Louis Gave: Emerging Markets And Europe Will Outperform The US In The Next Decade

Economics / Emerging Markets May 24, 2017 - 11:11 AM GMTBy: John_Mauldin

By Stephen McBride : “The key to successful investing is not picking winners, it’s avoiding losers…” Louis Gave, the head of asset management at Gavekal Research, explains his investment philosophy at Mauldin Economics’ 2017 Strategic Investment Conference.

By Stephen McBride : “The key to successful investing is not picking winners, it’s avoiding losers…” Louis Gave, the head of asset management at Gavekal Research, explains his investment philosophy at Mauldin Economics’ 2017 Strategic Investment Conference.

He thinks US stocks will be the losers of the next decade.

Stay Away from Tech and US Equities

Louis points out that the prevailing investment theme of the day is often the one to bet against.

Whether energy stocks in the 1980s, Japanese stocks in the 1990s, or US tech stocks heading into the new century, these sectors were often the worst performing over the following decade.

Today, five of the ten largest companies in the world are US tech firms. Louis thinks they are likely to face a correction in the next years.

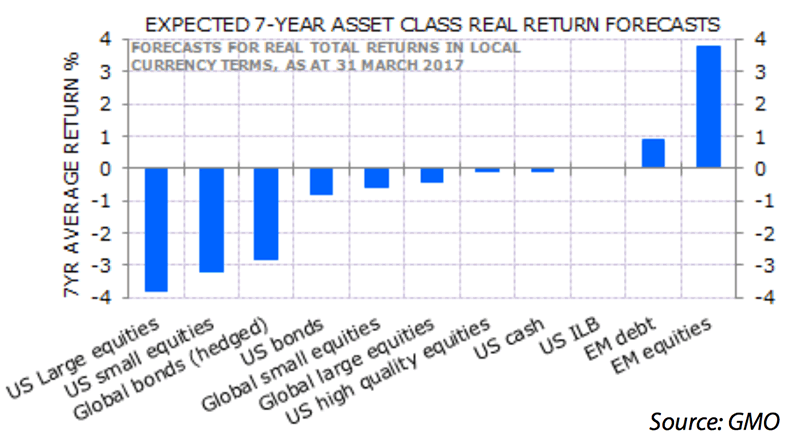

However, it’s not simply history Louis relies on. Projections from GMO, one of the world’s largest money managers, shows that US equities will generate the worst returns among any asset class over the next seven years.

China, India, and Europe Show Much Potential

Louis points out that having been in decline since 2011, emerging markets now look extremely attractive.

One of the major reasons is the reacceleration of growth in China. Louis is bullish on China because of the growing consumer class, which is now 750 million strong.

He’s is also bullish on India… and here’s why.

One of the major problems in India has been the banking sector. Loan growth has been falling for over a decade. However, this trend will likely soon reverse due to the demonetization of the country.

President Modi outlawed 85% of all currency in circulation last December, and since then, 270 million bank accounts have been opened in India.

Louis also pointed out that Europe is likely to outperform the US over the next decade due to a rebounding construction industry and a strengthened relationship between France and Germany.

Louis Gave’s Top Two Picks

At the end of this keynote speech, Louis shared his two best investment ideas for the next decade.

The first one is eurozone stocks. He thinks financials are likely to do well after years of underperformance. The second is consumer staples in developed nations.

Get Live Updates from the Sold-Out 2017 Strategic Investment Conference

Don’t miss out as some of the world’s leading asset managers, geopolitical experts, and Federal Reserve insiders—including John Mauldin, George Friedman, and Ian Bremmer—discuss how to assemble a winning portfolio for the Paradigm Shifts now destabilizing the world. Click here to tune in.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.