Credit Crisis Financial Armageddon

Stock-Markets / Credit Crisis 2008 Aug 31, 2008 - 03:26 AM GMT Where are we now in the credit crisis, and why isn't the massive Fed and ECB weekly lending working to loosen interbank lending? Why is the credit crisis not really improving? Where is this going next? We describe what may happen next as Credit Crisis II in this article.

Where are we now in the credit crisis, and why isn't the massive Fed and ECB weekly lending working to loosen interbank lending? Why is the credit crisis not really improving? Where is this going next? We describe what may happen next as Credit Crisis II in this article.

Now that the credit crisis that started in 2007 is a year old, there has been a debate about whether the financial system will recover, or will the Western/world financial system end up like the Japanese financial system after the stock and real estate crashes in the 1990's. In that case, the Japanese banks more or less carried their tremendous losses for ten years, and Japan entered a mild but painful decade of deflation. To this day, Japan is battling some of the deflationary forces from that time.

The question now becomes, will the Western financial system recover some normalcy, or are things merely going to get worse and the world end up with a financial malaise lasting ten years like Japan's?

If the second alternative is the case, then the central banks which are merely propping up the financial institutions with their ‘temporary' lending will find they are taking the losses off the banks hands, taking them on to their balance sheets, and effectively monetizing the losses.

The ECB and the Fed are both hoping to find a way out of having to keep the bad assets they took as collateral. They have lent hugely to financial institutions, taking their bad mortgage bonds, securities, derivatives as collateral. And at the same time, the financial institutions in question are carrying a sum total of $500 billion of losses on their books, the losses they admit so far, while estimates of ongoing losses from these bad assets runs well over $1 trillion. In effect, the Western credit industry is still crippled. Why is it so crippled still?

Either the financial industry earns its way out (will take ten or more years) and drastically pull back credit, or they find enough new investors to pony up new capital infusions, perhaps through stock sales. And new such investors are becoming increasingly hard to find. Hence, the central banks are the only alternative.

A theme now arises where it is becoming apparent that it is impossible to actually purge the escalating losses from the financial system, and that even big public bailouts don't purge the losses because of interlinkages between stocks, bonds and derivatives. If one class or institution is bailed out, the losses of capital merely move to the other class. And the losses are clearly so huge as of now, that they weigh on the currencies themselves and cause a fall in their exchange rates.

It is estimated that the USTreasury/Fed/FHLB has infused a total of $2 trillion and counting since Aug 07 to the various credit infusions to the US financial system, and that the ECB is in at similar levels. And even after $ 4 trillion worth of infusions over the last year has been thrown out by the Fed and ECB, the world credit/financial system is actually getting worse. What will be the outcomes into 09?

Bankrupt en masse

In effect, this means the Western banks, etc are bankrupt en masse. The only thing propping up the entire Western financial system, and its respective stock markets has been massive ‘temporary' lending, on an ongoing basis, by the Fed and ECB. Both central banks are beginning to balk at this situation. Even as they are starting to have second thoughts, the Western financial institutions continue to borrow more money than ever on a weekly basis. Why aren't things loosening up?

Can't stop or else

And, if the ECB or the Fed stops the emergency infusions, or even admit who the borrowers are, another round of collapsing banks/bank runs ensues as investors flee and pull their money out. In other words, the central banks have no choice but to continue the weekly $30-50 billion or so of infusions each for the Fed and the ECB, or else face a cascade of bank runs around the world.

…And each week the Fed and the ECB are effectively taking on another $30 or $50 billion of the bad assets from the various and sundry financial institutions scattered across the EU and the US. So, week after grueling week, the Fed and the ECB keep adding another $50 to $100 billion of bad assets to their balance sheets, as ‘collateral' and making ‘temporary' loans they keep having to roll over and extend the repayment on. Ie, the junk stuff is becoming a permanent resident on the central bank's balance sheets. If either the Fed or the ECB stop the weekly infusions, quite possibly the entire Western financial system stops dead. And we get a massive world stock crash.

The question now becomes, what happens when these two central banks finally decide they have to let go? You are not going to tell me they are going to keep infusing a combined $50 to $100 billion worth of financial bailouts each week forever? This massive temporary lending certainly has to end at some point.

And even with all this new money every week, the credit system is barely functional anyway right now. And this half dead world credit system is dragging economies downward, as there is less and less and less credit. This is a paltry return for all the bailouts and massive temporary lending.

Probably what is happening is that this is a classic case of a parabolic world credit peak, as more and more money is needed each week merely to keep the bubble from collapsing. And the only ones left to infuse this money are the central banks. No one else is willing to step in. Financial institutions won't lend to each other, and investors won't recapitalize the crippled banks. As financial institution's stocks fall, issuing new stock becomes prohibitively expensive.

Parabolic peak

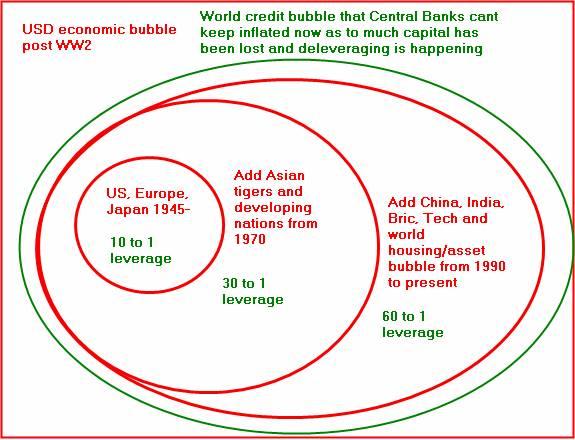

One could say all that is happening is that all financial institutions in the world don't really trust each other, and won't lend to each other. And that an astounding $50 to $100 billion of weekly infusions from the Fed and the ECB is not fixing the situation, and that we are witnessing the final parabolic peak of the world credit bubble that has built up for the 63 years after WW2 ended. That, and the end of the USD and Yen driven credit/asset/finance bubble which ensued from the early 1970's.

So, before we continue, it might be said that the present development of the credit crisis, from August 07 to now, is Credit Crisis I. And the present state of affairs is that the Fed and the ECB have to infuse a weekly $50-100 billion plus into their respective financial regions merely to prevent a world finance implosion.

I also have noticed that the Credit Crisis I has had a one year periodicity of major new developments, ie that if one major sector had a problem on a given month, that the next year the same sector seems to reinvent a new worse manifestation.

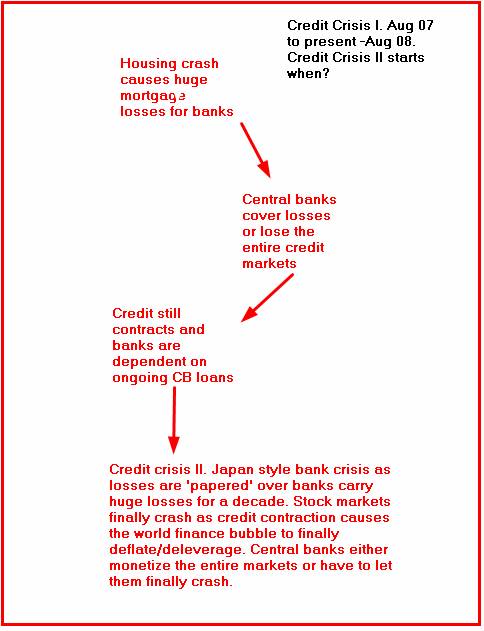

I made a graphic to describe the general situation:

So, when the central banks stop this massive weekly lending, what happens? Massive forced deleveraging and probably world financial Armageddon. This would be Credit Crisis II, or Phase II. We will look into Credit Crisis II in a moment.

This is the conclusion we came to here at PrudentSquirrel, trying to ascertain where we are in the big picture on the Credit Crisis now. It is that the Central Banks are desperately trying to stave off Credit Crisis II, and they are losing, and probably knowing this, they will at some point confer together and pick a time to let the credit system implode, and try to weather the stock/financial crashes that will occur at that time. Likely, some currencies can collapse as well, and a great deal of FX (foreign exchange) chaos and restrictions will ensue for several years after the fatal date.

If it is true, as we suspect, that we are at the peak of a credit/financial bubble that started right after WW2 ended, and it is at a parabolic peak and cannot be sustained, then the world's central banks already know this too. They probably are trying to decide when to let go …They all don't have to agree, it only will take one major Central Bank to let go, then the others will be forced to follow.

The central banks in question would be the BOJ, the US Fed and the ECB, and likely the BOC. The Russian central bank is an odd man out and is a wild card, but not as central to the equation. Either all the major central banks listed keep up the same rate of infusions, or the end of the world credit system comes in a week or two after one ‘lets go'.

Now as to the USD strengthening now, and gold's vexing $100 plus volatility, it just seems best to make any protective moves well ahead of the fatal day. Once the situation gets out of control, Credit Crisis II begins, in a week from that point you will find it hard to make any changes. I view gold's present volatility as a total side issue, compared to what would happen if all one's money was tied to the financial system, the USD and so on, and then one's financial situation was frozen if the central banks decide to let go, and world foreign exchange restrictions are instituted. Gold is still one of the best ways to ride out what may come to pass.

Our present state of affairs in Credit Crisis I

Let's look at a few examples of why I am saying the world is at a parabolic credit bubble peak, and why the Central banks are finding they have no choice but to keep pumping out $50 plus billion a week of new ‘temporary' lending, or else face a real financial Armageddon…

The ECB, Spanish banks, and North-South EU dissention

How Spanish banks are creating mortgage securities to get ECB funding is a perfect example of our present financial crisis…and how the ECB seems to have no choice but to continue the short term funding of the entire EU financial system, and it is causing big dissention between the North EU and South.

By Ambrose Evans-Pritchard

Last Updated: 3:06pm BST 21/08/2008

The European Central Bank has issued the clearest warning to date that it cannot serve as a perpetual crutch for lenders caught off-guard by the severity of the credit crunch.

Not Wellink, the Dutch central bank chief and a major figure on the ECB council, said that banks were becoming addicted to the liquidity window in Frankfurt and were putting the authorities in an invidious position.

"There is a limit how long you can do this. There is a point where you take over the market," he told Het Finacieele Dagblad, the Dutch financial daily.

"If we see banks becoming very dependent on central banks, then we must push them to tap other sources of funding," he said.

While he did not name the chief culprits, there are growing concerns about the scale of ECB borrowing by small Spanish lenders and 'cajas' with heavy exposed to the country's property crash. Dutch banks have also been hungry clients at the ECB window.

One ECB source told The Daily Telegraph that over-reliance on the ECB funds has become an increasingly bitter issue at the bank because the policy amounts to a covert bail-out of lenders in southern Europe.

"Nobody dares pinpoint the country involved because as soon as we do it will cause a market reaction and lead to a meltdown for the banks," said the source.

This "soft bail-out" is largely underwritten by German and North European taxpayers, though it is occurring in a surreptitious way. It has become a neuralgic issue for the increasingly tense politics of EMU.

The latest data from the Bank of Spain shows that the country's banks have increased their ECB borrowing to a record €49.6bn (£39bn). A number have been issuing mortgage securities for the sole purpose of drawing funds from Frankfurt.

These banks are heavily reliant on short-term and medium funding from the capital markets. This spigot of credit is now almost entirely closed, making it very hard to roll over loans as they expire.

The ECB has accepted a very wide range of mortgage collateral from the start of the credit crunch. This is a key reason why the eurozone has so far avoided a major crisis along the lines of Bear Stearns or Northern Rock.

While this policy buys time, it leaves the ECB holding large amounts of questionable debt and may be storing up problems for later.

The practice is also skirts legality and risks setting off a political storm. The Maastricht treaty prohibits long-term taxpayer support of this kind for the EMU banking system.

Few officials thought this problem would arise. It was widely presumed that the capital markets would recover quickly, allowing distressed lenders to return to normal sources of funding. Instead, the credit crunch has worsened in Europe…” Bold emphasis is mine Telegraph.co.uk

Fannie and Freddie rescue dilemma- their stocks and debt are held by other banks

Another perfect example of the impossible state of affairs in the world credit crisis is Fannie/Freddie. And that means that if the Fed/Treasury does a bailout, their stocks collapse in value, and all the other financial institutions take losses on that because they hold lots of Fannie and Freddie stock. Of course the stock is already in the tank, but the issue is still there and shows the interlinkages.

Then there is the question of the Fannie and Freddie bonds out. That is another can of worms, and the Chinese just stated this week that a collapse of Fannie-Freddie could lead to an economic catastrophe – their Central Bank advisor Yu Yongding stated. The Chinese hold hundreds of billions ($376 billion mostly in US agency bonds) of Fannie and Freddie debt and stock.

In many respects, because of all these cross holdings of the Fannie Freddie bonds and stocks by banks everywhere, and by Central Banks, it would seem that the losses cannot really be removed from the financial system – ie purged. If Fannie and Freddie are bailed out, their stocks collapse and those losses now translate to all these other banks and central banks that hold them. It's virtually a no win situation.

These cross linkages reveal that it is virtually impossible, even with bailouts, to purge the ever growing $500 billion and counting losses of capital from the banking/financial system. The latest numbers being speculated on are the losses will be over $1 trillion (IMF) and $2 trillion or more (Roubini).

Now, maybe $2 trillion doesn't sound like a lot compared to the entire world economy. The trouble is, that capital is leveraged anywhere from 10 to 50 times by the financial system. Fannie and Freddie have 60 to 1 leverage.

Losing $2 trillion of capital will totally wipe out the entire world financial system for a decade because of the leverage at 60 to 1. Basically, unless those losses can be purged in some way, it has to be earned back over a period of years/decades. That essentially cripples the entire world financial system.

I remember a very well put quote from a banker last Fall 07 about the credit crisis then. (I'm sorry, I don't remember his name.) He stated “The credit deleveraging will not be denied.” I think that sums things up very well.

It appears that a relentless unwinding of the world credit/finance bubble with many dimensions and twists and turns cannot be avoided, even if the central banks were willing to try. The issue is the cross linkages and the fact that the capital losses in every corner of the world will not and maybe cannot be purged from the financial system, even with big public bailouts. There is possibly no way to do it other than to allow things to just unwind and try to re earn it all back the hard way.

Even if it appeared the central banks could figure out a way to purge the losses from the financial system, and take them on their books, then their currencies are in danger. The capital losses are there – period. The deleveraging of 60 to 1 credit is happening – period. The financial institutions don't trust each other – period.

The Fannie – Freddie bailout proposals are being discussed in the light that the US government/Treasury can just about double the so called national debt from $9 trillion by possibly adding another $5 plus trillion, as they effectively have to guarantee those GSE bonds. That is now playing into a debate on the US fiscal situation….as if the USD needed another problem.

In short, once again, we see that it appears impossible to purge the effects of so much lost capital to the world financial system. The deleveraging will not be denied. We see this a year after the Credit Crisis I exploded worldwide Aug 07.

End of a huge world bubble

If that is true, then the theory I laid out above, that we are witnessing a peak in a parabolic finance/asset/stock bubble of world proportions, is going to pan out. I think the entire credit crisis can be looked at from that perspective. We are merely witnessing the relentless unwinding of the biggest financial bubble in history. And, ominously, this particular bubble has grown from the end of WW2 to the present. That is one HUGE economic bubble, and this one envelops the entire world. This is not just a bubble in one country's economy.

The point of emphasizing it's from the end of WW2 is that we are not talking merely about a banking crisis, or whatever. We are talking about the deleveraging of the greatest economic/finance bubble in history. Once the level of leverage reached 60 to 1, it becomes impossible to stay ahead of the deleveraging, even for central banks. The implications are staggering. Every major economy in the world is involved. The outcomes of deleveraging this monster bubble, represented by the green oval, will be what I term Credit Crisis II. At 60 to 1 leverage, a loss of 1 to 2% wipes out the capital.

Whether it's the Chinese Central Bank (BOC), the Fed, the ECB, and then all the other world financial institutions of every type, insurance companies, gigantic retirement funds, other banks, you name it, the present losses of capital to the world financial system is pervasive worldwide.

Nobody will escape the wrath of this deleveraging, and that is why I call it Credit Crisis II. Credit Crisis I was only the preliminary round…Credit Crisis II is characterized by the realization that the gigantic losses of capital cannot be purged from the financial system , even with big public bailouts. And that this deleveraging cannot be stopped. There are too many interlinkages. And, without writing a book on this, the next victim when Credit Crisis II unfolds, will be massive world currency instability. This will make any of the banking and currency crises we have seen since WW2 look like child's play. It is not clear when Credit Crisis II begins but it is threatening already.

By Christopher Laird

PrudentSquirrel.com

Copyright © 2008 Christopher Laird

Chris Laird has been an Oracle systems engineer, database administrator, and math teacher. He has a BS in mathematics from UCLA and is a certified Oracle database administrator. He has been an avid follower of financial news since childhood. His father is Jere Laird, former business editor of KNX news AM 1070, Los Angeles (ret). He has grown up immersed in financial news. His Grandmother was Alice Widener, publisher of USA magazine in the 60's to 80's, a newsletter that covered many of the topics you find today at the preeminent gold sites. Chris is the publisher of the Prudent Squirrel newsletter, an economic and gold commentary.

Christopher Laird Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.