Strange Link between Inflation and Gold

Commodities / Gold and Silver Stocks 2018 Feb 15, 2018 - 03:17 PM GMTBy: Arkadiusz_Sieron

It was a strange day. Inflation surged yesterday. But gold dropped initially, only to quickly reverse the fall and fly into the air. What happened? And – importantly – will gold soar on the inflation fuel?

It was a strange day. Inflation surged yesterday. But gold dropped initially, only to quickly reverse the fall and fly into the air. What happened? And – importantly – will gold soar on the inflation fuel?

Inflation Rears Its Ugly Head (or Tries to, at Least)

The recent payrolls report showed that wages had jumped 2.9 percent in January on an annual basis. It was the best result since 2009, which awakened fears of inflation. That’s why investors awaited yesterday’s data on consumer prices. On Tuesday, we warned our readers: “(…) tomorrow, we will see the newest CPI report, which may affect the markets, given that inflation worries were one of the key reasons behind the recent stock market volatility.”

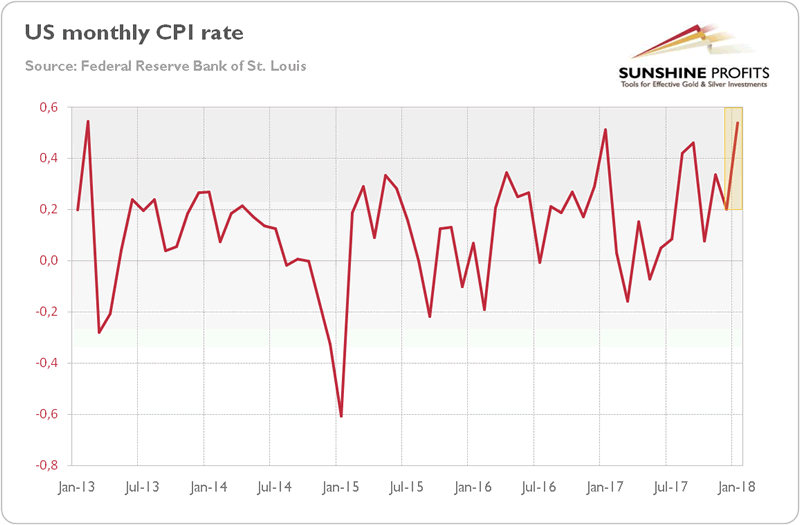

Indeed, we got a hot CPI print, which shook the markets. The prices jumped surprisingly high. The Consumer Price Index leaped 0.5 percent in January, following a 0.2-percent increase in December, as one can see in the chart below.

Chart 1: U.S. monthly CPI rate (in %) from January 2013 to January 2018.

The boost in energy prices was partially responsible for the move, that’s sure. But the core version of the index, which excludes energy and food, also rose. And it actually accelerated from 0.2 percent in December to 0.3 percent in January. It implies that inflationary pressures may settle in, although the rebound in apparel prices (change from -0.3 in December to +1.7 percent in January) did the job here.

Over the last 12 months, consumer prices went up 2.1 percent, while the core CPI increased 1.8 percent. The growth of both indices was the same as in December. So no acceleration here. Given the unchanged annual inflation rate, the fears of inflation may be overdone. When markets realize this, gold prices may correct.

Gold – Inflation Hedge or Safe-Haven?

Nevertheless, the investors focused on the monthly dynamics, as the January numbers marked the biggest increase in five years, adding to the recent worries about rising inflation. And how did gold react? Try to guess. As a famous inflation hedge, it probably jumped, right? Well, not quite. Surely, it ended a day with huge gains. But let’s look at the chart below. It displays yesterday’s New York gold prices, hour after hour.

Chart 2: New York Gold Price on February 13, 2018.

Please take a good look. Do you see a sharp decline immediately after 8:30? We bet you do. Sorry for saying that, but it was gold’s initial reaction to the CPI report. Look once again – there is no doubt. The inflation rate surprised investors with its strength – and gold dropped. So much for the hedge against inflation, at least in the very short term.

However, the price of gold reversed very quickly, jumping above $1,350. So maybe gold protects against inflation, after all. Maybe. This is the standard story that everybody repeats. We offer you better explanations.

Gold is a safe haven. It started to climb yesterday after the stock market volatility increased again. We mean here the early morning, when U.S. equities fell and the analysts expected another day of declines. However, they ultimately finished higher on Wednesday and the CBOE Volatility Index fell.

Gold is also a bet against the U.S. dollar. The greenback strengthened initially, but struggled to build on its post-data gains, helping the yellow metal to regain its positive traction. The weak data on U.S. retail sales also supported the rally in gold.

Last but definitely not least, traders might just have second thoughts. Initially, they feared that the Fed would be unable to ignore higher inflation and would tighten its stance. But after a while, investors decided that the CPI report would not radically change the U.S. central bank’s medium-term stance. The Fed will remain behind the curve. When the Fed lags inflation, gold smiles. So it is an inflation hedge, in a sense – however, what really matters is not the mere inflation rate, but the Fed’s position against it!

Conclusions

Gold soared on Wednesday. The reason is the stronger than expected inflation data. However, the price of bullion fell initially, which raises some doubts about the sustainability of the rally, especially that the CPI report boosted expectations that the Fed will raise interest rates in March. Luckily for gold, the greenback failed once again, helping the yellow metal to jump above $1,350. It suggests that the markets expect that the U.S. central bank will stay behind the curve – the forecasts of an aggressive Fed would have inclined traders to buy the American currency. Hence, there is room for further upward moves in the gold market.

But don’t bet on soaring consume prices. Inflation expectations don’t suggest that inflation is going to explode. Any gold’s gains related to inflation fears should be, thus, limited.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.