Asda Sales and Profits CRASH - UK Retailer Sector Crisis 2017 Continues to Worsen

Companies / Retail Sector Aug 03, 2017 - 07:40 AM GMTBy: Nadeem_Walayat

Up until results released this weeks, Asda had been battling Sainsbury to take the second place spot in terms of being Britain's 2nd largest retailer with sales for both virtually neck and neck on £24 billion. Asda as part of the giant US Wal-Mart group has been seen as being the more robust of Britain's largest retailers, many of whom are facing a perfect storm of BrExit inflation producer price hikes, contracting customer disposable earnings and loss of customers to the discounters such as Aldi and Lidl. Which has thrown all of the retailers into a full blown crisis as my analysis from earlier this year has been warning of that ultimately this means we may witness a Woolworth's moment that see's one of Britain's largest retailers goes bust, with my focus being on Britain's biggest retailer TESCO that has been in a literal death spiral now for several years.

Up until results released this weeks, Asda had been battling Sainsbury to take the second place spot in terms of being Britain's 2nd largest retailer with sales for both virtually neck and neck on £24 billion. Asda as part of the giant US Wal-Mart group has been seen as being the more robust of Britain's largest retailers, many of whom are facing a perfect storm of BrExit inflation producer price hikes, contracting customer disposable earnings and loss of customers to the discounters such as Aldi and Lidl. Which has thrown all of the retailers into a full blown crisis as my analysis from earlier this year has been warning of that ultimately this means we may witness a Woolworth's moment that see's one of Britain's largest retailers goes bust, with my focus being on Britain's biggest retailer TESCO that has been in a literal death spiral now for several years.

Asda's latest results show a 5.7% collapse in sales over the past 12 months to £21.7bn with profits crashing by 19% to £792m. This now kills Asda's hopes of knocking Sainsbury off it's 2nd place perch as Asda is now definitely Britain's third largest retailer, as previously both had been virtually neck and neck on annual sales of £24bn, with Morrisons trailing a distant 4th place on sales of just £16 billion.

Asda being part of the Wal-mart group does not have its own share listing. The Wal-Mart stock price at $80.53 is trading at 95% of its 2014 high of $85. The Wal-Mart stock price is obviously more influenced by US economic and market dynamics than its UK Asda subsidiary. So despite underlying weakness at Wal-Mart's UK Asda operations, it is highly unlikely that Asda is going to experience a Woolworth's moment despite the collapse in profits and revenue, given how robust the overall group appears to be.

Personal Experience- Asda and Tesco have a lot in common in terms of store size, number of products on sale and in terms of generally being in poorer / cheaper locations. Which means in terms of whether to shop at a Tesco or Asda is dependant upon distance, so for most shoppers Tesco would be the more probable place to shop since there are far more Tesco stores out there.

The bottom line is that Asda's bad performance is an harbinger for even worse to come at the other major UK retailers as my forecast retail sector crisis becomes manifest that ultimately could claim a major retailer in a Woolworth's moment.

And do watch my video from earlier this year that warned of why Britains' major retailers were set to experience an ever worsening crisis this year and likely well into 2018.

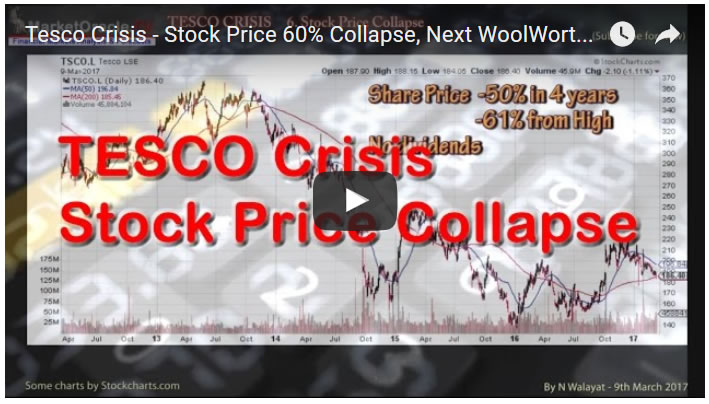

And my videos in the 'Tesco Crisis' series as Britains' largest retailers stock price gravitates towards zero.

1. Customer Experience Nightmare:

2. Brexit Inflation:

3. Tesco Club Card and Vouchers

For what happened to the great Tesco discount offers and what it means for future prospects for Britain's largest retailer.

5. Fraud Fine and Investor Compensation:

6. Stock Price 60% Collapse:

By Nadeem Walayat

Copyright © 2005-2017 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.