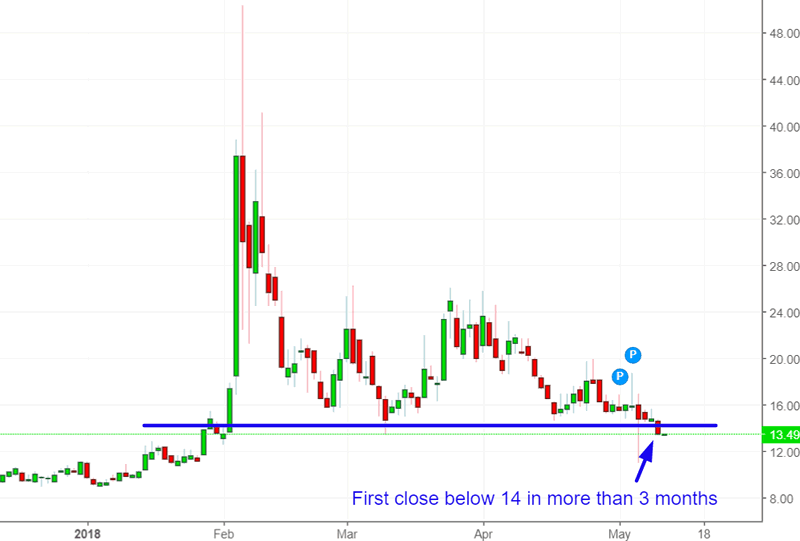

What happens to the Stock Market when VIX closes below 14

Stock-Markets / Volatility May 10, 2018 - 03:01 PM GMTBy: Troy_Bombardia

VIX closed below 14 yesterday for the first time since February 1, 2018. This study examines what happens next to the stock market (historically) when VIX closes below 14 for the first time in at least 3 months.

Here are the historical dates:

- March 21, 2016

- January 4, 2013

- August 13, 2012

- June 23, 2004

- June 28, 1996

- May 19, 1992

- November 13, 1991

Here’s what happened next to the S&P 500

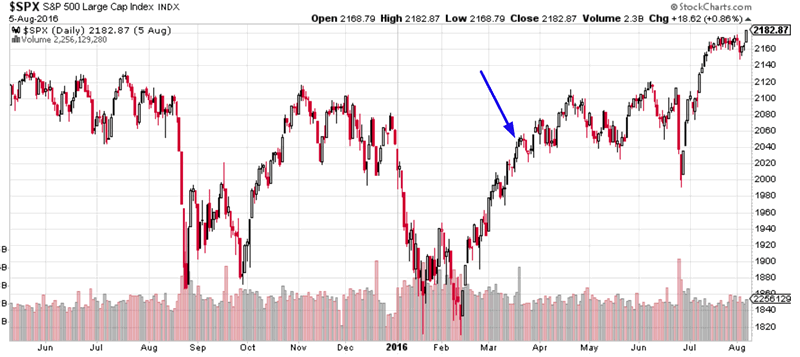

March 21, 2016

This occurred AFTER the S&P 500 had already finished its “significant correction”. The correction’s bottom was already in. The S&P swung sideways for the next 3 months before rallying higher.

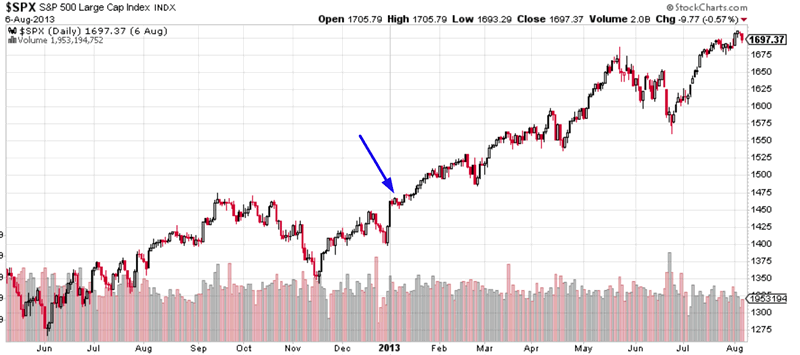

January 4, 2013

This occurred AFTER the S&P had already finished its 8.8% “small correction”. The correction’s bottom was already in. The S&P 500 continued to rally higher nonstop.

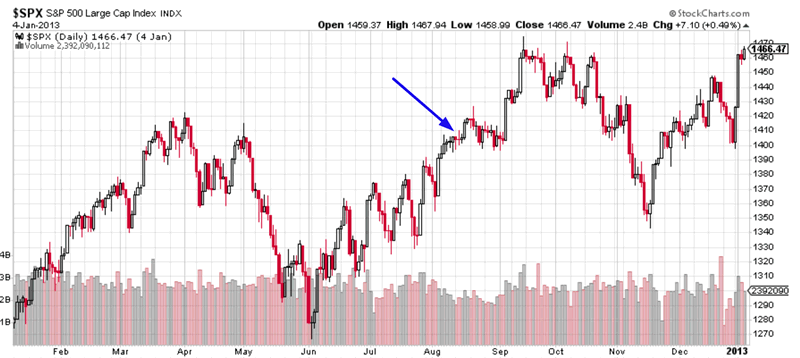

August 13, 2012

This occurred AFTER the S&P had already finished its 10.9% “small correction”. The correction’s bottom was already in. The S&P began another “small correction” 1 month later, but the stock market’s downside was limited.

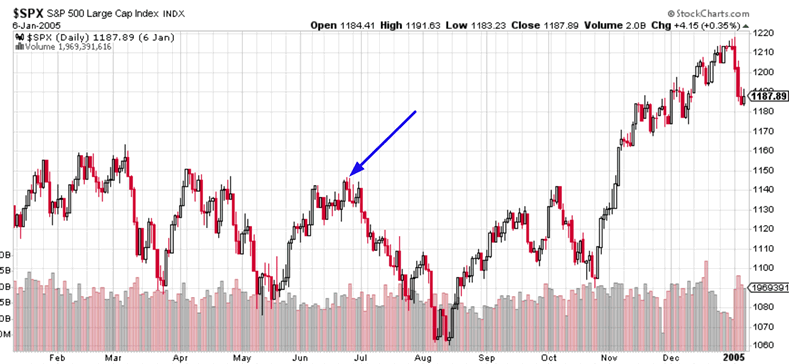

June 23, 2004

This occurred BEFORE the S&P had finished its 8.8% “small correction”. The correction’s bottom was not in, and the stock market made a marginal new low. But the important thing here is that the stock market’s downside was limited.

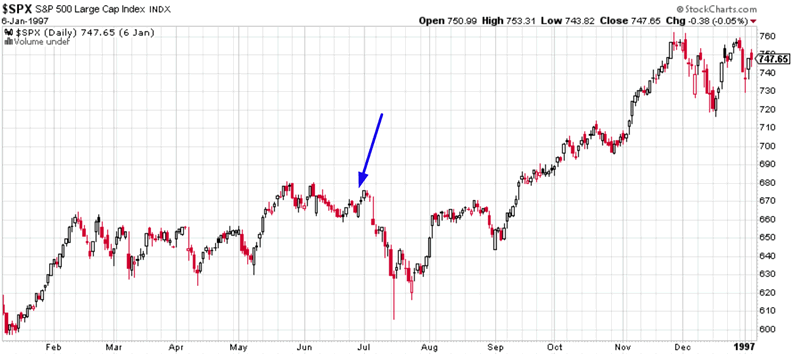

June 28, 1996

This occurred near the beginning of the S&P 500’s 11% “small correction”. This historical case doesn’t really apply to today because the S&P has already made an 11.8% “small correction”.

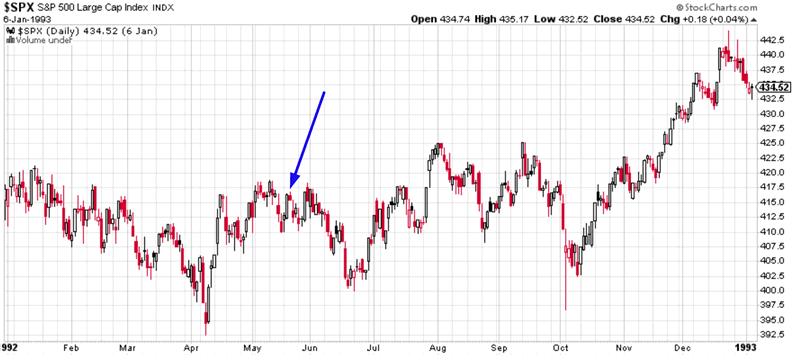

May 19, 1992

This occurred AFTER the S&P had already finished its 6.8% “small correction”. The correction’s bottom was already in. The stock market swung sideways over the next 5 months, but trended higher over the next 6-8 months.

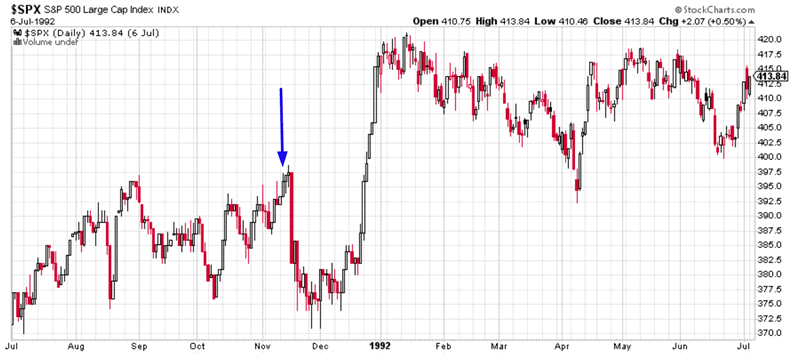

November 13, 1991

This occurred 1 day before the S&P began a 6.7% “small correction”. This historical case doesn’t apply to today because the S&P has already fallen 11.8% from the top to bottom of the current “small correction”.

Conclusion

This study’s conclusion is simple.

- The stock market might have a little more downside over the next few weeks (i.e. within less than 2 months). This is a 50-50 bet.

- But the stock market trended higher in the next 6-12 months in ALL of these historical cases.

This is a medium-long term bullish study for the stock market right now.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.