Why You Are Not An Investor

Stock-Markets / Stock Market 2017 Apr 22, 2017 - 06:39 PM GMTBy: Raul_I_Meijer

You are not an investor. One can only be an investor in functioning markets. There have been no functioning markets since at least 2008, and probably much longer. That’s when central banks started purchasing financial assets, for real, which means that is also the point when price discovery died. And without price discovery no market can function.

You are not an investor. One can only be an investor in functioning markets. There have been no functioning markets since at least 2008, and probably much longer. That’s when central banks started purchasing financial assets, for real, which means that is also the point when price discovery died. And without price discovery no market can function.

You are therefore not an investor. Perhaps you are a cheat, perhaps you are a chump, but you are not an investor. If we continue to use terms like ‘investor’ and ‘markets’ for what we see today, we would need to invent new terms for what these words once meant. Because they surely are not the same thing. Even as there are plenty people who would like you to believe they are, because it serves their purposes.

Central banks have become bubble machines, and that is the only function they have left. You could perhaps get away with saying that the dot-com bubble, maybe even the US housing bubble, were not created by central banks, but you can’t do that for the everything bubble of today.

The central banks blow their bubbles in order to allow banks and other financial institutions to first of all not crumble, and second of all even make sizeable profits. They have two instruments to blow their bubbles with, which are used in tandem.

The first one is asset purchases, which props up the prices for these assets, through artificial demand. The second is (ultra-) low interest rates, which allows for more parties -that is, you and mom and pop- to buy more assets, another form of artificial demand.

The most important central bank-created bubble is in housing, if only because it facilitates bubbles in stocks and bonds. Home prices in many places in the world have grown much higher than either economic growth or homebuyers’ wages justify.

In many instances they have even caused a feeding frenzy, where people are so desperate to either have a place to live or not miss out on profits that they’ll pay any price, provided rates are low enough for them to get a loan approved.

As I said a few weeks ago in Our Economies Run on Housing Bubbles, the housing bubbles created in this way are essential in keeping our economies going, because it is through mortgages -loans in general- that money is created in these economies.

If this money creation machine would stop, so would the economies. Home prices would come down to more realistic levels, but there still wouldn’t be anyone to buy them, so they would sink further. That, too, is called price discovery. For which there is a bitter and urgent need.

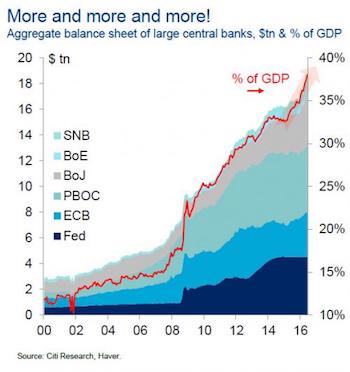

The Fed is an outlier in the central bank system, in that it no longer buys up too many assets. But other central banks have duly taken over. Indeed, Tyler Durden observes today via Bank of America that BoJ and ECB have bought more assets so far in 2017 than central banks ever have before. One may wonder at what point the term ‘asset’ will lose its rightful meaning to the same extent that ‘investor’ and ‘markets’ have:

A quick, if familiar, observation to start the day courtesy of Bank of America which in the latest overnight note from Michael Hartnett notes that central banks (ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” As Hartnett notes, the “Liquidity Supernova is the best explanation why global stocks & bonds both annualizing double-digit gains YTD despite Trump, Le Pen, China, macro…”

A recent graph from Citi and Haver illustrated it this way:

Note the rise in central bank balance sheets before 2008. There’s nothing innocent about it.

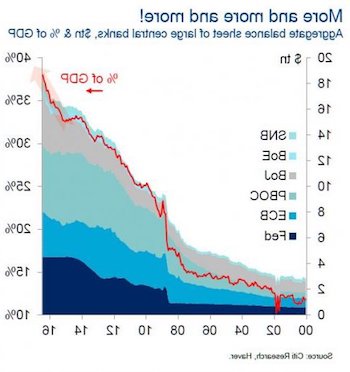

As an aside, I like this variation from the Twitter account of “Rudy Havenstein”, which came with the comment:

Here is a chart of the well being of the American middle-class and poor over the same period.

The Fed tries to become even more of an outlier among central banks, or at least it seems to discuss ways of doing this. Now, I don’t know what is more stunning, the fact that they go about it the way they do, or the lack of anger and bewilderment that emanates from the press and other voices -nobody has a clue what a central bank should be doing-, but the following certainly is ‘something’:

Fed Intensifies Balance-Sheet Discussions With Market Players

Federal Reserve staff, widening their outreach to investors in anticipation of a critical turning point in monetary policy, are seeking bond fund manager feedback on how the central bank should tailor and communicate its exit from record holdings of Treasuries and mortgage-backed securities. Fed officials are intent on shrinking their crisis-era $4.48 trillion balance sheet in a way that isn’t disruptive and doesn’t usurp the federal funds rate as the main policy tool. To do that, they need to find the right communication and assess market expectations on the size of shrinkage, which is why conversations with fund managers have picked up recently. “All indications suggest that conversations around the balance sheet have accelerated,” said Carl Tannenbaum at Northern Trust Company. “The consideration of everything from design of the program to communication seems to have intensified.”

Most U.S. central bankers agreed that they would begin phasing out their reinvestment of maturing Treasury and MBS securities in their portfolio “later this year,” according to minutes of the March meeting. They also agreed the strategy should be “gradual and predictable,” according to the minutes. Fed staff routinely seek feedback from investors and bond dealers to get a fix on sentiment and expectations. The New York Fed confirmed the discussions and said it is part of regular market monitoring. The Fed is getting closer to disclosing its plan, and conversations have become more intense. “They are gauging what’s the extent of weak hands in the market that will dump these assets,” said Ed Al-Hussainy, a senior analyst on the Columbia Threadneedle Investment’s global rates and currency team. “They are calling all the asset managers. It is not part of the regular survey.”

The Fed-created bubbles in stocks, bonds, housing, what have you, have propped up these ‘market players’, which wouldn’t even be ‘market players’ anymore if they hadn’t. That would have made for a much saner world. These people are not ‘investors’ any more either, by the way, and they’re not the chumps either; they are the cheats, the profiteers. At your expense.

Now, with the new capital they have, courtesy of the Fed and other central banks only, certainly not their own intelligence or timing or knowledge, they get calls from Yellen and other Fed people about what the Fed can do for them this time. Yellen et al are afraid that if the Fed starts selling, the so-called ‘market players’ will too. Of course they will.

The bubble created by artificial demand cannot be allowed to burst all at once, it has to be done “gradual and predictable.” As if that is possible, as if the Fed controls the bursting of bubbles it has itself created. And Yellen is not going to call you or me, she could not care less; she’s going the call the pigs she fattened up most. The Fed is more than anything a bunch of academics, seduced exclusively by textbook theories that are shaky at best, to transfer wealth to the most sociopathic and hence seductive financial predators, at everyone else’s expense.

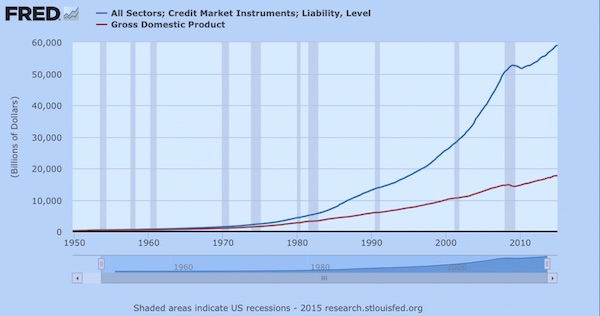

And that expense is humongous. At the same time that the Fed and the rest of the world’s central banks fattened their balance sheets as seen in the graph above, this is what happened to US debt vs GDP:

The Fed bubbles, intended to keep market players whole, are blown at the expense of the real economy. Imagine if all those $20 trillion and counting in central banks’ bubble blowing would have been used to prop up Main Street instead of Wall Street; everybody would have been better off except for the ‘investors’ who are not even real investors.

The problem is, the Fed has no control over its own bubbles. It may or may not devise ways to ‘deflate’ its balance sheet, but the bubbles that balance sheet gave birth to cannot be deflated in the same way. If the Fed did have ‘bubble control’, it would have chosen to keep both the stock markets (S&P) and housing prices at a much lower level, with only a gradual increase. That would have given the impression that things were still doing sort of fine, without adding the risk -make that certainty- that the while shebang would blow up. But once’s the genie’s out of the bubble…

The academics must have missed that part. In the end the Fed works for banks and affiliated ‘industries’, not for people. Even -or especially- those people that like to think of themselves as ‘investors’. Today, in the process, America’s central bank is actively destroying American people. And while the Fed’s operatives may know this or not, the people certainly don’t. They think they’re making fat profits in either stocks or housing. And they are the lucky ones; most Americans are simply drowning.

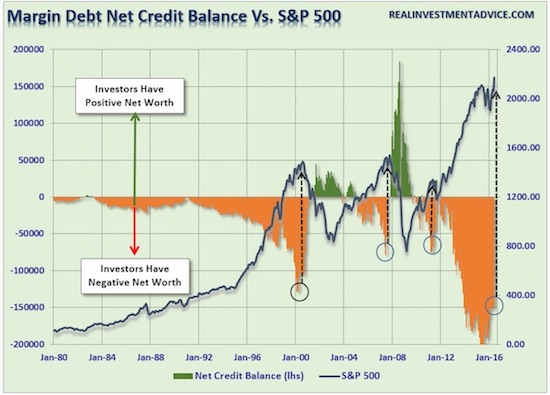

A great representation of all that’s wrong in this comes courtesy of this Lance Roberts graph. A chilling illustration of the price you pay for setting S&P records.

These days, every rising asset price, every single bubble, comes at the expense of enormous increases in debt. And there are still people who wish to claim that this is not a bubble. That it is OK to get into deep debt to purchase a home, or stocks, with leverage: can’t miss out on those rates! And sure, that is still true in theory; all you have to do is get out in time. If only the Fed can get out in time, if only you can get out in time.

‘Getting out in time’ is bubble territory by definition. It’s not investing. Investing is buying an interest in something that you expect to do well, something that you think may be successful in benefiting society in such a way that people will want to own part of it. As I write down these words, I can’t help thinking of ‘It’s A Wonderful Life’, simply because it is so obvious but already feels so outdated.

I’m thinking also of Uber and Airbnb and Tesla and so many other ‘innovative’ ideas. All seemingly thriving but only because there’s so much excess cash sloshing around courtesy of Bernanke and Yellen and Draghi, looking for a next bubble to ‘invest’ in. Ideas that apparently have no trouble raising another $1 billion or $10 billion ‘investment’, in the same way that the Tulip Bubble had no such trouble, or the South Sea or Dot.Com ones.

Good luck with all that, but you’ve been warned, you’re hereby on notice. The odds that you’ll be able to ‘get out in time’ are vanishingly small. And even if you do, most others just like you won’t. And neither will the Fed academics. They have the most so-called ‘money’ at their disposal, and the least sense of what to do with it. But they have their advisers in the private banking industry to tell them all about where to put it: in one bubble or another; anywhere but the real economy.

Have I mentioned yet that all these start-ups and other bubbles are being launched into a rapidly shinking economy? Or you don’t think it is shrinking? Look, there would be no need for the Fed to blow bubbles if the economy were doing fine. And if so, they wouldn’t. Even academics have an innate sense for risk overdose.

C’mon, you’re not an investor. And perhaps you won’t even end up a loser, though the odds on that are slim, but one thing’s for sure. You are a character in an epic poem about losers.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2017 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.