haven bids for gold as a hedge against the French presidential election, which comes on April 23 (the first round) and May 7 (the second round).

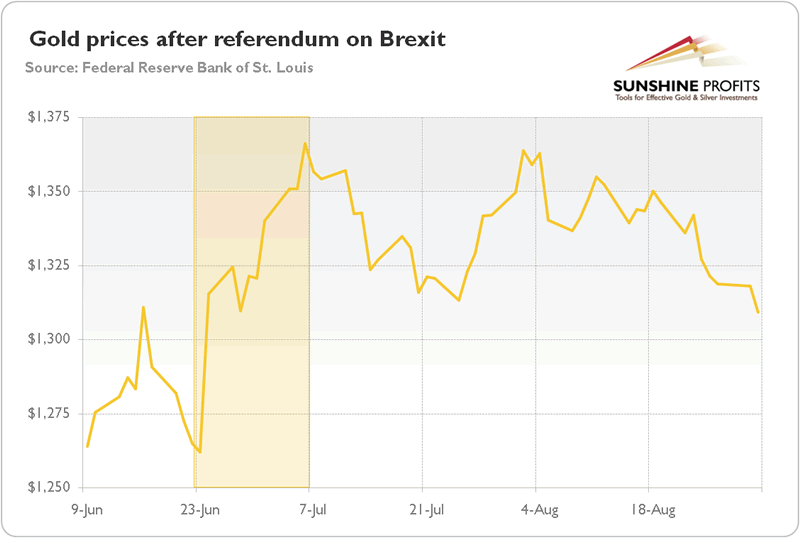

When it comes to France, the biggest threat is that Marine Le Pen, the leader of the anti-Islam and Euroskeptic National Front, will win, since she pledged to hold a referendum on France’s membership in the EU. However, the polls (can we trust them any longer?) predict that Le Pen will win in the first round of voting, but lose in the run-off. You see, if she triumphs in April, it is likely that Socialists (or Republicans) will strategically vote to prevent the National Front from taking the Presidency. And even if she becomes the President, she would probably have to change the constitution to hold a referendum on the French exit from the EU. However, before the election, and especially after the potential success of Le Pen in April, gold may get a boost as a hedge against the Frexit (which would probably end the European bloc we know). But after the second round of elections, the price of gold should decline, since the biggest uncertainty will vanish. As we repeated many times, geopolitical events provide only short-term support for the price of gold (in contrast to banking crises, which, by the way, is still possible in Italy). As the chart below shows, the Brexit vote caused only a short-term rally in gold prices.

Chart 1: The price of gold in the aftermath of the 2016 referendum on the British exit from the EU.

The last key election in Europe will be held in Germany on September 24. Angela Merkel is running for a fourth term as a Chancellor and she is expected to win, although her lead has dramatically narrowed recently. However, she has not lost support in favor of the nationalist Alternative for Germany party, whose growing popularity worries investors the most, but in favor of the Social Democrats. Hence, even if Merkel loses, the power will retain in the hands of mainstream, pro-EU politicians. So it seems that German elections may be the least supportive for the yellow metal, however investors should remember that a lot could happen before September. For example, another terrorist attack in Europe may significantly affect the prospects of elections.

2017 will be an interesting year, to be sure. Actually, it is likely to mark the most volatile political risk environment since World War II according to the Eurasia Group. The French presidential elections probably create the biggest political risk, although elections in the Netherlands and Germany may also shake the markets. Other political risks include: the Iran presidential election, North Korea’s nuclear program, more and more authoritarianism in Turkey, the situation in the Middle East, the possible early elections in Italy, the actions undertaken by Russia, the unfolding Brexit, and the never-ending Greek story. However, the concerns connected with the European elections are significantly overstated. There are, of course, downside risks, but their probabilities are very low. Surely, it may be smart to allocate some funds into gold as a hedge in uncertain times, but any gains may be limited due to the upward pressure on the U.S. dollar. And the gold prices will probably decline after these elections finally take place. As a reminder, 2016 was also a very volatile year for political risk, with Brexit and Trump’s victory, but gold gained just 8 percent.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.