Will Eurozone Growth Boost Gold Prices?

Commodities / Gold and Silver 2017 Sep 16, 2017 - 03:32 AM GMTBy: Arkadiusz_Sieron

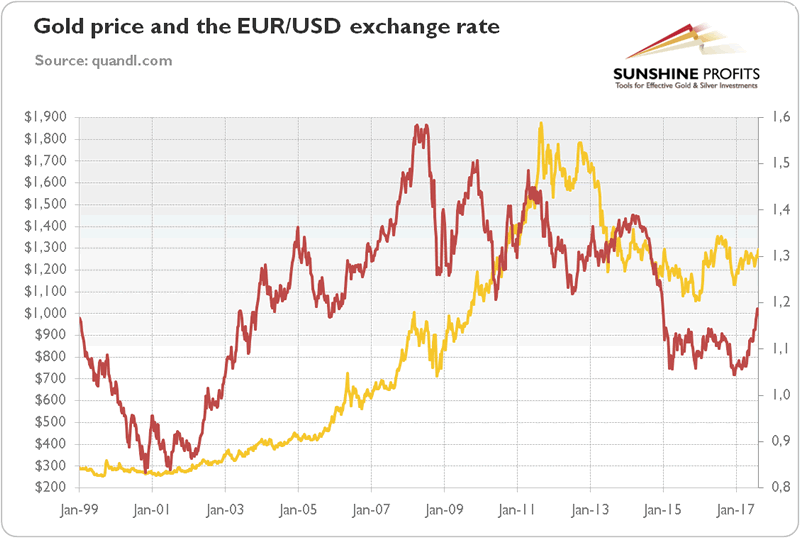

The euro has appreciated about 13 percent against the U.S. dollar so far this year, as the chart below shows. Although it seemed ready to reach parity with the greenback or even to break up, the shared currency was the top-performing currency in the G10 in the first half of the year. Now, there is a hot debate about the future of the euro. As the EUR/USD exchange rate is one of the crucial drivers of gold prices (see the chart below), let’s analyze the outlook for the Eurozone and its currency.

The euro has appreciated about 13 percent against the U.S. dollar so far this year, as the chart below shows. Although it seemed ready to reach parity with the greenback or even to break up, the shared currency was the top-performing currency in the G10 in the first half of the year. Now, there is a hot debate about the future of the euro. As the EUR/USD exchange rate is one of the crucial drivers of gold prices (see the chart below), let’s analyze the outlook for the Eurozone and its currency.

Chart 1: Gold prices (yellow line, left axis, P.M. London Fix, weekly averages) and the EUR/USD exchange rate (red line, right axis, the ECB reference rate, weekly averages) from 1999 to August 2017.

The recent euro’s strength was caused by three factors. First, the populist and anti-euro candidates lost in the Dutch and French elections. Actually, the Macron’s victory in the first round of the French presidential elections was a turning point for both the euro and the yellow metal, as we pointed out it in the June edition of the Market Overview. As Angela Merkel is likely to win the German federal elections in September, the geopolitical risk related to the Eurozone has receded. Surely, the common bloc remains fragile (the political and banking situation in Italy is especially worrisome) and needs to solve many structural problems, but the wave of populism was stopped. Hence, although the Eurozone remains subject to significant risks, their balance improved and it seems that the worst could be over for the euro area for now. As the political uncertainty diminished on the margin, the fate of the euro is now more dependent on macroeconomic factors.

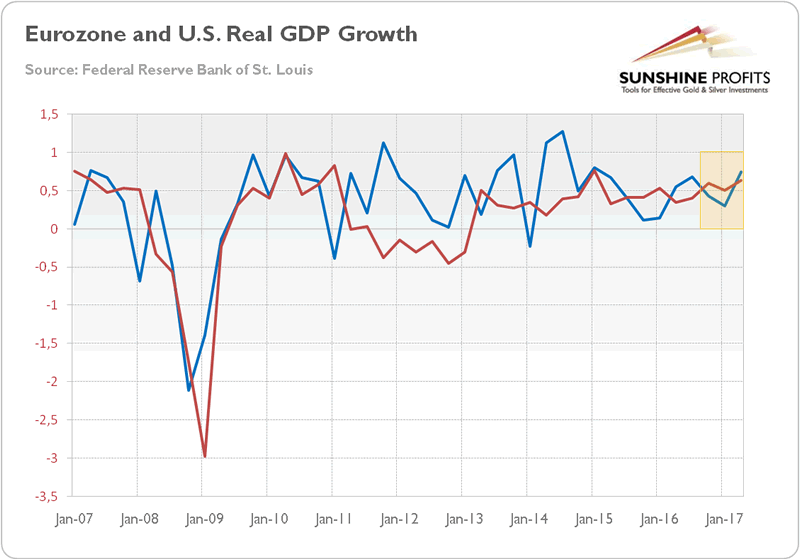

Second, the macroeconomic situation in the euro area has definitely improved. In 2016, the economy expanded by 1.7 percent, compared with 1.6 percent for the U.S. And more recently, GDP expanded 0.6 percent in the second quarter of 2017, following the 0.5 percent in Q1, according to Eurostat, while the U.S. economy grew 0.75 percent and 0.3 percent, respectively, as one can see in the chart below.

Chart 2: The real GDP growth for the Eurozone (red line) and the U.S. (blue line) from 2007 to Q2 2017 (quarter-on-quarter).

Moreover, the unemployment rate has been falling; in June it hit an eight-year low of 9.1 percent. Credit action is also getting better and better, and we see reviving investments. Importantly, the economic recovery and the strengthening of the labor market are not limited only to Germany, but also to peripheral countries. By the way, at the end of July, Greece has returned to the global financial markets for the first time in years, after the economy grew in the first quarter and S&P raised its outlook for Greece from “stable” to “positive”. The strong incoming data about the Eurozone economy pushed sentiment to a multi-year high, attracting investors’ capital to European ETFs and the euro.

Third, the subsided political uncertainty and upgraded macroeconomic outlook in the euro area convinced markets to believe that the ECB will start to tighten its monetary policy at any moment. That assumption was strengthened after Draghi’s speech in Sintra, Portugal, in which he noted that “deflationary forces have been replaced by reflationary ones.” However, as we pointed out in the August edition of the Market Overview, investors over-reacted to Draghi’s statement, which was not as hawkish as it was interpreted. The ECB remains worried about subdued inflation and a sharp appreciation of the euro, which was perfectly seen in its recent minutes. As a reminder, the stronger currency means that imported goods become less expensive. Hence, the question is whether the Eurozone’s macroeconomic fundamentals in general, and inflation in particular, will be strong enough to prompt the ECB to taper its quantitative easing program in the upcoming fall.

Well, practically all numbers, from the unemployment rate, corporate earnings, to economic sentiment and manufacturing output, signal that the economy is gaining steam and that the firm, widespread recovery will extend into the second half of the year. Although the inflationary pressure remains muted, the ECB hopes that stronger momentum will eventually boost prices. In August, the flash estimate of the annual inflation rate in the Eurozone increased from 1.3 percent in July to 1.5 percent, beating expectations. Our take is the ECB may announce a tapering in October or December, especially since it could otherwise run out of bonds to purchase, but it should keep a very accommodative stance, due to still subdued inflation. In contrast to the Fed, which has a dual mandate, the ECB is concerned only about price stability. And the inflation in the Eurozone is expected to average 1.5 percent this year (a jump from 0.2 percent in 2016), and then to drop to 1.3 percent in 2018, before edging up to 1.6 percent in 2019, according to the ECB’s own most recent macroeconomic projections.

What does it mean for the gold market? Well, the euro has room to increase further in the medium term. The other side of the coin will be weaker greenback (distrust in the Trump administration should also help). The appreciation of the U.S. dollar in recent years was based on the significantly stronger U.S. growth outlook compared to its major peers. But this is no longer the case, given the revival of the Eurozone economy. Investors discount future – and given that the European recovery started much later, it could last longer and be stronger than the U.S.

Hence, the rise in the EUR/USD exchange rate should be fundamentally bullish for the gold market in the medium term. However, the euro, and thus the yellow metal, could fall in the short-term against the U.S. dollar, as market expectations for the ECB’s pace of tightening are probably too elevated. On the other hand, the market could view the revival of the Eurozone as something that decreases the global risk in general and thus gold’s appeal as a safe-haven asset could diminish. From this point of view, gold could decline despite declining value of the USD relative to the European currency (thus, it is worth preparing for the bottom).

Which of the trends will prevail? A lot will depend on non-fundamental factors and the market sentiment, however, for now, we can say that monitoring the early part of the price move in gold once the tapering does indeed take place in the Eurozone should prove particularly useful, as the way the markets react in the first weeks is likely to be representative of the reaction for the next months.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.