Bitcoin Price Rebound after Correction

Currencies / Bitcoin Jun 21, 2017 - 11:57 AM GMTBy: Mike_McAra

Bitcoin is down from the all-time high but not really down significantly. In an article on CNBC, we read:

Bitcoin is down from the all-time high but not really down significantly. In an article on CNBC, we read:

Bitcoin quickly bounced back from the lows of June, amid improved sentiment about the future of the digital currency.

Bitcoin traded higher Saturday near $2,680, up more than 20 percent from a June low of $2,185.96 hit Thursday that had erased gains for the month, according to CoinDesk.

Worries about overexuberance in digital currencies overall and heated debate among developers about how to upgrade bitcoin's technology weighed on its price.

"A proposal was accepted to merge the two upgrade methods, making them compatible," Brian Kelly, a CNBC contributor and founder of BKCM, which runs a digital assets strategy, said Friday. "So we have seen a relief rally on this progress."

The mainstream media are now running even more stories on Bitcoin than was the case at the all-time high. This is a very clear indication that the public is now becoming increasingly aware of the appreciation of the digital currency. This is not yet a screaming indication of the final top of the move but it certainly seems we’re getting there. It might even be the case that the appreciation is already over. There’s no way to know whether this is true. What we might infer here, however, is that we are definitely in a time where the market is to be watched very closely.

Bitcoin Appreciates Again

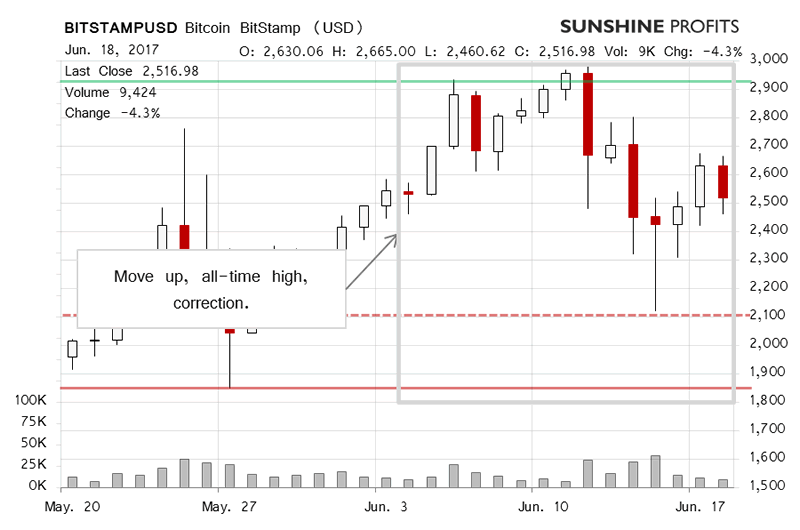

On BitStamp, we see that the period of depreciation was followed by a rebound. In our previous alert, we wrote:

Bitcoin has gone up some more since our previous alert was posted but the move was not on huge volume. The cloudiness of the picture remains in place since the currency reached yet another all-time high, just below $3,000 but the move today has been mostly to the downside and on strong volume (...). Even though all this has “bearish” written all over it, there’s still more to the situation.

We saw more depreciation following the publication of our alert. Bitcoin went down to around $2,100 and the move took place on elevated volume levels. Bitcoin came below the 23.6% Fibonacci retracement level (around $2,500) and even below the 38.2% level (around $2,200) based on the rally to the all-time high. This, however, is not necessarily bearish as the currency quickly returned back above both these levels. It can be argued that we’re seeing a downward correction within a strong move up. This is not necessarily the outlook toward which we would tilt, but the indications cannot be ignored.

Move to Upside

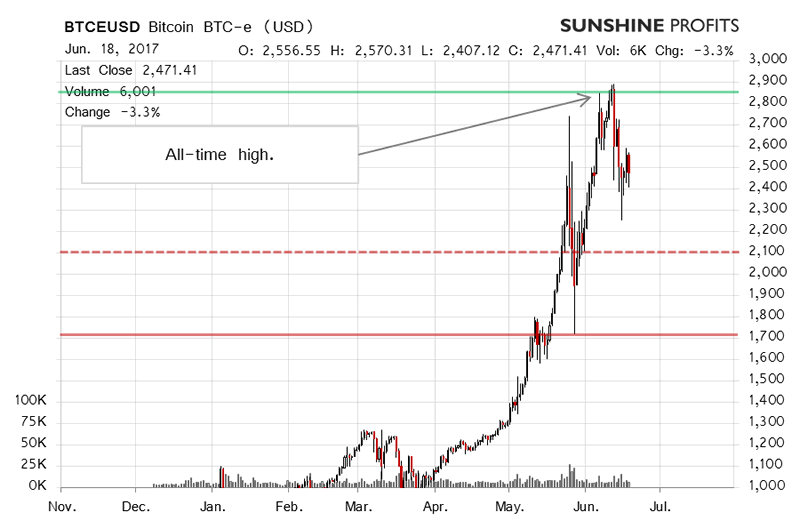

On the long-term BTC-e chart, we see the move to the all-time high was followed by a serious correction and right now we’re seeing yet another rebound to the upside. In our previous commentary, we read:

We’re up from where we were a couple of days ago and the situation is more extreme in terms of the price, and possibly volume, but the move down today has not been enough to turn the situation around and we might still see a rebound to the upside. If this doesn’t materialize soon enough, we might consider shorts without an additional move up. (…)

Since we have seen a rebound to the upside on high volume, the situation is not really clearly bearish for the short term. It is even more so because of the fact that the recent move below the 23.6% retracement level was denied. The outlook for the next couple of weeks is still more bearish than not, however, a move above the recent all-time high is still possible. Right now, we would prefer to wait for a move below the 38.2% retracement level before considering shorts.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.