Stock futures are struggling. May reverse Today

Stock-Markets / Stock Markets 2018 Jan 12, 2018 - 02:43 PM GMT Good Morning!

Good Morning!

SPX futures are easing away from their morning high at 2776.75. The cash market may be complete at 2767.56. We’ll know at the open.

ZeroHedge reports, “World stocks hit a new all time high on Friday with U.S. equity futures rising for the 8th trading day out of 9 in 2018 - the Dow is just a little over 300 points away from 26,000 - alongside Asian shares while European stocks and oil are little changed. The euro surged to a three-year high as Germany was said to reach a "grand coalition" agreement, heaping more pressure on the dollar before inflation data.

European stocks advanced with U.S. equity futures as BlackRock Inc. kicked off a busy earnings season with profits that beat estimates.”

On the other hand, there were some flies in the ointment as JPM Reports Mystery $143 Million Loss To Unnamed Client As FICC Revenue Tumbles 34% and Retail Sales Miss December Expectations For 4th Straight Year.

NDX futures took a nosedive this morning at 8:00 am as Facebook Tumbles After Zuckerberg Warns Of Lower "Engagement"

Are the FANGs being defanged?

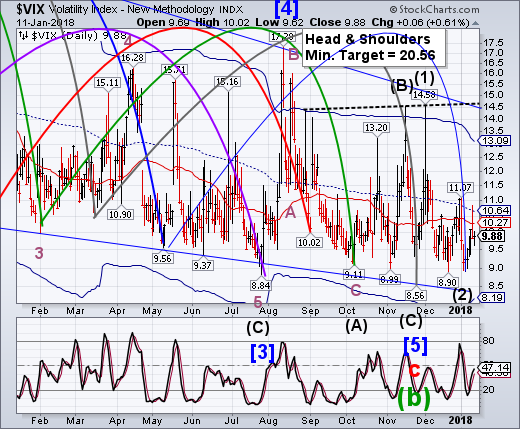

VIX futures are gaining some traction after a flat overnight market. Although the January 4 low is 2 ticks higher than the December low, the Cycle Model seems to suggest a better fit then the December low for Wave (2) and the Master Cycle low.

ZeroHedge posted an article yesterday that bears re-reading concerning the net short positions on the VIX. This could be an explosive setup.

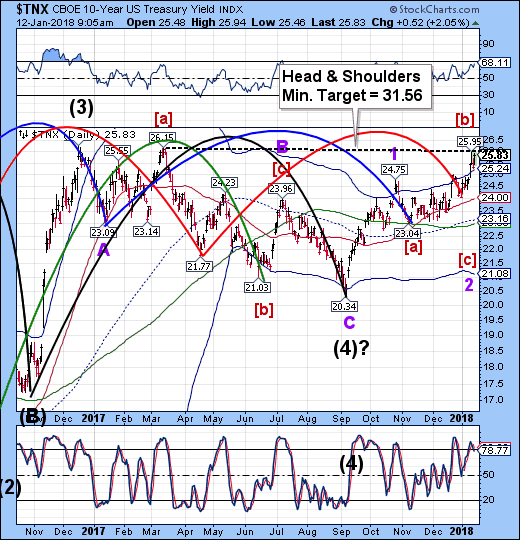

TNX is retesting its high this morning. It may probe even higher, but should not affect the Head & Shoulders formation as it completes Wave v of (c) of [b].

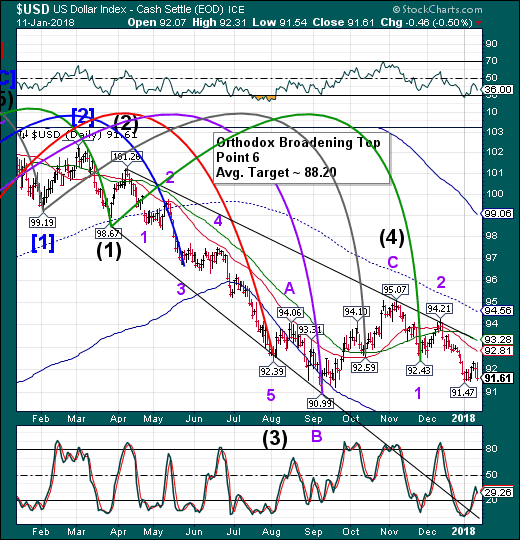

USD futures began a sell-off at 3:00 am that has it breaking down beneath last week’s low. The decline may gather strength over the next week with the Master Cycle low due near the end of the month. The Orthodox Broadening Top doesn’t show in the daily chart because it started three years ago. I have been anticipating “Point 6” for the past year.

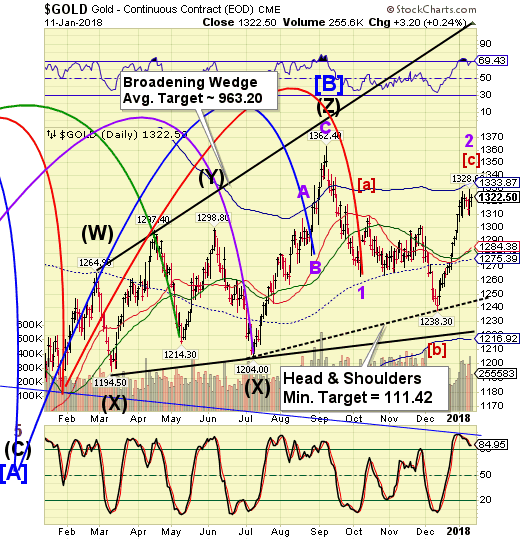

Gold may have made its final retracement high this morning at 1333.70. It has had quite a run for a retracement rally. It may end up trapping a lot of goldbugs as the decline is not likely to take any prisoners.

WTI made its Fib target of 64.20 yesterday, giving the green light for the decline to begin. Crossing beneath the Cycle Top at 60.83 gives us an aggressive buy signal with confirmation beneath the 50-day Moving Average at 58.03.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.