GM, Ford, Chrysler on Sales Collapse Risk Bankruptcy

Companies / US Auto's Sep 04, 2008 - 03:17 AM GMTBy: Mike_Shedlock

The Wall Street Journal is reporting Auto Sales Tumble, But Industry Sees Signs of Hope .

The Wall Street Journal is reporting Auto Sales Tumble, But Industry Sees Signs of Hope .

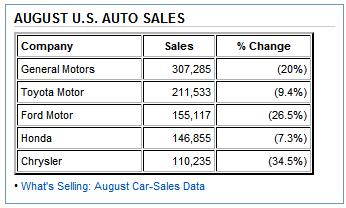

Sales of cars and light trucks fell 15.5% to 1.25 million last month, down from 1.48 million a year earlier, according to Autodata Corp. The closely watched seasonally adjusted annualized selling rate was 13.7 million vehicles, up from 12.55 million in July, but down from 16.3 million in August 2007, Autodata said.

"There are early indications of somewhat improving conditions," said Ford Motor Co. economist Ellen Hughes-Cromwick, in a conference call with analysts and reporters. She pointed to a decline of about 40 cents a gallon in the price of gasoline, improvement in a key measure of consumer confidence and an upward revision in the federal government's estimate of second-quarter economic growth.

"The biggest issue is credit," Chrysler President Jim Press said in an interview. "It isn't the gas mileage of the vehicles turning people off, it's getting credit and financing.

Disingenuous Talk At GM, Ford, Chrysler

There are no legitimate reasons to state "There are indications of somewhat improving conditions". Falling crude prices are a strong sign of a collapsing global economy. Second quarter GDP is simply not believable. See GDP Much Weaker Than Headline Numbers for the rationale.

To suggest that auto financing issues are "the biggest issue" is complete silliness. People are tapped out and increasingly frugality is one issue. GM, Ford, and Chrysler producing SUVs, trucks, and cars that are now out of favor is another reason.

Car Sales Post 10th Straight Decline

Bloomberg is reporting GM, Ford Drag U.S. Car Sales to 10th Straight Decline .

Here is my favorite quote from the article. It is from Chrysler President Jim Press: " Maybe towards the end of '09, going into 2010, there'll start to be some signs of recovery. "

GM Celebrates

In celebration of our 100th anniversary, we're sharing our GM Employee Discount . You pay what we pay. Not a cent more.

2009 models include Chevy HHR, Cobalt, Malibu, Impala, Equinox, Avalanche, Silverado, Buick Enclave, Pontiac G5, G6, Vibe, G8, Solstice, Torrent, GMC Acadia, Sierra, Saturn Aura, SKY, OUTLOOK, Cadillac CTS, SRX, DTS, STS, HUMMER H2 and H3. At participating dealers only. Take delivery by 9/30/08. See dealer for details.

If things were improving, would GM be celebrating?

On June 24 GM announced price hikes on 2009 models by an average of 3.5%. I called it GM's Ridiculous Bluff . Indeed it was.

I panned GM's Employee Pricing Ploy on August 19th with this statement:

" GM is offering over $4,000 in incentives and extending the offer to some 2009 models as well. It will not be long before the offer is extended to all 2009 models (and/or some other incentive program is put in place for 2009 models). "

Well that did not take too long.

The original offer was due to expire on September 2nd, but has now been extended to September 30th. Coverage of included 2009 models has been expanded to most 2009 models as noted in the above list.

Shop Until You Drive

Chrysler continued its 'Shop 'Til You Drive' Campaign by offering Up to 40 Percent Off MSRP.

"To help consumers, we are offering some of our most popular vehicles at significant savings. In August, we saw this formula generate new signs of momentum on vehicles like our Chrysler and Dodge minivans, Dodge Ram light-duty trucks and Jeep(R) Liberty. In September, we will continue to offer competitive values and showcase dynamic new vehicles like the 2009 Dodge Challenger, and hybrid Dodge Durango and Chrysler Aspen SUVs."

Chrysler's 'Shop 'til You Drive Sales Event' continues through Sept. 30, offering up to 40 percent off MSRP on select vehicles, and zero percent APR for 72-months on the 2008 Dodge Ram, Dodge Durango, Chrysler Aspen, Jeep Grand Cherokee and Jeep Commander. Especially strong values are available on Dodge Ram pickup trucks, with up to $9,000 discounts in select markets. The only sign of momentum is in reverse. Nonetheless, at 40% off Chrysler will eventually clear inventory. What a difference from 2006.

Chrysler Achieves All Financial Targets

Chrysler CEO says Chrysler Shrinking to a Profitable Size .

Chrysler cut a million units of assembly capacity in the past year, pared its lineup and now will thin its dealer ranks with a goal of making money on annual sales of as many as 2.5 million vehicles, down from an "unprofitable" 4 million, Press said today in Los Angeles.

In the first half of 2008, "we've achieved all of our financial targets that Cerberus set at the start of the year," Press said. Those must have been the easiest financial targets in automotive history.

Chrysler Tops Peers in Bankruptcy Risk

On August 15 Bloomberg reported Chrysler Tops Peers in Bankruptcy Risk, JPMorgan Says .

Chrysler LLC is the most likely of the three U.S. automakers to file for bankruptcy protection in the next two years, JPMorgan Chase & Co. said, citing a panel discussion among credit-rating companies.

General Motors Corp. is the next most likely and Ford Motor Co. is the least, JPMorgan analyst Himanshu Patel wrote in a report today, quoting discussion yesterday by analysts from Standard & Poor's, Moody's Investors Service and Fitch Ratings. S&P and Moody's both cut Chrysler's credit one level on Aug. 7, seven steps below investment grade.

Moody's cut GM's rating to Caa1 on Aug. 13. S&P lowered GM and Ford to B- on July 31. Fitch downgraded Ford to B- on Aug. 1, matching its action on GM on June 25.

Without government (taxpayer) bailouts, these companies simply cannot survive.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.