US Dollar Will be Key to Gold Sesame

Commodities / Gold and Silver 2018 Jan 24, 2018 - 06:32 PM GMTBy: Arkadiusz_Sieron

Gold may be considered to be a bet against the U.S. dollar. The depreciation of the greenback supported the yellow metal in 2017. The price of gold managed to rise last year in rather unpleasant macroeconomic environment mainly thanks to the weakness of the U.S. dollar. Now, the key question is whether the bearish trend in the greenback will continue or we will see a trend reversal (or actually a continuation of a rebound which started in September)?

Gold may be considered to be a bet against the U.S. dollar. The depreciation of the greenback supported the yellow metal in 2017. The price of gold managed to rise last year in rather unpleasant macroeconomic environment mainly thanks to the weakness of the U.S. dollar. Now, the key question is whether the bearish trend in the greenback will continue or we will see a trend reversal (or actually a continuation of a rebound which started in September)?

Theoretically, the U.S. dollar should strengthen in 2018. The reason is straightforward. Interest rates in the U.S. are higher than in the Eurozone. And the Fed will continue the monetary policy of gradual interest rate hikes next year, while the ECB will not start hiking until 2019. Therefore, the divergence in monetary policies between the Fed and the ECB, and in the level of interest rates in the U.S. and the Eurozone, should increase. According to the interest rate parity, it should encourage investors to sell European assets and to buy American to achieve higher yields. Such transactions should then strengthen the U.S. dollar and weaken the euro.

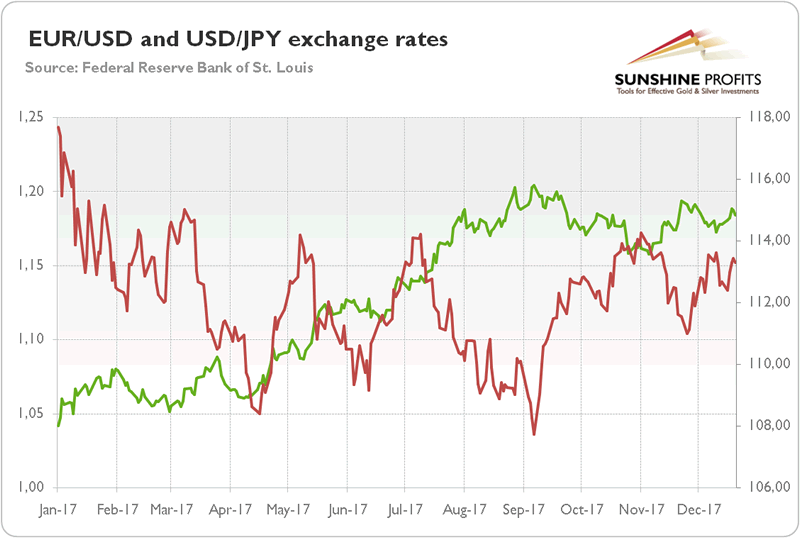

This line of reasoning has strong theoretical foundations, but it has one small defect – the last year invalided it completely. The Fed hiked interest rates four times since December 2016, but the broad U.S. dollar index fell about 6 percent. The greenback lost about 12 percent against the euro and about 3 percent against the Japanese yen, as one can see in the chart below.

Chart 1: EUR/USD exchange rate (green line, left axis) and USD/JPY exchange rate (red line, right axis) over the last twelve months.

How can we explain the depreciation of the U.S. dollar despite the Fed tightening cycle? First, markets are forward looking and investors often buy rumors, and sell (or ignore) facts. The implication is that the U.S. dollar appreciated between 2014 and 2016 in anticipation of the more aggressive pace of monetary tightening, including the unwind of the Fed’s balance sheet. Looking at things from this perspective, the U.S. dollar could continue a downward trend in 2018. This is because markets anticipate the start of tightening by the ECB. And the Fed is relatively advanced in its tightening program, so it does not make sense to expect a significant acceleration in it.

Second, investors should remember that the Eurozone and America are in different stages in the business cycles. The economic recovery in the United States is more advanced than in Europe. It means that the Eurozone economy has greater potential for growth ahead. This difference should be reflected in the appreciation of the EUR/USD exchange rate, which is positive news for the gold market.

Third, the decline in the U.S. dollar index might reflect weak U.S. economic policy. As a reminder, in January 2017, President Trump started to express his desire for a weaker greenback. In other words, the protectionist measures and attempts to stimulate the economy in the short-term (through fiscal stimulus) replaced policies aimed at improving productivity. The combination of protectionist schemes and deficit spending weakened the U.S. position in the global economy, so the greenback fell against the euro.

Putting the above fundamental considerations aside, let’s keep in mind that the reason that the USD didn’t rally yet is because history is simply repeating itself. As we explained in October, the current series of rate hikes has only one similar event in the recent history - the rate hikes in 2004 and 2005 during the Greenspan era. Back then the USD didn’t rally until the 4th rate hike (3rd in the series of hikes) and applying this to the current situation suggests that an upswing in the USD Index should start shortly or that it’s already underway. Back then, the USD Index started approximately a year long rally, so we might see a big upswing in 2018, too, after all.

The bottom line is that the U.S. dollar may continue its downward trend in 2018 or it may soar. The reason for the former is that although the tax reform and infrastructure spending may add to economic growth in the short-term, investors seem skeptical about their long-term impact on the U.S. economy. Unless the politicians implement some structural reforms boosting labor productivity instead of stimulating the economy through fiscal deficits, the weakness in the greenback may persist. Especially when markets expect that the ECB will have to tighten its monetary policy in the near future due to the surprisingly positive performance of the Eurozone. Moreover, the purchasing power parity also suggests that the EUR/USD could increase further in the long-run, to about 1.35 (at least, according to the Big Mac Index). On the other hand, if history simply repeats itself and we see the repeated effect of the previous series of rate hikes (2004 and 2005), the USD Index will soar.

The former case would be good news for the gold market, as the yellow metal is negatively correlated with the U.S. dollar. However, it does not mean that there will be a rally in gold. The higher real interest rates, strong economic momentum, the competition of the stock market and cryptocurrency market may exert downward pressure on the yellow metal even if the USD Index declines. Hence, the modest gains or a sideways trend may continue in this case. Having said that, the beginning of the year is usually a good period for the gold prices. In 2016 and 2017, the shiny metal rallied in January and February. Will this time be any different? The fundamental factors don’t point to a specific outcome in the short term – it seems best to monitor the market for the technical developments and see in which way the situation in the USD Index continues to evolve.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.