DJ Commodity Index is Supporting Higher GOLD

Commodities / Gold and Silver 2017 Oct 12, 2017 - 01:00 PM GMT The Dow Jones Commodity Index is a broad measure of the commodity futures market that emphasizes diversification and liquidity through a equal-weighted approach. It doesn’t allow any sector to make up more than 33% of its portfolio or any single commodity to make up more than 15%.

The Dow Jones Commodity Index is a broad measure of the commodity futures market that emphasizes diversification and liquidity through a equal-weighted approach. It doesn’t allow any sector to make up more than 33% of its portfolio or any single commodity to make up more than 15%.

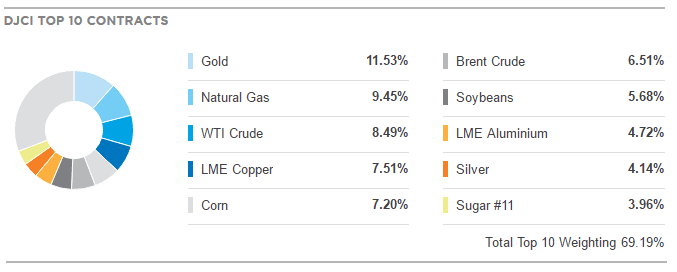

Gold is the top weighted commodity of the index with 11.53%, silver only represent 4.14% and Copper 7.51%. Consequently, a total of 23% for metals means that any significant move in that sector should be reflected on the price of DJCI therefore we can use to identify the global trend for commodities around the world.

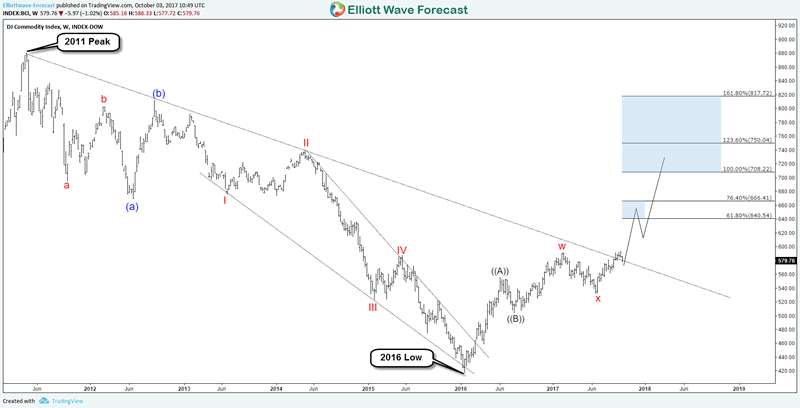

DJ Commodity Index Weekly Chart

From 2011 peak, the Commodity Index traded lower in a regular flat structure which ended at January 2016 low. Up from there, DJCI started a new bullish cycle showing an incomplete 5 swings bullish sequence and it’s suggesting a move higher toward equal legs area 708 – 750 as long as it stays above the recent June 2017 low.

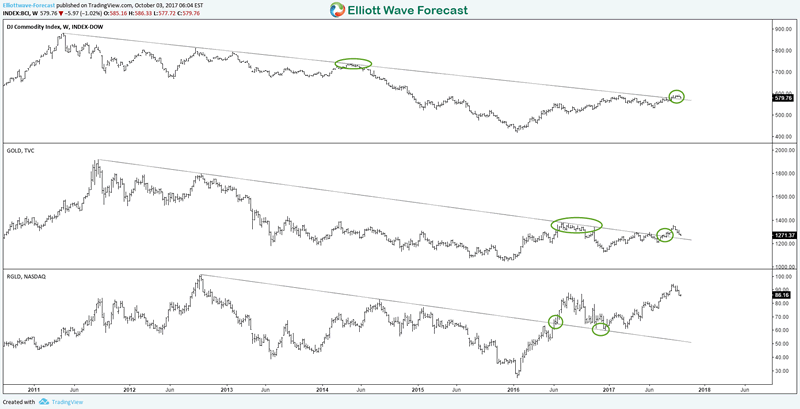

DJCI vs GOLD vs RGLD

In the above charts, we can notice DJCI is breaking above the 2011 bearish trend-line same as Gold and a related mining stock RGLD. The move is supporting the case for higher commodities in the future especially strong move for Gold.

The precious metal is leading the pack higher as many Gold instruments have a bullish sequence / structure like Royal Gold Stock giving us clues about the next investing opportunity in the stock market

Recap:

The DJ Commodity Index is one of many other indexes that can be used to determine the next move for this sector and as a result of the recent bullish breakout it will give a big boost to the rest of commodities.

We cover many commodities , so if you’re interested in getting more insights about the precious metals or any other related instruments like GDX or XME , then take this opportunity and try our services 14 days only for $9.99 to learn how to trade forex, indices, commodities and stocks using our blue boxes and the 3, 7 or 11 swings sequence. You will get access to our 78 instruments updated in 4 different time frames, Live Trading Room and 2 Live Analysis Session done by our Expert Analysts every day, 24-hour chat room support and much more.

By Ayoub Ben Rejeb

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including Forex majors & crosses, Commodities and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup .

Copyright © 2017 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.