Silver Price Plunge Is Nearing Completion

Commodities / Gold and Silver 2017 Jul 11, 2017 - 02:31 PM GMTBy: GoldCore

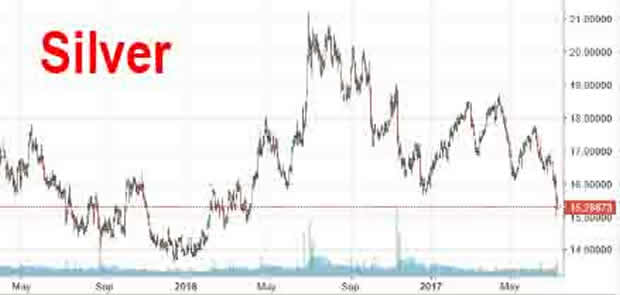

– Silver’s plunge is nearing completion – Bloomberg analyst

– Silver’s plunge is nearing completion – Bloomberg analyst

– Silver’s 10% sharp fall in seconds remains “mystery”

– Plunge despite anemic global supply and strong demand

– Total silver supply declined in ’16 – lowest level since ’13

– Silver mine production down in ’16, first time in 14 years

– Total silver supply decreased by 32.6 Mln Ozs in 2016

– Supply deficit in 2016- fourth consecutive year (see table)

– “Falling knife” caution but opportunity presenting itself

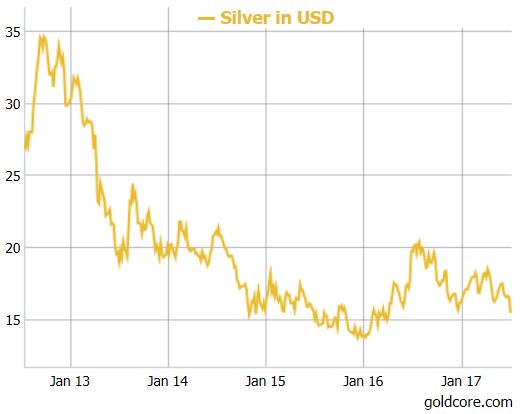

Silver has had a torrid time of late with a the “flash crash” seeing a massive $450 million silver futures sell order pushing silver 10% lower in seconds and follow through selling later Friday after the better than expected U.S. jobs number.

The electronic futures silver and gold exchanges continue to ‘wag the dog’ of the global silver and gold markets … for now.

If one had just looked at the short-term trends of silver at the end of 2016, you would have thought we would be mad to predict that 2017 would be a bearish year.

At the time it appeared as though silver was in a new bull market and in the early months of 2017 the price climbed by around 9%. But since April silver has handed back its gains and some and it is now down 3% for the year.

This has been counter intuitive to gold and silver investors alike who are looking at an economy filled with macroeconomic, geopolitical and indeed monetary uncertainty and central banks who appear increasingly fallible as the months go on.

Some were left wondering how much lower silver could go when last Wednesday it fell through the important $16 level for the first time in 2017.

In addition, the silver price weakness was given an extra push two days later when it collapsed by 10% in a matter of seconds. The reasons why this happened are still unknown, if it was a mistake then no-one is owning up to it and if it was a result of a desire to shift off $450 million worth of silver futures in minute then we will never know.

But their might be a (silver-powered) light at the end of the tunnel. Some silver market and industry experts are forecasting the silver plunge to be coming to an end.

A justified plunge ended by global yields

Bloomberg’s Michael Cudmore believes that the plunge in silver was justified

‘Gold and silver have a particularly strong correlation with real rates since the metals provide no yield, and hence demand is inversely related to the opportunity cost of speculation.

An environment in which global bond yields are rising in the absence of significant inflationary pressures is about as bad as it gets for speculative precious metals, so the move makes sense.’

But, Cudmore argues, it won’t stay like this forever.

‘If the rise in global yields persists, then severe spillover effects in other asset markets could prompt a bid for precious metal havens again. So we are approaching the point where both higher yields and lower yields have the potential to boost the asset class.’

New diversified industrial demand

But for many investors, talk of very short term yield hikes are about as handy as a wet finger in the air. Is the picture still as bullish when you look at the basic fundamentals of physical silver demand and silver supply?

According to the Silver Institute around 55% of all silver consumed is for industrial use. The remainder is taken up by jewellery, coin, bullion and silverware. As a result of this dual demand, one can understandably get distracted by figures that suggest investment demand is down and therefore the price outlook is bearish.

But, on the other side of the demand coin things are not only looking positive but the face of industrial demand for silver is also changing. This is an indicator of a market which is able to be agile in the face of changing times. Something which cannot be said for other markets so involved in technology.

Bearish commentators like to refer to the falling in use for silver in the field of photography, once a big source of demand. However, the Silver Institute remind us that this has been the case for many years and is unlikely to be impacting upon demand figures now,

‘Photographic demand fell by just 3 percent in 2016 to 45.2 Moz, representing the lowest percentage decline since 2004, potentially indicating that the bulk of structural change in the photography market is over and that current fabrication volumes may be largely sustainable.’

In the meantime, bears would be wise to remember that there are several other applications for industrial silver and they are growing.

In the 2017 silver survey data showed new highs were recorded for silver’s growing use in the photovoltaic (solar energy) and ethylene oxide (essential ingredients in plastics) sectors. These are two major and growing sectors for industrial silver.

By way of example, photovoltaic demand climbed by another 34% in 2016, the strongest growth in six years thanks to a 49% increase in demand for solar panels. In all it appears that the physical demand for industrial use silver is still at a strong level.

Declining supply?

As readers know silver has a dual role: it is a precious metal and an industrial one. This means that when one might expect it to react to monetary events such as a rate hike, it doesn’t because other factors are also at the forefront of traders’ minds.

For silver the weak performance of both gold and base metals in the last few months has weighed down on the price, an almost double whammy if you will.

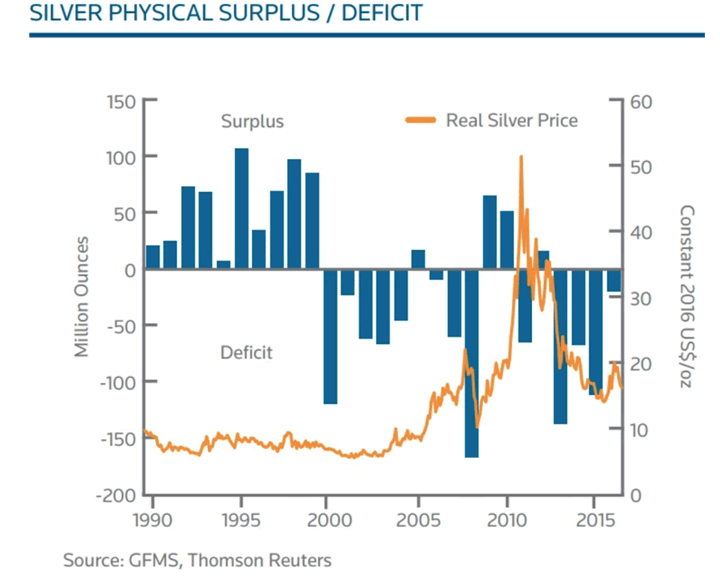

In 2016 the total demand for silver decreased marginally to 1.028 billion ounces, but declining supply meant that importantly 2016 was the fourth consecutive year with a supply deficit.

Scrap supply has been falling for some time and posted its lowest level since 1996. Meanwhile in 2016 global silver mine production recorded its first decline since 2002. When added to declining silver scrap supply and a contraction in producer hedging, total silver supply decreased by 32.6 million ounces last year.

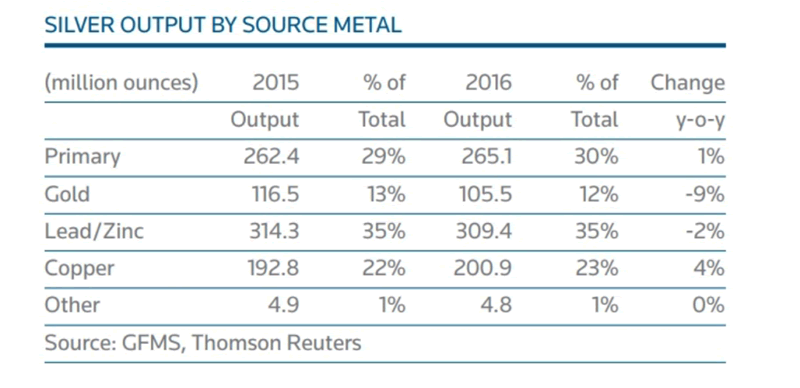

It does not appear as though the mining figures are set to improve. The Silver Survey 2017 report shows that the total silver mined in 2016 fell by 0.6% to 885.8 million oz. A large proportion of the drop was attributable to the lower output from the lead, zinc and gold sectors.

According to the Silver Institute 2017 survey, only 30% of the mined silver comes from mines whose primary metal is silver. 12% comes from primary gold mines and 23% is mined as part of primary copper deposit.

Given current gold and copper prices, it is not impossible to imagine further pressure on silver’s supply side given very few new mines will be developed in the current price environment.

“Falling knife” caution but buying opportunity presenting itself

The commentary space has generally been quiet about the price of silver. Instead, the behaviour of gold in relation to the geopolitical sphere has been the main topic of interest.

However, we appear to be close to a bottom in silver. This is in relation to both very positive supply demand fundamentals but also the likelihood of continuing robust investment demand as evidenced in robust silver ETF holdings.

In the short term, no one really knows where the price is headed to and silver looks vulnerable to further selling in the very short term.

During similar price falls over the years we have warned not to “catch a falling knife” on many occasions and this was echoed by Cudmore in his Bloomberg piece (on the terminal) as published on Zero Hedge.

However, one thing is for sure, silver remains great value given the still very strong fundamentals and when compared to valuations in stock and bond markets.

Silver and gold buyers should use the most recent bout of “mystery” selling as an opportunity to stack up on silver coins and bars in order to get long term exposure and financial insurance at short-term, discounted prices.

Gold Prices (LBMA AM)

28 Jun: USD 1,251.60, GBP 976.25 & EUR 1,101.91 per ounce

27 Jun: USD 1,250.40, GBP 980.31 & EUR 1,111.36 per ounce

26 Jun: USD 1,240.85, GBP 975.56 & EUR 1,109.32 per ounce

23 Jun: USD 1,256.30, GBP 987.70 & EUR 1,125.27 per ounce

22 Jun: USD 1,251.40, GBP 988.36 & EUR 1,120.13 per ounce

21 Jun: USD 1,247.05, GBP 989.04 & EUR 1,118.98 per ounce

20 Jun: USD 1,246.50, GBP 981.99 & EUR 1,117.24 per ounce

Silver Prices (LBMA)

28 Jun: USD 16.78, GBP 13.08 & EUR 14.78 per ounce

27 Jun: USD 16.66, GBP 13.07 & EUR 14.79 per ounce

26 Jun: USD 16.53, GBP 12.98 & EUR 14.79 per ounce

23 Jun: USD 16.71, GBP 13.12 & EUR 14.97 per ounce

22 Jun: USD 16.58, GBP 13.09 & EUR 14.85 per ounce

21 Jun: USD 16.51, GBP 13.03 & EUR 14.81 per ounce

20 Jun: USD 16.59, GBP 13.10 & EUR 14.88 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.