Will Surge in Bond Yields Smash Gold?

Commodities / Gold and Silver 2018 Jan 19, 2018 - 10:09 AM GMTBy: Arkadiusz_Sieron

Yields on U.S. Treasuries have leaped recently. It will wreck the yellow metal. Or maybe not.

Yields on U.S. Treasuries have leaped recently. It will wreck the yellow metal. Or maybe not.

Yields Reach New Heights. Breakthrough for Gold?

Last week, we wrote that concerns emerged that China could stop or slow buying the U.S. Treasuries. The U.S. bond yields reacted strongly. We noted that in theory it should sink gold, but the usual “correlation between bullion and Treasury yields broke down thanks to the depreciation of the U.S. dollar, which supported the gold prices”. Due to the importance of that issue for the gold outlook, we continued to monitor the developments in the bond market to keep investors updated.

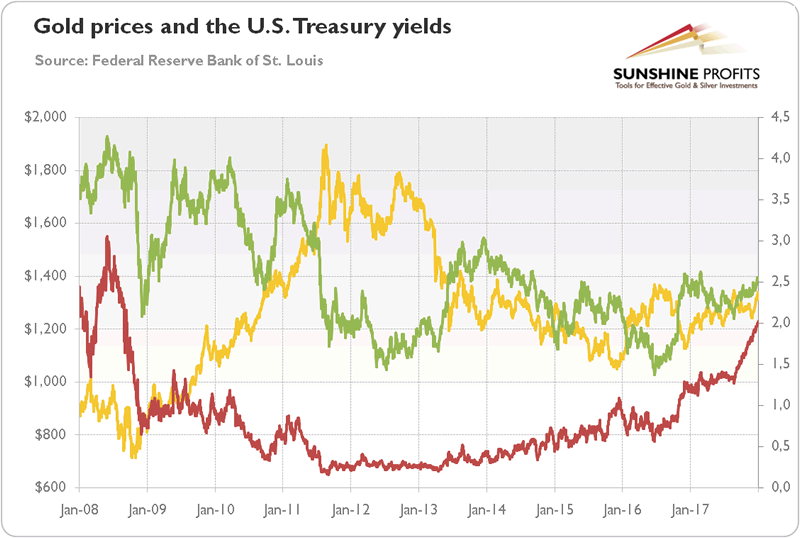

Let’s look at the chart below. It shows that yields on 2-year U.S. Treasuries jumped on Tuesday to 2.03 percent, the highest level since 2008. And one can also see that 10-year Treasury yields hit 2.54 percent, the highest level since the beginning of 2017.

Chart 1: The price of gold (yellow line, left axis, London P.M. Fix, in $), the yields on 10-year Treasuries (red line, right axis, in %), and the yields on 10-year Treasuries (green line, right axis, in %) over the last ten years.

Many analysts assert that soaring yields will scupper the golden ship. But the price of the yellow metal rallied last week. It dropped slightly on Tuesday, but it rose again yesterday. Anyway, gold doesn’t look as casualty of rising yields. At least so far. Why?

Real, not Nominal, Rates Matter for Gold

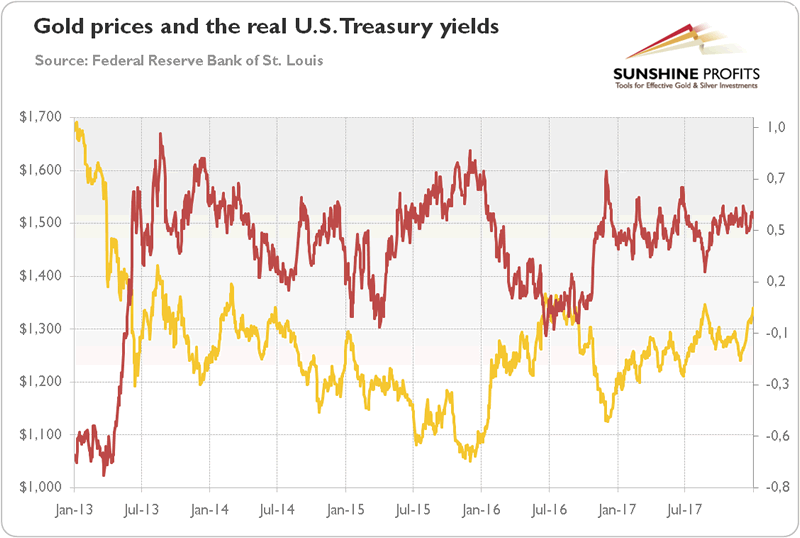

One of the reasons behind the counterintuitive gold’s reaction is that real interest rates didn’t soared. Of course, they also jumped, but remained within the trading range seen since 2017, as one can see in the chart below.

Chart 2: The price of gold (yellow line, left axis, London P.M. Fix, in $) and the U.S. real yields (red line, right axis, yields on 10-year Treasury Inflation-Indexed Security, in %) over the last five years.

Climbing nominal yields with steady real interest rates indicate that investors expect that inflation hydra may finally raise its ugly head. Indeed, the recent data shows that the Producer Price Index increased 2.6 percent in 2017, the fastest pace in six years. The annual rate of inflation in consumer prices slipped from 2.2 percent to 2.1 percent in December, but the core CPI edged up from 1.7 percent to 1.8 percent last month. Gold may not be the best weapon to use against hydras, but it is perceived to be a good hedge where investors may safely hide their wealth.

Weakness in Greenback Supports Gold

Another key factor is that rising yields haven’t helped so far to halt the decline in the U.S. dollar. However, there might be a rebound in the greenback, at least in the short-term. We saw the first potential signs of that yesterday, when the dollar rose from a three-year low. Today, the earlier downward trend reestablished, but there might be some consolidation in the euro, and thus in gold as well, ahead of the ECB’s policy meeting next week. Especially that the ECB officials have recently sent some dovish signals. Vitor Constancio, the ECB vice president, said he did not rule out that monetary policy would still continue to be “very accommodating for a long time”, while Ewald Nowotny told reporters that the euro’s recent strength against the greenback is “not helpful”.

Conclusions

The U.S. bond yields continued their rally. Gold didn’t plunge as the real interest rates remained within the sideways trend. A buildup in inflation could push the Fed to raise interest rates more aggressively, but the U.S. central bank seems to remain behind the curve. Higher inflation would lower real interest rates, which should support the gold prices. The weakness in the U.S. dollar is another key tailwind in the gold market. There might be a reverse in the EUR/USD exchange rate ahead of the ECB’s monetary policy meeting next week. Gold would decline, then. But if the eurozone’s economic expansion continues, the bearish trend in the dollar may remain with us, which would be supportive for the gold market. We will elaborate on this in the February edition of the Market Overview. Stay tuned!

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.