Why Airlines Are The Next Big Trade

Companies / Sector Analysis Jun 07, 2017 - 04:41 AM GMTBy: John_Mauldin

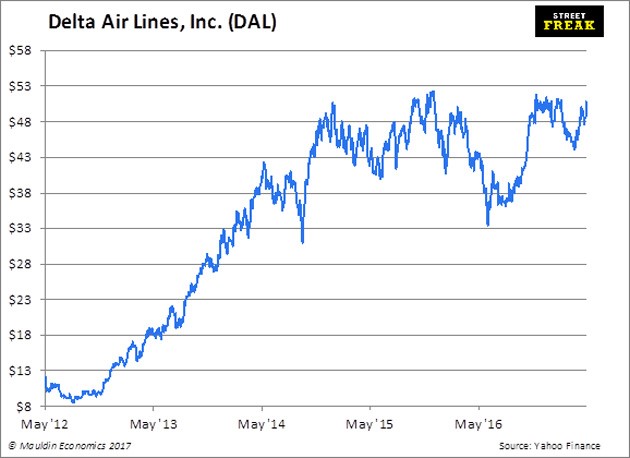

BY JARED DILLIAN : I’m a longtime airline bull, going all the way back to 2012–2013—long before it was trendy.

BY JARED DILLIAN : I’m a longtime airline bull, going all the way back to 2012–2013—long before it was trendy.

I liked airlines because everyone hated them. Especially Warren Buffett, who once said that someone should have shot Orville and Wilbur out of the sky. He now owns the stocks.

A pilot wrote a great article in The New York Times saying that the conventional wisdom about airlines (which is that they suck) is all wrong.

People like to talk about the golden age of flying, with three-course meals, plenty of room to stretch out, people wearing ties, the piano bar in 747s… all that jazz.

But there was no golden age of flying. In fact, the golden age of flying is now.

Flying today is:

- Massively cheaper—prices are down over 50% in real terms.

- Way more convenient—there are flights pretty much wherever you want to go.

- Safer—there hasn’t been a crash by a major airline in the US in 15 years.

- Greener—planes were louder, less fuel-efficient, and more polluting.

- Smoke-free—people used to smoke! Today, that would be intolerable.

- Fun—there’s enough entertainment, with in-flight wifi, unlimited movies, etc.

- Still pretty roomy—there’s a little less space than there used to be, but not as bad as people think.

This is yet another example of people being habitually sullen and taking things for granted. Flying is pretty awesome. As Louis C.K. said: “You’re in the sky… in a chair!”

False Perception

But didn’t United Airlines just throttle a guy and drag him off the plane?

Didn’t a flight attendant from another airline try to start a fight with a passenger?

Didn’t Spirit Airlines customers start a riot at the ticketing desk in Fort Lauderdale?

There is a phenomenon in social psychology—I don’t know if there is a name for it1—but when you see something in the news, like a passenger being mistreated, chances are you going to see that over and over again for months, until the news people get bored and move on to something else.

Based on the newsflow, you might be led to believe that airlines beat up their passengers all the time, and that flying commercial is some kind of dystopian hell.

Certainly some aspects of it are less pleasant than they used to be, and a lot of that has to do with airport security.

If Everyone Hates It, Buy It

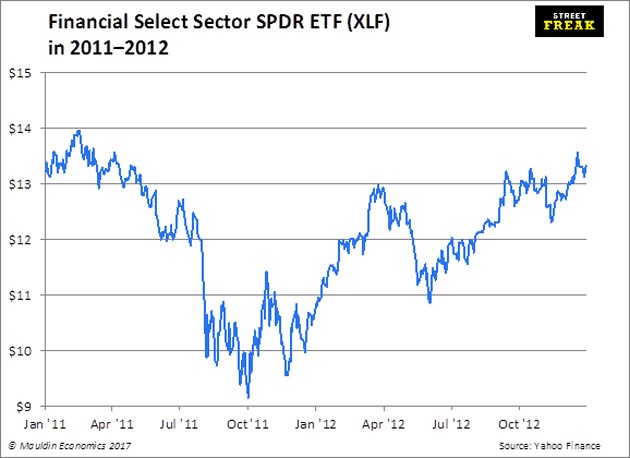

One of my really great trades was back in 2011 when Occupy Wall Street happened.

Oh, I remember that clearly.

Sentiment towards banks and bankers is still pretty bad, but it reached a low point in 2011. I remember thinking… if everyone hates banks, then banks are probably going to… rally!

In fact, it was a massive rally. I called the trade “Occupy XLF” at the time. Occupy Wall Street pretty much marked the lows in financials.

It always works out that way.

Airlines aren’t on the lows, but I can tell you that when everyone hates airlines… airlines are probably going higher.

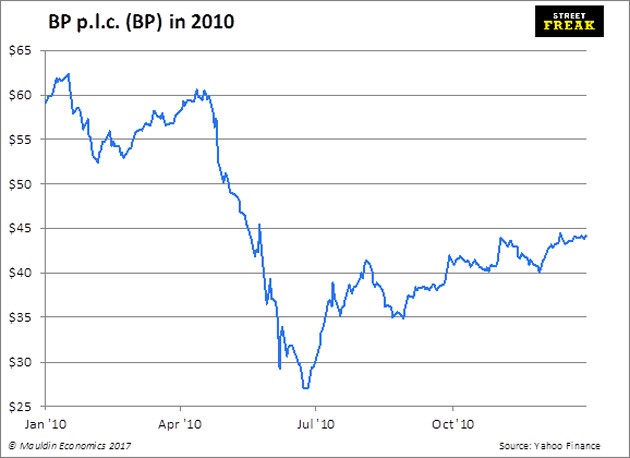

Want another example of how this works? Remember Deepwater Horizon? The BP oil leak in the Gulf of Mexico?

The explosion happened on April 20, 2010, and the leak was capped in July. Remember how angry people were at oil companies?

Yup. The Occupy BP trade.

Airlines Are Big Businesses

Airlines have been such horrible stocks for so many years that people have completely forgotten that they can be… not horrible.

There was actually a time where there was speculation that United Airlines would be taken private in a leveraged buyout (LBO) in the late eighties, sending the stock into space.

Of course, that was peak private equity stupidity because an airline is about the worst possible business to LBO. But it shows how drastically different sentiment can be from one decade to the next.

Let’s play the market cap game.

American Airlines is the largest airline in the world (by routes). What do you think the market cap is?

Dum dum da…

$23 billion.

eBay is $37 billion. eBay is where old people sell baseball cards.

I don’t know, guys.

Airlines are not special. They have the ability to be wildly profitable like any other business. Now that there are only four major American carriers, my guess is that they have some pricing power.

And fares have come up a bit—and they will come up more.

And you will pay them—because you are getting richer, and because they are still very low in real terms.

It would have been nice if Buffett was bullish in 2013, but he’s no dummy. It’s not hard to see the potential here.

Grab the Exclusive Special Report, The Return of Inflation: How to Play the Bond Bear Market, from a Former Lehman Brothers Trader

Don’t miss out on this opportunity to cash in on the coming inflation.

Jared Dillian, the former head of Lehman Brothers’ ETF trading desk, reveals why inflationary price increases could be much higher than 1% or 2% and how you can position yourself for big profits as the bond market falls.

Download the special report now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.