How to Trade Gold During Second Half of January, Daily Cycle Prediction

Commodities / Gold and Silver 2018 Jan 18, 2018 - 11:06 AM GMTBy: Chris_Vermeulen

Metals are setting up for that “Rip Your Face Off Rally”. The following charts for Gold and Silver show a very interesting setup that is unfolding as the US markets continue to strengthen – that being that the Metals are showing strength in price and we can only assume this is related to some level of FEAR in the markets or expectations that the “Equities and Bitcoin Bubbles” are nearing an end.

Metals are setting up for that “Rip Your Face Off Rally”. The following charts for Gold and Silver show a very interesting setup that is unfolding as the US markets continue to strengthen – that being that the Metals are showing strength in price and we can only assume this is related to some level of FEAR in the markets or expectations that the “Equities and Bitcoin Bubbles” are nearing an end.

Gold and Silver have been one of our primary focuses for years. We warned of the “Rip Your Face Off” rally near the Third Quarter 2017 as our cycle analysis was bottoming in December.

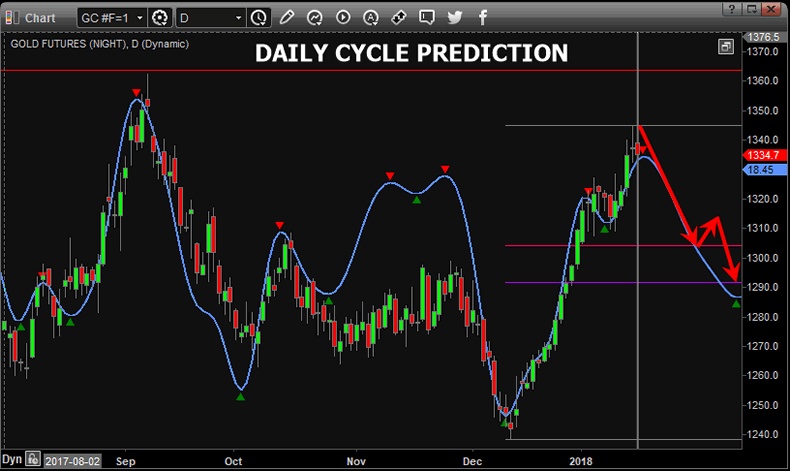

The recent rally in Gold has been substantial and has managed to breach recent resistance levels near $1300~1310. At this point, we are expecting a moderate pullback in Gold over the next few weeks to levels likely near or below the $1300 level before the next leg advances well above $1380. The presumed formation of Wave 3, if our analysis is correct, should prompt a massive move in the metals over the next 3~7 months with a number of pullbacks along the way. Right now, it all depends on how Gold reacts to the recent highs and how deep the next retracement in price is. We could see a $1270~1300 level price pullback before the next leg higher executes. This would be the best entry zone for both traders and long-term investors.

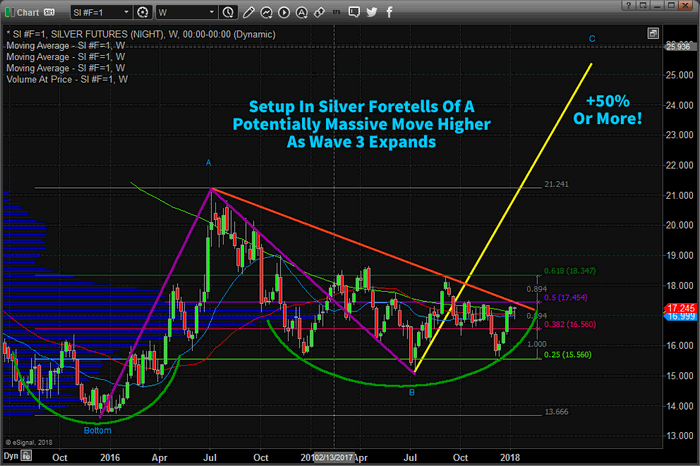

Silver is the “forgotten shiny metal” by many. As we have been warning our readers, this next move in the Metals market should be a massive Wave 3 (or completed Wave 5 that will prompt a Wave B correction). Either way, this next move could end substantially higher than where current prices have been consolidating. Because of the expected continued rally in the US equities markets and because of the strong growth in the economic fundamentals, we believe the next contraction phase in the Metals will be a very opportunistic BUY ENTRY ZONE for traders.

Silver, which has not shown the volatility or price activity that Gold has recently shown, is one of those markets that many people forget about. Yet, Silver has so much more opportunity for massive price gains as related to the setups that are currently playing out in the US and global markets. As fear builds and global markets react to the Everything Bubble, Crypto volatility, Global Market Concerns and Global Political Concerns, the Metals are certainly going to be an interesting and opportunistic play for traders.

As you can see from this Silver Weekly chart, the setup in Silver is similar to the Gold chart, yet the price activity in Silver is very much more muted in volatility than Gold. We believe that Silver, when the move happens, will show substantial price acceleration to the upside while Gold continues to rally.

2018 is setting up to be a very good year for BOTH traders and long-term investors as the opportunities for skilled and strategic trades is astounding. Visit our website to learn more about the markets and to receive our daily updated market predictions and trade alerts.

Watch our recent video report analysis just posted live showing our predictive modeling systems and how we target our research to helping our members make money. Once you see for yourself how our analysis is accurate and timely.

We urge you to subscribe to www.TheTechnicalTraders.com to support our work and to benefit from our trade setups. We believe 2018 – 2020 will be the years that strategic trades will outperform all other markets. Join us in our efforts to find and execute the best trading opportunities and profit from these fantastic setups.

Visit www.TheTechnicalTraders.com to see what we are offering you.

Chris Vermeulen

www.TheGoldAndOilGuy.com – Daily Market Forecast Video & ETFs

www.ActiveTradingPartners.com – Stock & 3x ETFs

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.