The US Dollar Has Already Figured Out That Inflation is Coming

Economics / Inflation Jun 07, 2018 - 05:59 PM GMTBy: Graham_Summers

The Fed has gone dovish. In fact, it’s going to allow inflation to explode higher.

The Fed has gone dovish. In fact, it’s going to allow inflation to explode higher.

That, in of itself, is significant… to understand why, we first need to acknowledge how the Fed currently operates to control risk in the financial system.

The Fed currently has two primary tools for controlling the financial system. They are:

1) The size of its balance sheet (via Quantitative Easing, or QE, and Quantitative Tightening, or QT, programs)

And …

2) The Fed Funds Rate which controls the prices of “money” in the system.

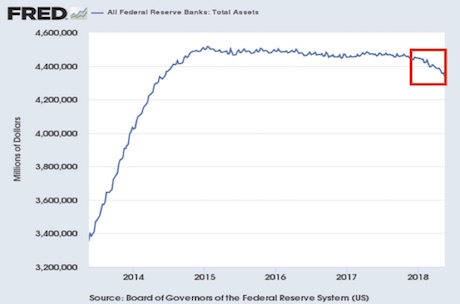

Regarding #1, after engaging off and on in QE for six years (2008-2014), the Fed has only been tapering QE for six months and it’s already in trouble.

The fact the Fed is already “pumping the brakes” despite having shrunken its balance sheet a mere $126 billion (less than 3% of its gargantuan $4.3 TRILLION balance sheet) is telling.

`

`

Regarding #2, the Fed has raised the Fed Funds Target rate six times from 0.15% to its current level of 1.5%-1.75%. While this DOES seem significant, it is worth noting that these are usually the levels to which the Fed CUTs rates during a recession/ crisis.

Put another way, having kept the Fed Funds Target Rate at ZERO for seven years (’08-’15), even after some 2+ years of tightening, rates remain at levels that USUALLY mark EXTREMELY easy conditions.

To conclude… both of the Fed’s primary tools for controlling the financial system have barely budged towards normalization… and the Fed is already going dovish. Indeed, the Fed opened the door to an inflationary “overshoot” of its 2% inflation target in last month’s FOMC release!

Let me be blunt… The Fed will ALWAYS understate things because its primary role is to maintain financial stability. So if the Fed is even hinting at permitting an inflationary overshoot, it’s because the Fed knows this is unavoidable.

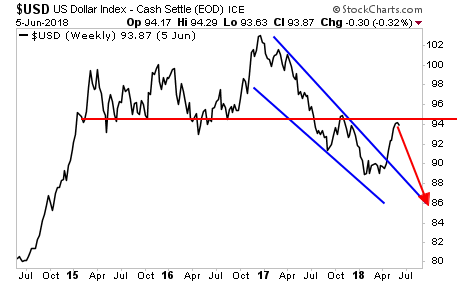

The $USD has already figured this out and is rolling over on its way to a NEW lows.

And this move is going to send risk assets, especially inflation/ reflation trades THROUGH THE ROOF.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.