Silver Price Forecast 2018-2019 - These Indicators Are Predicting New All-time High Silver Prices

Commodities / Gold and Silver 2018 Aug 28, 2018 - 08:09 PM GMTBy: Hubert_Moolman

The Dow/Gold ratio is a very reliable measure for where we are on the long-term economic timetable. It allows for an accurate reading of key economic conditions that are present at a particular period of time.

The Dow/Gold ratio is a very reliable measure for where we are on the long-term economic timetable. It allows for an accurate reading of key economic conditions that are present at a particular period of time.

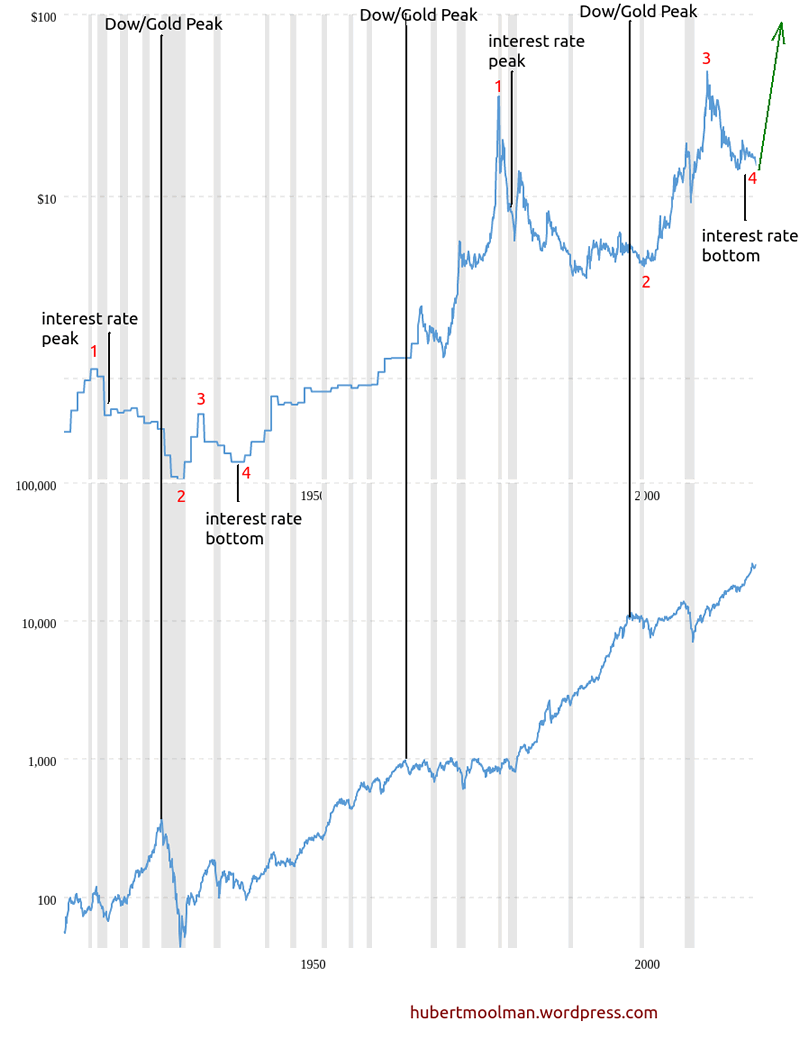

With regards to silver, the period after a Dow/Gold peak is generally great conditions for silver prices. After every major Dow/Gold ratio peak over the last 100 years, silver has gone to new all-time high prices, except for the period since the 1999 Dow/Gold ratio peak (see the silver vs Dow chart below:)

(chart generated at macrotrends.net – silver prices are above, and the Dow is below)

Since the 1999 Dow/Gold ratio peak, silver was only able to reach around $49, just short of the 1980 high of $50 (not so clear on the chart since it deals with monthly prices). This tells me that all-time highs are still coming.

Interest rates are also a very important economic measure, especially for silver prices, as explained previously (explained for gold, but also applies to silver). A period after a major interest rate bottom is generally great for silver.

After the last major interest rate bottom (around 1941), silver went on to make new all-time highs. We appear to have another major interest bottom (in 2016) and it is in fact lower than the one of 1941. This means another key measure tells us that conditions for silver are more favourable.

Therefore, the chances of silver going on to make new all-time highs are extremely good.

If we combine the above information of the two key indicators (Dow/Gold ratio and interest rates) with fractal analysis, then it would appear that silver has reached a key point before a major rally.

On the chart (above), I have shown how the period since the 1919 silver high (marked 1 to 4) is similar to the period since the 1980 silver high (marked 1 to 4). The interest rate bottom of 2015, as well as the recent silver low (which is likely the bottom), appears to be the final confirmation of the coming silver rally that will take prices to new all-time highs.

For more on this and this kind of fractal analysis, you are welcome to subscribe to my premium service. I have also recently completed a Silver Fractal Analysis Report as well as a Gold Fractal Analysis Report. You can also subscribe to this blog (enter email at the top right of this page) to get my latest free gold and silver updates.

Warm regards,

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2018 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.