Government Finances and Gold - Cautionary Tale told in Four Charts

Interest-Rates / US Debt Nov 02, 2017 - 01:11 PM GMT “President Trump, in complete contradiction to candidate Trump, has praised Yellen for being a ‘low-interest-rate-person.’ One reason Trump may have changed his position is that, like most first-term presidents, he thinks low interest rates will help him win reelection. Trump may also realize that his welfare and warfare spending plans require an accommodative Fed to monetize the federal debt. The truth is President Trump’s embrace of status quo monetary policy could prove fatal to both his presidency and the American economy.” – Ron Paul, Institute for Peace and Prosperity

“President Trump, in complete contradiction to candidate Trump, has praised Yellen for being a ‘low-interest-rate-person.’ One reason Trump may have changed his position is that, like most first-term presidents, he thinks low interest rates will help him win reelection. Trump may also realize that his welfare and warfare spending plans require an accommodative Fed to monetize the federal debt. The truth is President Trump’s embrace of status quo monetary policy could prove fatal to both his presidency and the American economy.” – Ron Paul, Institute for Peace and Prosperity

Editor’s note: This issue of our newsletter features several interactive, live charts offered in conjunction with the St. Louis Federal Reserve and the ICE Benchmark Administration/LBMA. You can access statistical details by moving your cursor over the charts. If the chart does not automatically update, please move the toggle button on the year bar all the way to the right. We invite you to bookmark this edition for future reference.

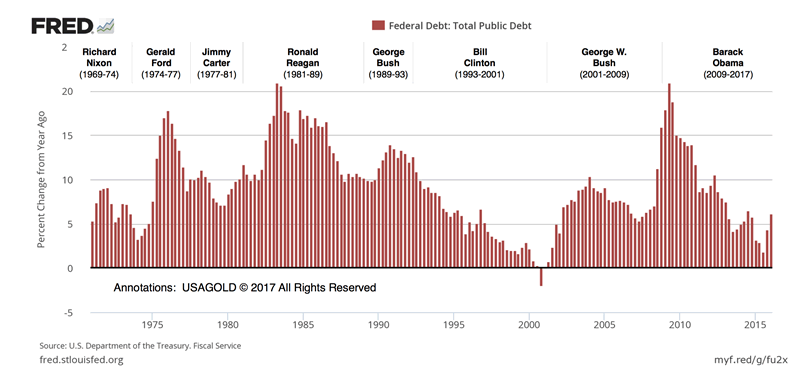

CHART 1: Sustained by both political parties, the national debt has taken on a life of its own

Since the early 1970s, the logic for gold ownership has been inextricably bound to the cash flow problems of the federal government. As the national debt increased so did the well-documented damage associated with it – to the dollar, to financial markets and to the economy in general. Simultaneously, gold’s role as an inversely correlated portfolio hedge grew over that nearly one-half century as well.

As you can see from the chart above, which shows the percent change in the national debt from the previous year, those problems do not favor any particular political party or president. In a certain sense, it has taken on a life of its own, marching to over $20 trillion without regard to party ideology. I mention that for the benefit of those who might think that somehow things might be different under a Trump administration. In fact, the greatest percentage growth in the national debt occured surprisingly during Republican administrations.

“As GOP lawmakers are struggling to enact an agenda of spending and tax reform,” says one journalist, “they continue to face the painful reminder that Trump has no ideological drive to tame the deficit. The President has made clear that he doesn’t mind if deep tax cuts result in a ballooning of the national debt.”

CHART 2: How the national debt and the Fed could bankrupt the nation

DEFICITS MATTER!

Democrat Franklin Delano Roosevelt was the first to publicly declare that deficits did not matter since, he reasoned, we owe the money to ourselves. Dick Cheney, who should have known better, made the same claim on behalf of Republican deficits. Deficit denial has never held water simply because holders of government paper, foreign or domestic, intend to be repaid and with interest. It’s that part about creditors demanding interest that blows a hole in the “deficits-do-not-matter” argument. One of the stand-out features of the chart above is that, as interest rates have declined over the last several years, the interest paid by the federal government has increased markedly due to the rapid growth in size of the accumulated debt.

Some quick background:

* * * In 2008 when the national debt stood at $10 trillion, the federal government paid $336 billion in interest. For a measuring stick, the ten-year Treasury bill drew an average interest rate at the time of around 3.66%.

* * * In 2012 when the debt crossed the $16 trillion threshold, the interest payment was almost $456 billion. The ten-year Treasury bill drew an average interest rate of 1.80%.

* * * In 2016 with the national debt approaching the $20 trillion mark, the interest payment was $497 billion. The ten-year Treasury bill drew an average interest rate of 1.84%. It is difficult to overlook the fact that 2016’s interest payment was an all-time record at the second lowest rate on the 46-year chart.

* * * If the ten-year Treasury bill were to rise to 2.82% (the average since 2007), the implied interest payment would exceed $750 billion, 20% more than what the United States spends annually on the national defense.

* * * If the average interest rate were to double from current levels (about 3.7% on the ten year Treasury bill), the United States would pay almost $1 trillion annually in interest on the national debt, or nearly one-third of 2016 tax revenues ($3.27 trillion). At that point, markets might begin to question the solvency of the U.S. federal government.

The exercise above points up the limitations on the Federal Reserve with respect to raising interest rates. It is a cautionary tale told in some very big numbers that promise to become even larger. In short, the onerous public debt has hamstrung the Fed in ways that policy-makers are loathe to discuss publicly. The Federal Reserve either keeps a leash on interest rates, or it bankrupts the nation.

CHART 3: The national debt is the ultimate threat to the dollar’s reserve currency status

In the worst-case scenario, the accumulated debt and interest payments reach levels the markets find intolerable, threatening the dollar’s reserve currency status and foreign creditors’ confidence in U.S. Treasury paper. We came perilously close to that in 2011 when Standard & Poor’s downgraded America’s credit status citing the lack of “effectiveness, stability and predictability of American policymaking and political institutions.” Since then, an argument could be made that things have only gotten worse. Not only has the red ink flowed at an unprecedented rate, the U.S. debt to GDP ratio has gone from 62% in 2007 to 105% now. Among the G-20 nations, the United States now has the third worst debt-to-GDP ratio. Only Japan and Italy have worse. One cannot help but wonder what might lie ahead as we enter a new round of Washington wrangling over government finances.

CHART 4: The national debt has made gold a superstar

Few correlations in the financial markets ring truer and more consistently than the one between the federal debt and gold. That relationship between the two is about as fundamental as it gets because it goes to the heart of what’s wrong with the debt-based fiat money system. As the federal government borrows more and more dollars into existence and the banking system pushes those dollars through the global monetary system, it diminishes the value of all the other dollars already being held somewhere by somebody – domestic private investors, financial institutions, foreign governments and central banks, et al.

With respect to foreign holders of the U.S. sovereign debt, the process begins with trade imbalances that are later converted to Treasury paper in order to earn a yield. This process of replication simultaneously showcases gold, which cannot be replicated at will, as the dollar’s counterpoint and chief competitor – a superstar portfolio holding for reasons French president Charles DeGaulle famously outlined in his “Criterion” speech delivered in 1965. France set the tone and strategy for dealing with the “export” of dollars, as he described it, by converting those imbalances to gold and taking delivery within French borders.

From that time forward global investors, both private and public, have followed the French model with China’s current gold acquisition program the most notable recent example. The result is what you see on the chart. For those with capital preservation as the goal, gold has been a stalwart and productive ally since the United States went off the gold standard in 1971 and launched the era of fiat money, federal deficits and the massive federal debt.

As for the future, we should keep in mind that the very same conditions which created the long-term secular trend for both the national debt and gold are still in place today – nothing has changed fundamentally. As long as that is the case, we can assume gold will continue to attract capital as a long-term portfolio hedge just as it has, to varying degrees, through the first 46 years of the fiat money system. Please note, too, that gold is trading below the federal debt’s trend line, an indication that it might have some catching up to do in the months and years ahead.

If you would like to broaden your view of gold market, we invite you to sign-up for our regular newsletter and receive quality commentary like what you have just read. It’s free of charge and comes by e-mail. You can opt out at any time.

News & Views is the contemporary, web-based version of our client letter which traces its beginnings to the early 1990s as a hard-copy newsletter mailed to our clientele. The “Big Breakout of 1999” headlined in the November, 1999 issue of our newsletter moved the gold price from $250 to $325 per ounce. It was a major event.

The times have changed, but our mission has not. Simply put, it is to deliver value to our readers in the form of cutting-edge Forecasts, Commentary and Analysis on the Economy and Precious Metals. The very same mission that has been displayed in our banner for over 25 years.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.