Crypto Craziness: Bitcoin Plunges on Fork Concerns, Steem Skyrockets and Dash Surges Above $100

Currencies / Bitcoin Mar 19, 2017 - 04:34 AM GMTBy: Jeff_Berwick

The last month has not helped bitcoin’s reputation as being a volatile currency.

The last month has not helped bitcoin’s reputation as being a volatile currency.

A month ago bitcoin was trading near $1,000. Two weeks later it sat on the cusp of $1,300. Then, after the SEC turned down a bitcoin ETF, it sank below $1,000 briefly a week ago.

Since then it climbed above $1,250. And, in the last three days, has given up all those gains and is currently below $1,000 yet again.

The biggest reason appears to be concern about a possible bitcoin hard fork.

For those not used to cryptocurrencies, that means a large amount of the users of the currency may split the blockchain and create their own chain… which will leave many, afterwards, having to choose between two different versions of bitcoin.

We warned TDV subscribers that this was the biggest risk we saw to bitcoin a few months ago and it has now come to fruition.

For this reason, I am interviewing one of the biggest names in bitcoin, Trace Mayer, right after this blog is released. It will be released as soon as we can on The Dollar Vigilante Youtube channel here (make sure to subscribe to the channel to ensure you see it as soon as it is out).

Trace is about as connected in bitcoin as anyone I know… in fact, he is my pick for actually being Satoshi Nakamoto. So you won’t want to miss this interview… it could move the market dramatically.

Then, as soon as I am done with Trace, I am interviewing the Bitcoin Jesus, Roger Ver. That interview will be put on Anarchast’s Youtube Channel here (so make sure to subscribe so you don’t miss it).

Roger Ver is the largest proponent of Bitcoin Unlimited and is the one who appears to be forcing this fork issue forward. So, we’ll be talking to him about what he is doing and what might happen next.

DASH & ETHEREUM AT ALL-TIME HIGHS

We have featured very few altcoins to TDV subscribers but two of the ones we have featured are at all-time highs.

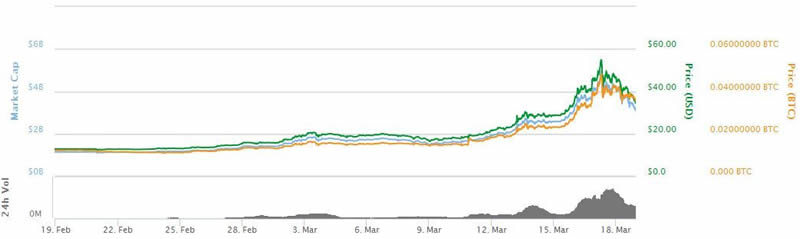

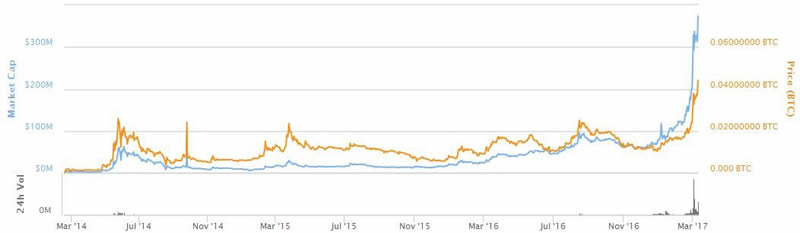

We featured Ethereum about one year ago when it was near $2. It is currently over $40.

To find out what might happen next make sure to check out my interviews with Trace Mayer and Roger Ver in the next 1-2 days and subscribe to the TDV newsletter (subscribe here) to always get the best information on cryptocurrencies.

STEEM SKYROCKETS 200%+

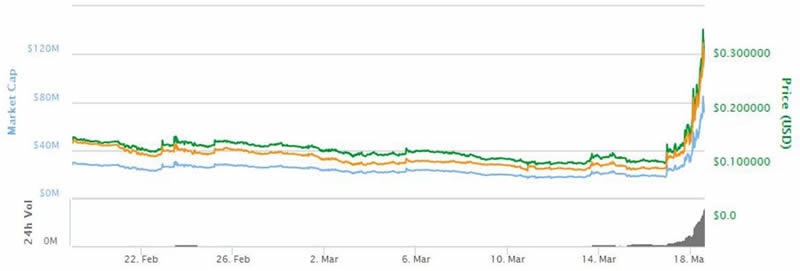

One other cryptocurrency that we featured to subscribers last year is Steem. I warned that it was going to be very, very speculative, but an interesting speculation when it neared $0.20.

It since had sunk as low as $0.07 but then a few days ago, Dan Larimer, one of the co-founders of Steemit, announced his resignation.

The timing was interesting because Steem announced a new powerdown schedule nearly 14 weeks ago and it meant, and some speculated, that it would put extreme pressure on the Steem currency for 13 weeks (the length of the new powerdown).

That looks like it may have come true because Steem skyrocketed in the last few days and is up over 200% in the last 24 hours alone to over $0.33.

CRYPTO CRAZINESS

As you can see, the cryptocurrency market is wild and crazy as you’d expect a brand new sector to be. And, also as you can see, massive gains can be had. We even featured bitcoin at $3 in 2011 so we have made many of our subscribers fortunes.

To find out more about cryptocurrencies and make sure you get all the best information on the space from the financial newsletter who has covered it since 2011 click here.

Yes, cryptocurrencies are volatile. But they also have the potential to make fortunes. And, by using cryptocurrencies you are not abetting or aiding war, terrorism or drug smuggling like those who use US dollars do.

Not that there is anything wrong with drug smuggling. But, that’s a topic for another day.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.