Will ICOs Take Down Wall Street as Bitcoin Takes Down Central Banks and Fiat Currencies?

Currencies / BlockChain Oct 19, 2017 - 11:49 AM GMTBy: Jeff_Berwick

I’ve said it many times in the past. Blockchain technology is the biggest evolution since the internet.

I’ve said it many times in the past. Blockchain technology is the biggest evolution since the internet.

We’ve seen bitcoin quickly become a challenge to fiat currencies and central banks.

We’ve seen Ethereum change the very nature of apps into dapps or decentralized apps. And, it’s barely even begun yet.

And now we are seeing ICOs, Initial Coin Offerings, change how companies are formed and funded.

ICOs, similar to bitcoin, threaten entire industries.

It threatens the traditional investment banking industry… could that be why Jamie Demon hates it so much? Ya think? Over $3 billion has been raised by ICOs in the second quarter of 2017 surpassing the total funds raised via traditional equity financing for the first time.

It threatens the traditional stock exchanges.

And it certainly threatens the government regulators.

And the businesses that are being built with the ability for their tokens to be tradeable without third parties will threaten almost every other traditional business sector in the world.

To say all of this is a massive paradigm shift is an understatement.

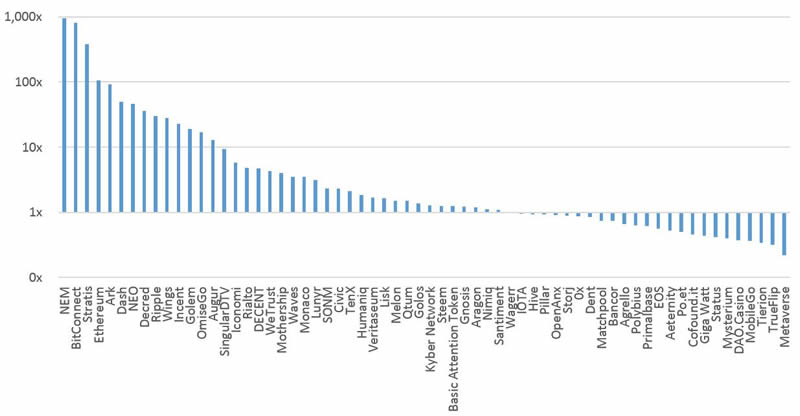

ICOs have proliferated in the last year and, so far, on average, they have performed very well for investors.

ICOs remove the stranglehold on investment capital that has been monopolized by the big investment banks and made prohibitively expensive and restrictive by criminal government regulators.

The Chinese government has, as we’ve seen, been one of the first to, as Christine Lagarde puts it, “banned the initial, um, offer of, um, bitcoins.”

And, I have zero doubt that the criminal SEC will soon violently attack those who peacefully and voluntarily participate in the ICO market.

But, like with bitcoin, they can’t stop it. They can only do what all governments do; threaten violence and extort people who try to make the world a better place.

So, there will definitely be a lot of bumps along the road… the same as there will be for bitcoin… as governments and central banks try to stop progress from occurring.

And, there will be plenty of failures, scams, and drama as always occurs in the free market.

But, there will also be investment opportunities potentially of a lifetime.

We’ve covered numerous ICOs in The Dollar Vigilante newsletter (subscribe here) and have done fantastically well on all of them except one. I’m looking at you EOS (more on that coming out soon in an interview with Dan Larimer).

But, from time to time on Youtube, I’ll also interview the founders of ICOs I find interesting as I have found very few people are covering the ICO space very well.

The first is one called Decent.bet (DBET).

They have very interesting plans to revolutionize the casino industry with blockchain technology.

I interviewed the founder and CEO, Jedediah Taylor, here:

We’ll continue to have on ICOs sporadically as I come across interesting looking ICOs on our Youtube channel.

Like with anything, do your own due diligence on any ICOs, these are just for informational purposes. And make sure to subscribe to TDV to get access to much more in-depth research, analysis, and recommendations in the space.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.