Russia Buys 34 Tonnes Of Gold In September

Commodities / Gold and Silver 2017 Oct 27, 2017 - 03:10 PM GMTBy: GoldCore

– Russia adds 1.1 million ounces to reserves in ongoing diversification from USD

– Russia adds 1.1 million ounces to reserves in ongoing diversification from USD

– 34 ton addition brings Russia’s Central Bank holdings to 1,779t; 6th highest

– Russia’s gold reserves are at highest point in Putin’s 17-year reign

– Russia’s central bank will buy gold for its reserves on the Moscow Exchange

– Russia recognises gold’s role as independent currency and safe haven

Editor: Mark O’Byrne

Prior to World War I Russia held the world’s third largest gold reserves, behind America and France. In the subsequent Russian Revolution, civil war and the rise of communism, they dropped down the table of nations with large gold reserves and the U.S. became the largest holder of national gold reserves.

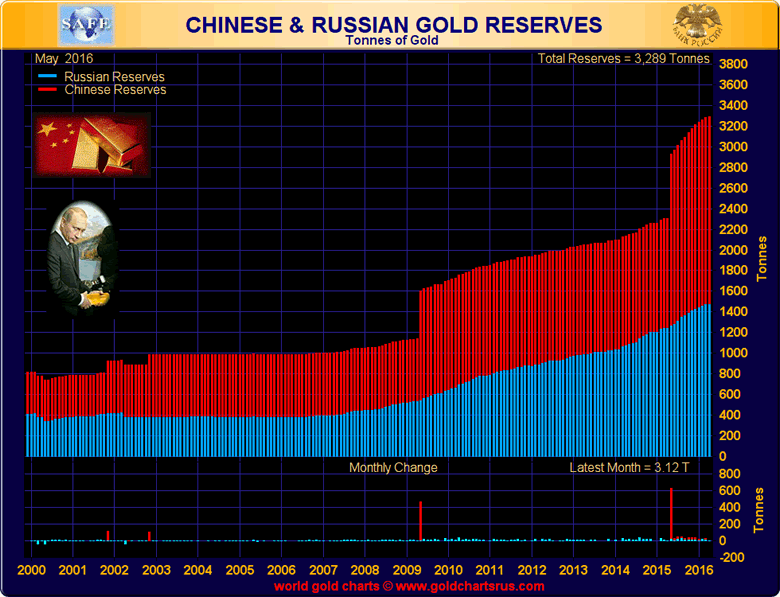

In recent years, since 2007, an increasingly powerful and assertive Russia has worked hard to reprise its place in the world’s top gold reserve rankings, quadrupling its purchases in the period to June this year.

A 34 ton purchase of gold (1.1 million ounce) in September has put Russia firmly back in the golden spotlight. The country now holds 1,779 tons of gold, placing it sixth in the world and just behind China.

In the first two quarters of the year the CBR purchased 129 tons, making the late-summer purchase the best since October 2016. Taking into account the September purchase, Russia needs to buy just another 37t in order to purchase 200t by the end of the year – the amount it has done each year, for the last two years running.

In order to support gold purchases, the CBR announced this week that it would start purchasing gold on the Moscow Exchange.

Why the obsession with buying up gold and increasing their gold reserves? It is primarily about protecting the ruble and combating US petrodollar hegemony.

Not just about gold purchases

Today, Russia is a prominent player in the global gold market, both on the supply and demand side. It is the world’s third-largest producer, with a 200-year history of gold mining, and the most significant official purchaser of gold.”

World Gold Council

Russia isn’t just making headlines for the amount of gold it is buying, but also for the amount it is producing.

The country is the world’s third largest gold producer, snapping at the heels of Australia in second. The most recently available figures from Metals Focus show Russia produced 274 tonnes of gold in 2016. The majority of which appears to have been bought by the Russian Central Bank.

Polyus, Polymetall, Kinross, Petropavlovsk, and Nordgold are the country’s top gold producers. Between them they produce more than 120 tons of gold a year, just under 50 percent of Russia’s total production, last year.

In the last decade the country has mined over 2,000t. According to Sergey Kashuba, Chairman of Russian Gold Producers Union this year’s production is expected to exceed 300t, and increase very significantly to 400t by the end of 2018.

Why the gold diversification?

Whilst the Russian Central Bank has been stocking up on gold reserves it has noticeably not been increasing its foreign exchange reserves, especially the US dollar.

This is a similar approach to fellow-gold buyers China who have also been reducing their holdings of and dependence on the dollar. Both Russia and China have created mechanisms for trading nations to use gold rather than the US dollar in bilateral trade arrangements.

US dollar hegemony has given the United States unparalleled strategic advantage, notably preventing Russia and China from creating an economic area of integration. For years this has worked in the United States’ favour, however when Putin came on the scene Russia almost immediately began to gradual move away from US dollar dependency.

Today the country has one of the lowest levels of dollar-denominated private and public debt, in the world. The country has also decreased the share of euro in its foreign reserves from 40% to 26%.

The danger with holding lots of dollars is if the US wanted to damage Russia’s finances, this would be possible through currency manipulations and sanctions. Iran is an example of country holding gold is insurance against such an event. There is also the very real risk that the U.S. with sharply devalue the dollar in the coming months and years. This would result in Russia’s dollar reserves becoming worth a lot less and in a worst case scenario become worthless.

China and Russia’s frustration at the over reaching of the United States and the power it yields with the US dollar has seen both countries accelerate both gold mining and purchases in recent years. Note the contrast with the United States which is not topping up (or even auditing) its own gold reserves.

Often the argument for holding foreign currency in reserve is to provide liquidity in time of need. Most analysts forget that in this day and age one of the most liquid currencies remains gold. Therefore, it cannot be argued that Russia and China are not stocking up their reserves adequately.

Independent of any government and arguably more liquid than any other sovereign currency, gold is the ultimate currency for countries such as Russia, especially in the face of sanctions.

Dmitry Tulin, the First Deputy Governor, has also stated that the Bank of Russia increased gold purchases because only this reserve asset provides total protection against legal and political risks – “100% guarantee from legal and political risks.”

Learn to invest like the Russians

When asked about the central bank’s gold purchases Elvira Nabiullina, Governor of the Bank of Russia said

“We are adhering to the principle of reserve diversification. This principle remains unchanged. From this perspective, our reserves do include gold.”

Savers should take note, diversification should be the number one priority when it comes to protecting and growing your wealth in these uncertain times. This is for precisely the same reasons the Russian Central Bank is doing so – in order to protect against legal and political risks (Brexit, Trump etc) , but also economic and financial risks.

The risks to a saver may seem vastly different to those of a central bank but really they are quite similar. Both are exposed to the decisions made by politicians around the world. Like Russia, we too are awaiting with baited breath what President Trump will do next or what the EU will soon decide is the best way to ‘protect’ the Super state bloc. We are exposed, as are our savings and investments.

Gold cannot be devalued as fiat currencies can, allocated and segregated gold cannot be confiscated thanks to the irresponsible actions of a counterparty. It is a borderless, free currency that acts as the ultimate reserve in a diversified portfolio.

Russia and China have a plan to take charge of their financial future and gold is at the heart of that plan.

Gold Prices (LBMA AM)

27 Oct: USD 1,267.80, GBP 968.35 & EUR 1,090.18 per ounce

26 Oct: USD 1,278.00, GBP 968.34 & EUR 1,082.34 per ounce

25 Oct: USD 1,273.00, GBP 964.81 & EUR 1,081.67 per ounce

24 Oct: USD 1,278.30, GBP 970.36 & EUR 1,087.32 per ounce

23 Oct: USD 1,275.25, GBP 967.79 & EUR 1,085.62 per ounce

20 Oct: USD 1,280.25, GBP 974.27 & EUR 1,084.76 per ounce

20 Oct: USD 1,280.25, GBP 974.27 & EUR 1,084.76 per ounce

Silver Prices (LBMA)

27 Oct: USD 16.72, GBP 12.76 & EUR 14.38 per ounce

26 Oct: USD 16.97, GBP 12.84 & EUR 14.37 per ounce

25 Oct: USD 16.89, GBP 12.75 & EUR 14.34 per ounce

24 Oct: USD 17.04, GBP 12.92 & EUR 14.49 per ounce

23 Oct: USD 17.00, GBP 12.90 & EUR 14.47 per ounce

20 Oct: USD 17.08, GBP 12.96 & EUR 14.46 per ounce

20 Oct: USD 17.08, GBP 12.96 & EUR 14.46 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.