Trump 2013 is Against Everything That Trump 2017 Does

Politics / US Politics Apr 15, 2017 - 05:00 PM GMTBy: Jeff_Berwick

In 2013, Donald Trump could have almost been mistaken for a Dollar Vigilante subscriber. He was against almost anything Obama was doing, was against all the wars and occupations, was against Obamacare and constantly pointed out all the corruption, criminality and waste in government.

In 2013, Donald Trump could have almost been mistaken for a Dollar Vigilante subscriber. He was against almost anything Obama was doing, was against all the wars and occupations, was against Obamacare and constantly pointed out all the corruption, criminality and waste in government.

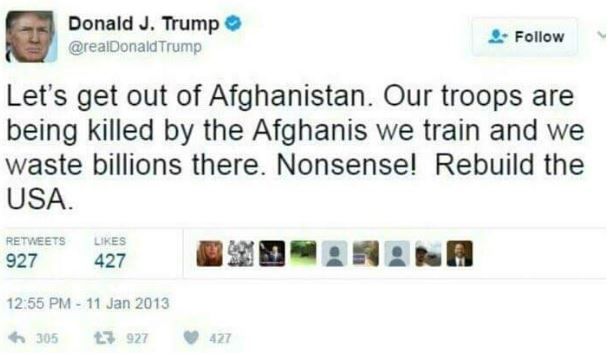

He was adamant about getting the US out of Afghanistan in 2013. He even was as late as 2016. But, then, after he had fooled enough people and became President, he began to do exactly what George W. Bush and Nobel Peace Prize winner, Barack O’Bomber, always did.

Except now he is doing everything even bigger. Or huge as he’d say.

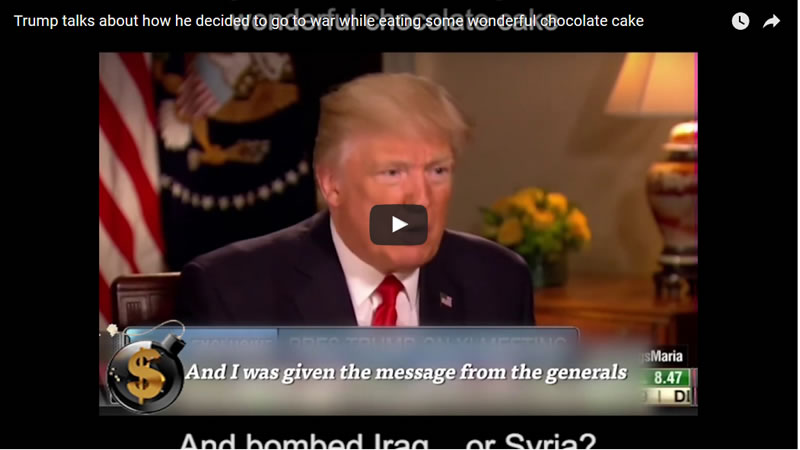

It took around a month for Obama to launch airstrikes on Islamic State group targets in Syria after the Syrian gas attack false flag/hoax in 2013. Trump took only 63 hours.

And, in Afghanistan, where things had grown relatively quiet over the years, Trump took it up a big notch this week, approving the dropping of something called the Mother Of All Bombs (MOAB) on Afghanistan.

So much for “getting out of Afghanistan,” as he wanted in 2013. Now that he’s the frontman for the US government, he continues to bomb a country that had nothing to do with 9/11. If he wanted to bomb the place that was behind 9/11 he’d bomb Washington, DC.

Given the fact he can’t even remember where he just bombed (see video below) maybe there is hope that one day, over some delicious chocolate cake, he’ll accidentally bomb the District of Criminals and get rid of most of the evil in the world.

Of course, Trump continues to say that he is bombing Syria and Afghanistan to “fight ISIS.” But even the LA Times knows that ISIS is a CIA funded operation just as was Al Qaeda.

Trump’s press secretary accidentally told the truth on that earlier this week.

We warned, before the (s)election that Trump was a globalist, Jesuit insider and would just carry on the same agenda that has been carried on now for decades. And it should be clear to everyone that is the case now.

And, even on the topic of “draining the swamp” and reigning in massive government waste, Trump has begun to overfill the swamp to unseen levels, has not reduced government waste by even a penny and, in fact, has somehow managed to outspend the eight ridiculous years of the Obama’s fantastic vacation expenses in less than a year.

Many people still haven’t realized that it was all a sham, but once they do we may see a large selloff in the market.

The Dollar Vigilante’s Senior Analyst, Ed Bugos, just issued a far-out-of-the-money put option on the S&P 500 to subscribers that could make fortunes if we see a large pullback in the stock market. One of the last times TDV issued this put recommendation was in August of 2015 when subscribers gained 4,500% in only three days.

Subscribe to The Dollar Vigilante newsletter to get access to Ed’s latest alert.

Trump said, before the election that he was going to create jobs. Having now bombed Syria, Afghanistan, funding genocide in Yemen and on the verge of war with Russia over Syria and China over North Korea, it looks like he may come through on that promise.

The only problem is that all the jobs will be in the military, as Trump has taken only a few months to enter the US onto the brink of World War III.

If anyone knows how we can get 2013 Donald Trump back, please let us know.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.