Bottom Holds in Bitcoin, Ethereum: Price Must Prove Sentiments

Currencies / Bitcoin Jun 06, 2018 - 12:04 PM GMTBy: Ryan_Wilday

Last week in my article, "A bottom in the crypto market, or more blood-letting?" I suggested that a bottom could be imminent, or that we had bottomed. I often look to our bellwethers, Bitcoin(BTC-USD) and Ethereum (ETH-USD), as signals for the larger crypto market.

Last week in my article, "A bottom in the crypto market, or more blood-letting?" I suggested that a bottom could be imminent, or that we had bottomed. I often look to our bellwethers, Bitcoin(BTC-USD) and Ethereum (ETH-USD), as signals for the larger crypto market.

I wanted to see $7085 hold in bitcoin and $495 in Ethereum. On May 28, bitcoin hit $7075, a nominal break and ethereum $505. So far, those levels have held, and we appear to have set up bullishly. As long as they do, we have a very bullish setup - the five-wave pattern off the April lows, which suggests this wave ii we believe bottomed that proceeds a larger third wave rally.

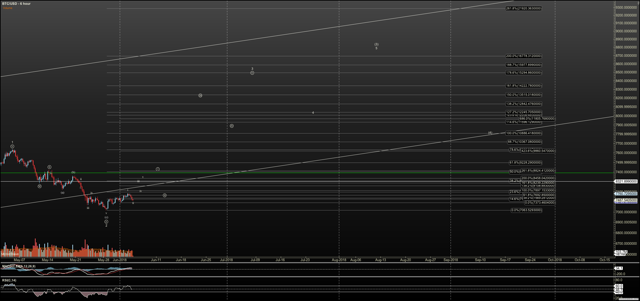

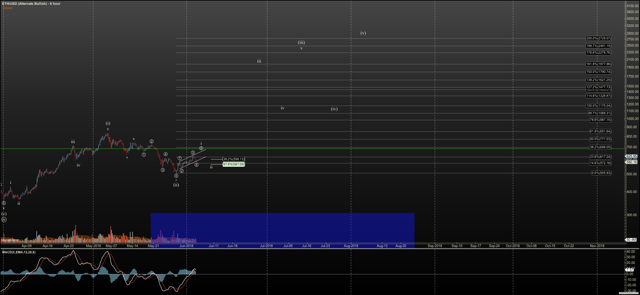

Below are six-hour charts that show the expected extent of the coming rally, if these levels hold.

See the charts provided in this article in an expandable format.

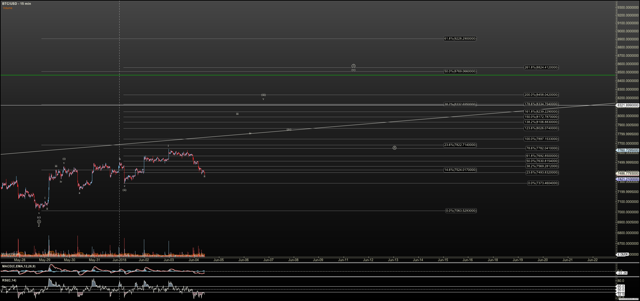

Now, let's take a look at the 15-minute chart again for an update.

Unfortunately, ethereum, while it started in a 5 wave move off the lows, it did not hold key support for an impulsive third wave. So, as of Monday morning I am tracking the pattern as a diagonal, with the expectation that we have another high over Sunday night’s high at $628.

If we break down below $538, the probability is we’ll see the May 28 low give way.

Bitcoin did not get as far as ethereum did before dropping Sunday night, so it may be called a 1-2,i-ii, where ii is the second wave in a minor third wave. It is immediately bullish as long as $7375 holds.

Note the green line on the charts. This is a key level on both, where we retrace .618 of the drop from the May highs. If impulsive over those levels, $8720 in bitcoin and $685 in ethereum, we'll have the strongest confirmation we can have without a direct breakout.

I currently consider sentiment to be very doubtful to apathetic. The apathetic holder feels shocked that they’ve seen such a drawdown but feels trapped and certainly doesn’t have the money to buy more. The doubtful holder believes bitcoin is in a large-scale correction and will remain in it for many months.

One trader I follow called for a 1.5-year correction. Some analysts I watch are calling for bitcoin to go below $5000. While I can see that price level possible, I cannot see it as probable at this time. Granted, if the key levels I’m watching and call out above, actually break, I will look down. And, those levels are quite tight to price here, so we have an early warning.

It seems, anecdotally, that we have sentiment conditions ripe for a larger rally to begin. But price must prove.

Conclusion

In short, so far price has held over the bottoms struck on May 28. We are now tracking nominally higher support levels in both ethereum and bitcoin to serve as an early warning of failure. As long as support levels hold, we see the next degree third wave as ready to start.

See the charts provided in this article in an expandable format.

Ryan Wilday is a cryptocurrency analyst at ElliottWaveTrader, where he hosts the Cryptocurrency Trading premium subscription service.

© 2018 Copyright Ryan Wilday - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.