EUR/JPY Exchange Rate and Gold

Commodities / Gold and Silver 2017 Jun 23, 2017 - 02:22 PM GMTBy: Arkadiusz_Sieron

We argued many times that the yellow metal behaves as a currency rather than as a commodity. Hence, macroeconomic factors and currency exchange rates affect the price of gold. In previous editions of the Market Overview, we analyzed the impact of the U.S. dollar and its exchange rate with the Euro and the Yen on the gold market. We pointed out that gold is negatively correlated with the greenback, so it moves in tandem with the Japanese or European common currency, as they are the major rivals of the U.S. dollar.

We argued many times that the yellow metal behaves as a currency rather than as a commodity. Hence, macroeconomic factors and currency exchange rates affect the price of gold. In previous editions of the Market Overview, we analyzed the impact of the U.S. dollar and its exchange rate with the Euro and the Yen on the gold market. We pointed out that gold is negatively correlated with the greenback, so it moves in tandem with the Japanese or European common currency, as they are the major rivals of the U.S. dollar.

However, some analysts claim that the cross rate between the euro and the yen affects the price of gold (the term “cross” meaning here that the quote does not involve the U.S. dollar). Are they right? Let’s see the chart below and check it out.

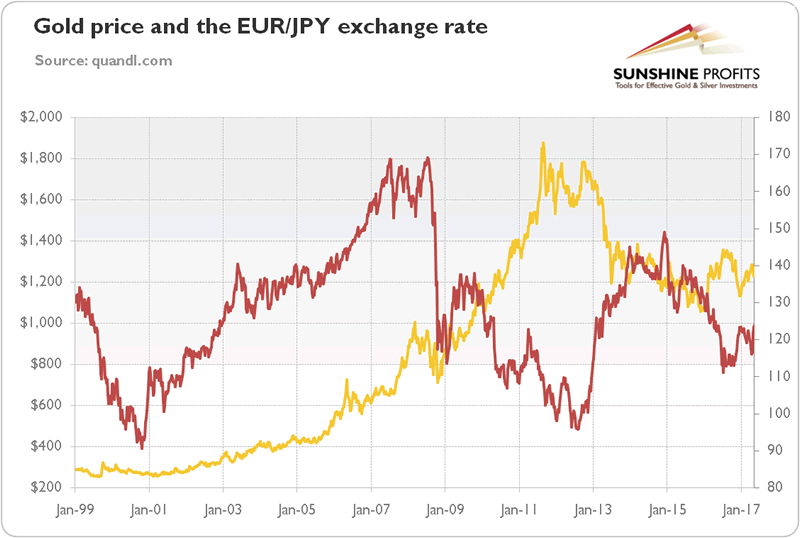

Chart 1: The price of gold (yellow line, left axis, London P.M. Fix, weekly average) and the EUR/JPY (red line, right axis, weekly average) exchange rate from January 1999 to May 2017.

Well, in the long-run, there is no clear pattern. In the 2000s, there was a positive correlation between the EUR/JPY exchange rate and the yellow metal, while the Lehman Brothers’ bankruptcy triggered a negative link. As the chart shows, in the aftermath of the financial crisis of 2008-2009, the Euro collapsed against the Japanese currency, while gold soared. In the beginning of 2013, the common currency appreciated due to improved financial situation in the Eurozone, while bullion continued its slide. But then we saw a positive relationship, which turned into a negative correlation around 2016 once again.

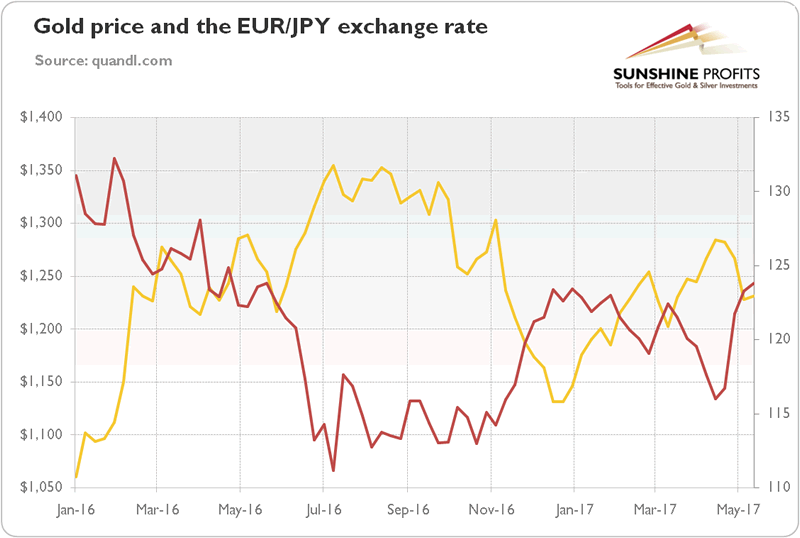

Let’s focus now on that very recent period. As one can see in the chart below, there is a clear negative correlation between gold prices and the EUR/JPY exchange rate in 2016-2017. It means that when the Euro strengthened against the Japanese currency, the price of gold dropped. And when the common currency depreciated against the yen, the yellow metal gained.

Chart 2: The price of gold (yellow line, left axis, London P.M. Fix, weekly average) and the EUR/JPY (red line, right axis, weekly average) exchange rate from January 2016 to May 2017.

How can we explain such a pattern? Well, the Yen is considered to be a safe-haven asset, which cannot be said about the European common currency. Therefore, when investors decrease their appetite for risk, they flee from the euro and park their money in the Japanese currency and gold. It was especially true over the last several months, which have been full of euro-specific risks. First, there was the British referendum about the withdrawal from the EU. The Euro plunged against the Japanese currency, while gold surged. Then, Trump’s victory revived the appetite for risk among investors, so the Euro rose, while the yellow metal went into freefall. And finally, the European common currency decreased against the yen before the French presidential election, but rebounded in the aftermath. Gold, respectively, rose and then declined.

What does it all imply for the gold market? First, the euro-specific risk decreased after the French presidential elections, so the Euro could strengthen further against the Yen in the short-term, which would be negative for gold.

However, the major re-pricing of the common currency in the aftermath of the French presidential election could have already taken place, so the EUR/JPY exchange rate is likely to stabilize (at least until the next major risk associated with the Eurozone occurs). In such scenario, the price of gold will be affected by the performance of the U.S. dollar. Given the Fed’s relative hawkishness (when compared to the ECB or the BoJ), the greenback could appreciate against both the Euro and the Yen in the long-run, which could be bad for the yellow metal. However, in the short-term, the U.S. dollar may remain under pressure against the European common currency due to uncertainty surrounding Trump and positive economic data from the Eurozone.

The bottom line is that the exchange rate between the Euro and the Yen is a useful indicator in gold investing. In the long term, there is no clear pattern, but we have recently seen a negative correlation between that exchange rate and the yellow metal. The EUR/JPY is a helpful gauge of the risk appetite among currency investors. It also isolates the impact of the U.S. dollar, which is very important, given the strong link between the greenback and the price of gold. However, it’s also a reason why investors should not rely only on this parameter (both the Euro and the Yen may move similarly against the American currency), but look also at the U.S. dollar and the real interest rates.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.