UK Terrorist Attacks See Gold Price Stay Firm

Commodities / Gold and Silver 2017 Jun 06, 2017 - 12:24 PM GMTBy: GoldCore

A summer evening on London Bridge and in Borough Market ended in terror on Saturday as attackers killed seven people and injured 48.

A summer evening on London Bridge and in Borough Market ended in terror on Saturday as attackers killed seven people and injured 48.

This is the second terrorist attack on British soil in less than two weeks and the the third this year. The attack was immediately labelled as a terrorist attack. In the hours that followed police arrested a further 12 people who were suspected of having links to the horrendous incident.

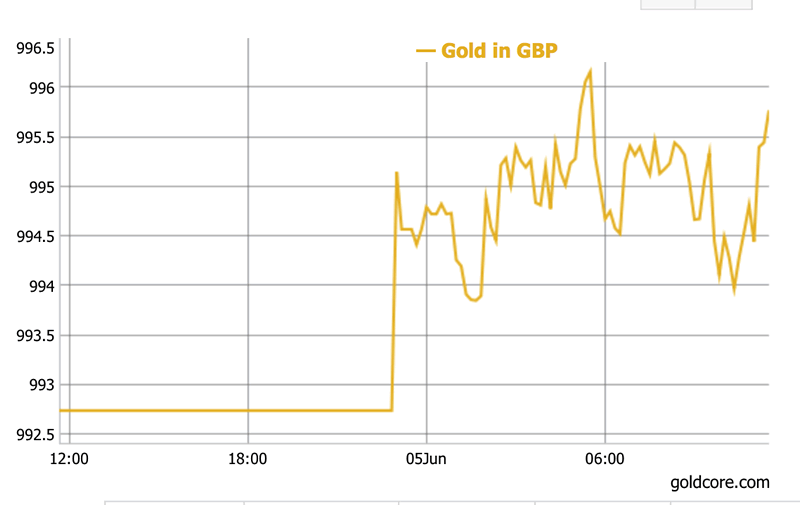

As was seen following the Manchester attack there has been a slight uptick in risk aversion over night. This morning the British pound slipped in Asian trading, both the Yen and gold have retained earlier gains. After dropping 0.7 percent last week the dollar index did edge higher earlier but remains close to 96.654, its lowest since the US election results.

On Friday gold hit its highest in over 6 weeks due to disappointing US jobs data. The Non-Farm Payrolls report showed the labour market was losing momentum. Unemployment is at a 16 year low of 4.3% but data showed below-forecast hiring and wage growth.

This morning gold has not improved on the 1.1% climb achieved on Friday. All eyes now look to the UK elections. Each of the European elections have seen some uptick in safe haven demand for gold but not at panic buying levels.

The London attack comes less than four days before the UK general election. As per the Manchester attack election campaigning was suspended by the majority of parties. It is expected to resume today, with party leaders stating that if we lose democracy then ‘they’ win. Since the attack a fortnight ago, Theresa May’s lead in the polls has reduced significantly.

Unsurprisingly both parties are now focusing on terrorism and counter-extremism polices. Theresa May is considered to be tougher on terrorism than the Labour Party but she has still felt the need to up the ante in her language. Following the London attacks she stepped away from her usual tolerance based rhetoric and stated that ‘enough was enough.’

“There is, to be frank, far too much tolerance of extremism in our country,” she said. “So we need to become far more robust in identifying it and stamping it out — across the public sector and across society. That will require some difficult and often embarrassing conversations.”

Labour are keen to remind voters that no matter what May says the sad fact remains that she has the worst record on countering terrorism. Despite officially suspending campaigning Jeremy Corbyn (previously considered to be weaker on policy regarding terror) used Saturday night’s events as ammunition to attack the Conservatives, who he accused of trying to “protect the public on the cheap”.

Barbs continued to be exchanged across parties, no doubt leading to more confusion and anger from the electorate. Just in time for Thursday’s vote which is looking increasingly close.

Tensions run high after terrorist attacks

Concerns over terrorism are clearly worldwide. We have been reminded of this not only in London where tourists were among the victims but also because of events in the Phillipines and Kabul.

Trump’s visit to the Middle East has also brought the conversation on terror back to the fore. This has already made an impact in the region, one which is likely to lead to upset and instability. This morning Saudi Arabia, Egypt, Bahrain, the United Arab Emirates and Yemen have announced they each cut diplomatic ties with Qatar.

Qatar is accused of destabilising the region due to its relationship with Iran. Qatar called the move “unjustified” with “no basis in fact”. This morning the United Arab Emirates gave Qatari diplomats 48 hours to leave the country. Abu Dhabi accuses Qatar of ‘supporting, funding and embracing terrorism, extremism and sectarian organisations.’

Trump also had something to say about London’s attacks when he tweeted, ‘”At least 7 dead and 48 wounded in terror attack and Mayor of London says there is ‘no reason to be alarmed!’”

Mayor Khan’s team said he had “more important things to do than respond to Mr Trump.” Whilst a few tweets might not mean very much they are a good example of the increasingly frayed relations and opinions between global leaders when it comes to approaching terrorism.

Markets look beyond London

Markets do not feel a significant impact following terrorism events. This is a sad fact as it suggests they are something that are just becoming a part of life. However markets should not be so laissez-faire.Consumer sentiment is very vulnerable, this combined with an already fragile economy and increasingly noisy financial markets could mean a spate of terrorist attacks will negatively impact markets to an extent not seen for many years.

Expect some turbulence in the gold price in the coming days as we approach not only the UK election but also the Federal Reserve meeting. Whichever way the decision goes we might see an uptick in the gold price, traditionally it responds to a dovish tone from the central bank but following recent rate hikes it has reacted positively.

Markets remain uncertain and often fragile. The uncertain political climate both in the UK and the United States its negatively impacting currencies. Concerns over the fragility of both the economy but also the security of countries’ citizens will lead to continuing demand for safe haven gold.

Gold Prices (LBMA AM)

05 Jun: USD 1,280.70, GBP 992.41 & EUR 1,136.88 per ounce

02 Jun: USD 1,260.95, GBP 980.39 & EUR 1,123.88 per ounce

01 Jun: USD 1,266.15, GBP 984.81 & EUR 1,128.01 per ounce

31 May: USD 1,263.80, GBP 987.79 & EUR 1,129.96 per ounce

30 May: USD 1,262.80, GBP 982.46 & EUR 1,132.23 per ounce

26 May: USD 1,265.00, GBP 983.41 & EUR 1,127.87 per ounce

25 May: USD 1,257.10, GBP 969.48 & EUR 1,119.57 per ounce

Silver Prices (LBMA)

05 Jun: USD 17.52, GBP 13.58 & EUR 15.59 per ounce

02 Jun: USD 17.19, GBP 13.37 & EUR 15.33 per ounce

01 Jun: USD 17.13, GBP 13.33 & EUR 15.26 per ounce

31 May: USD 17.31, GBP 13.48 & EUR 15.43 per ounce

30 May: USD 17.27, GBP 13.42 & EUR 15.49 per ounce

26 May: USD 17.29, GBP 13.45 & EUR 15.41 per ounce

25 May: USD 17.15, GBP 13.23 & EUR 15.29 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.