Moneyfacts comments on the Nationwide Building Society 25 year fixed rate mortgage

Personal_Finance / Mortgages Mar 26, 2007 - 03:25 PM GMTBy: MoneyFacts

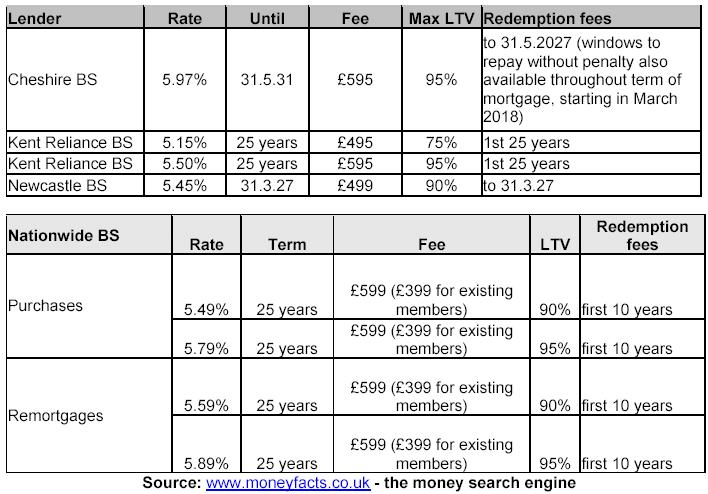

Julia Harris, mortgage analyst at moneyfacts.co.uk – the money search engine, comments: “The new Nationwide 25-year fixed rate mortgage is competitive when compared with other long-term fixed rates, particularly for those with a 10% deposit. It comes with a fee of £599 (and a £200 discount for existing members), which is not out of line, especially when you take into account some of the four figure or percentage based fees that we are now seeing for short term deals.

Julia Harris, mortgage analyst at moneyfacts.co.uk – the money search engine, comments: “The new Nationwide 25-year fixed rate mortgage is competitive when compared with other long-term fixed rates, particularly for those with a 10% deposit. It comes with a fee of £599 (and a £200 discount for existing members), which is not out of line, especially when you take into account some of the four figure or percentage based fees that we are now seeing for short term deals.

“It is refreshing to see that the mortgage is fully flexible and, more importantly that it does not charge a redemption fee after the first 10 years. So although the rate is guaranteed for the full 25 years, if after 10 years rates have fallen or your circumstances mean a different deal is preferable, you are free to change provider without financial penalty. However for anyone only looking at this deal for a 10-year period, better rates are available for 10-year fixed deals, so you are certainly paying a premium for the option to fix for the extra 15 years.

“Due to recent rises in interest rates it seems that the Nationwide is reacting to a greater demand for longer term fixed rates. A fixed rate can give borrowers additional peace of mind at a time when some experts are predicting another rise. With many homebuyers stretching their incomes to the maximum, this long term repayment stability may be just what they need.

“With over 130 fixed rate deals available for periods of 10 years or more, the longer term fixed market is very much a growth area. However, only a handful of lenders offer fixed rates for a term of 20 years or more, which after all will only suit a niche market of borrowers who still have the majority of their mortgage term remaining.”

By Julia Harris,

http://www.Moneyfacts.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.