Gold’s Fundamentals are Not Bullish…Yet

Commodities / Gold and Silver 2018 May 08, 2018 - 03:42 PM GMTBy: Jordan_Roy_Byrne

Ask some gold bugs why Gold has not broken out yet and you will probably get the usual answers. Some will say it’s due to manipulation or price suppression. Others will mention the current rally in the US Dollar (while neglecting that the previous decline in the greenback was unable to take Gold to a new high). Few would say the fundamentals are not in place. No one can know for certain but Gold’s fundamentals have not improved over the past year and are not where they need to be to support a breakout.

Ask some gold bugs why Gold has not broken out yet and you will probably get the usual answers. Some will say it’s due to manipulation or price suppression. Others will mention the current rally in the US Dollar (while neglecting that the previous decline in the greenback was unable to take Gold to a new high). Few would say the fundamentals are not in place. No one can know for certain but Gold’s fundamentals have not improved over the past year and are not where they need to be to support a breakout.

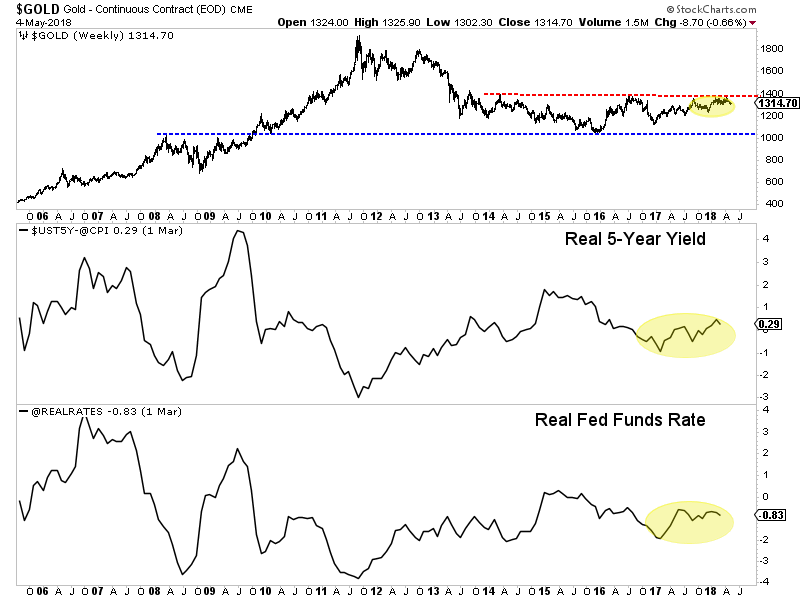

The vast majority of history shows us that Gold is inversely correlated to real interest rates (or real yields). It makes perfect sense because Gold has been money for thousands of years. When real rates decline, the real return on money in the bank or in a treasury bill or note decreases. Gold benefits. The corollary is also true. Rising real interest rates indicate stronger real return on money invested in the aforementioned instruments. That’s negative for Gold.

Real interest rates have actually strengthened for nearly 18 months, as the chart below shows. Gold has performed well during that period because of weakness in the US Dollar as well as some anticipation of an escalation in long-term yields.

Given the rise in real interest rates, it is not a surprise that investment demand for Gold has been weak. Gold bugs frequently trumpet strong demand from China and how tight the physical Gold market is but in reality, investment demand is what drives bull markets. Investment demand tends to respond to or follow negative and/or declining real interest rates.

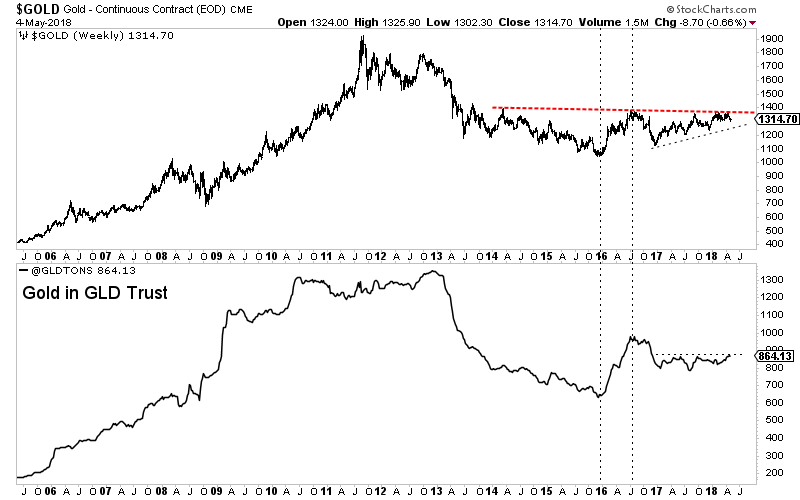

One way of measuring investment demand in real time is by following the amount of Gold held in the GLD trust. As we can see below, investment demand (by this metric) confirmed the rebound in Gold in the first half of 2016. However, it has essentially been flat over the past 18 months as Gold rebounded from the low $1100s all the way to $1360.

Gold & Tons in GLD Trust

So if Gold’s fundamentals are not bullish and investment demand is flat, what conditions need to change that would benefit Gold?

Obviously, Gold needs declining real interest rates. It needs some combination of an acceleration in inflation and a pause or slowdown in short-term yields including the Fed Funds rate. Inflation has risen in recent quarters but short-term yields have risen faster as evidenced by the increase in real interest rates (shown in our first chart).

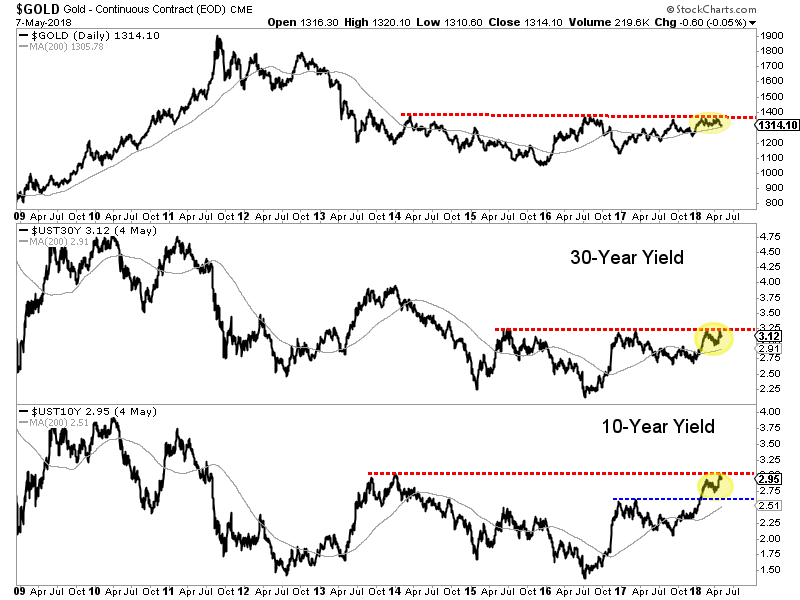

Weeks ago Gold was sniffing a breakout as long-term bond yields, such as the 10-year and 30-year yield were also threatening a breakout. An upside break in long-term yields would be significant for Gold as it would signal an increase in inflation expectations and pressure the balance sheets of both an over-indebted corporate sector as well as a government already running the largest non-recessionary, peacetime budget deficit in history. However, bond yields have yet to breakout even as the masses have positioned for such. In other words, Bonds could be ripe for a counter-trend rally which means yields would be ripe for a counter-trend decline.

Gold, 30-Year Treasury Yield, 10-Year Treasury Yield

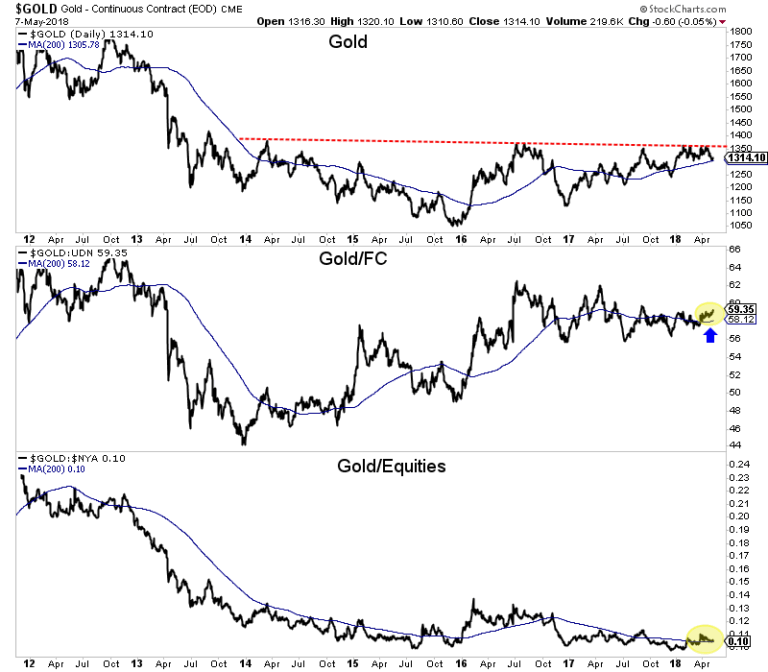

An upside breakout in bond yields could also potentially lead to a new uptrend in the Gold to Stocks ratio. It could cause issues in the economy and stock market which would in turn, benefit Gold. While Gold is in a new uptrend relative to Bonds (not shown) and is currently firming against foreign currencies, it has not been able to sustain strength relative to the equity market. From an intermarket perspective this is the link that has been missing to put Gold in a real bull market.

Gold, Gold/Foreign Currencies, Gold/Equities

It would not be a surprise to see Gold correct lower as fundamentals are not currently bullish and the US Dollar (the weakness of which supported Gold throughout 2017) is rebounding with potentially more upside. Although inflation is increasing, it has not increased fast enough to counteract the rise in short-term yields. A future breakout in long-term yields could be the missing catalyst for Gold as it would cause issues in the economy and stock market and lead to softer Fed policy. Until then, traders and investors would be wise to focus on the junior miners that can add value to their projects in the meantime.

To follow our guidance and learn our favorite juniors, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.