Will the Indonesian Rupiah Heading Towards the 16,500 level?

Currencies / Forex Trading Sep 05, 2018 - 12:12 PM GMTBy: Sam_Chee_Kong

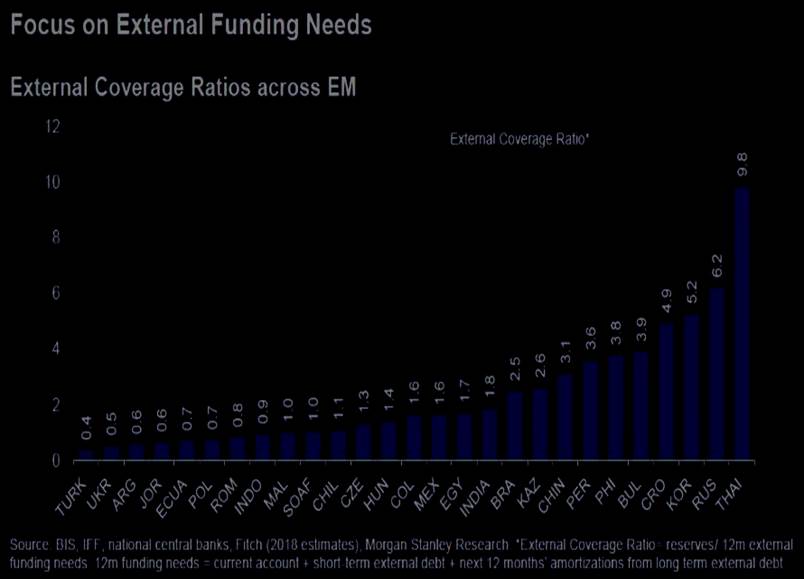

As of late, Emerging Markets have been garnering much attention. Unfortunately it was for the wrong reason. Emerging Market currencies like the Turkish Lira, Argentinian Pesos and the South African Rand have been almost in free fall mode.

As of late, Emerging Markets have been garnering much attention. Unfortunately it was for the wrong reason. Emerging Market currencies like the Turkish Lira, Argentinian Pesos and the South African Rand have been almost in free fall mode.

What is the narrative behind this?

It all started right after the Global Financial Crisis in 2008. Needless to say recent financial crisis such as the Asian Financial Crisis in 1998 and the Global Financial Crisis originated from having too much money in the economy. As in the Asian Financial Crisis there were just too much easy money going around in the economy. Banks have been lending out money to unqualified borrowers which in turn used the money to speculate in the housing and stock markets. This eventually pushes up asset prices way beyond their fundamental values. Hence, bubbles are created and the authorities are slow in tackling the problem. They only acted when the crisis is almost out of control. Sounds familiar to the causes of the Global Financial Crisis and the current Emerging Market Crisis?

In 2008, again the main cause for the crisis is the availability of cheap and abundant credit. During the crisis much of the dollar went into the US Treasuries as it was considered a save haven. As more and more dollars went back to the United States it pushes it's value upwards due to the shortage it created. Similarly the current Emerging Market Crisis has it's roots traced back to the Global Financial Crisis in 2008.

During that time excessive speculation in the housing crisis has led to the sub-prime crisis where unheard of derivatives such as MBS, CDS, CDO and so on was created. The value of these derivatives are tied to the underlying mortgages that they are linked to. Instead of marking to the market their value are marked to something else (probably imagination). Thus when those derivatives faltered it brought down not only the US economy but the entire world. To avoid a total meltdown of the global economy Quantitative Easing was introduced. This also helped by the gradual reduction of interest rates to almost zero or better known as ZIRP (Zero Interest Rate Policy).

To avoid collapse, Central banks around the world began open market operations by buying bonds and thus helped inflated much of the global money supply. Hence this helped eased the global liquidity crunch and enabled the gradual recovery of the global economy. The only downside of this recovery is that it was based on debt. As interest rates approaches 0.25% in December in the US there exists an arbitrage opportunity to make money. Funds are always seeking for higher yields and there is no better place than Emerging Markets. Hence, hedge funds and institutional investors took advantaged of this situation and engaged in “carry trade operations”. Carry trade refers to borrowing money from low interest rates source and invest in higher interest rates destinations. In this case much of the low interest rate funds from the US went to Emerging Markets around the world as they offer much higher interest rates.

Investors are making monster size returns as some emerging markets are offering up to 8% per year return. On top of that investors in carry trade can profit in another way. When investors borrowed in USD and invest in say Indonesian Rupiah, it tends to make more money when the USD depreciates or Rupiah appreciates. This is because when USD converted to Rupiah there exist a risk of 'foreign exchange exposure'. If Rupiah gains or the USD depreciates during the tenure of the investment then the investors will gain because he will get back more USD when he liquidates his investments. That was the narrative initially namely to make money from interest rate arbitrage and currency play.

As can be seen from the 10 years USD index below, investors are well compensated for their effort as the USD index was trading within a tight range. However things began to change when the FED started tapering in 2014. This move resulted in stagnating the money supply and thus causes an appreciation of the USD due to the shortage.The carry trade can still be profitable as long as the interest rate differential is higher than the Dollar appreciation. However things turned for the worst when the FED implements Quantitative Tightening (QT) which is the opposite of Quantitative Easing (QE) last year.

The FED's Quantitative Tightening program is done by either by stopping or slowing down the bond buying or leaving existing bonds to mature without rollover them. This causes a drop in the money supply and creates a shortage in dollar which eventually cause it to appreciates.

As mentioned above carry trade will only be profitable when interest rate differential and currency exchange rates are favorable. When there is a shortage of dollar it will appreciates and will cause a huge problem to carry trade investors. They have to unwind their trades before their profits turned into losses. However there is a problem. The more dollar leaving Emerging Markets the worse will be the dollar shortage situation. This will create an extra demand for the dollar and will further push up the value of the dollar. As a result of the dollar appreciation Emerging Markets will need more dollar to pay for their dollar denominated debts because their currencies have depreciated.

In order to stem further slide of their currencies they have to defend their currencies either by selling their dollar reserve or raising interest rates so as to compensate the carry trade investors. The catch is the more Emerging Markets currencies depreciates the more unwinding in dollar denominated assets will occur. Hence eventually this will bring out the animal spirits among them. The whole situation will turned into a negative feedback loop where selling begets selling. When dollar denominated assets are liquidated the dollar will eventually ends up in the US looking for safe haven. This will further strengthen the dollar. Hence, this is the situation currently facing most Emerging Markets and the question is how much longer can they withstand defending their currencies by selling their dollar reserves?

Will Rupiah be the next currency to fall in Asia?

After deliberating over certain economic fundamentals and metrics of different Asian countries, I reckon Indonesia has several weaker links which may pose a danger to it's economy. As with most Emerging Market economies Indonesia's economy went on steroids since the GFC in 2008.It's economy doubled from USD 510 billion in 2008 to USD 1015 billion in 2017.This firmly puts it as the 16th largest economy in the world. However to achieved that it had to borrow money from foreign sources. With the borrowed funds from abroad, loans to the private sector have increased from more than 1,000,000 billion rupiah in 2008 to 4,388,849 billion rupiah in 2018.

Consumer credit has also increased in an almost parabolic manner. See below.

As with other Emerging Market countries, Indonesia is now paying the price of having a big portion of it's debts denominated in dollar. About 40% of Indonesian Government bonds are denominated in foreign currency.

As a result of years in promoting consumerism to achieve high economic growth, it allowed its import to

overtake exports. Hence it created a negative Current Account since 2012. See below.

The Current Account is part of the balance of payment of a nation. The other half is the Capital Account.

The Current Account basically records the exports and imports and remittances arising from both inflow

and outflow arising from foreign direct investments. Hence a positive Current Account increases a

country's foreign exchange reserves while a negative will deplete it.

One of the determinants that attracts currency speculators is the chronic Current Account deficits.

As said Current Account deficit means depletion in the foreign exchange reserves and hence

during periods of uncertainties like now it will render a nation to speculative currency attacks.

Another criteria that attracts currency speculators is External Debt. External Debt as it implies are debts

borrowed in foreign currency. When the foreign currency appreciates, it means more Rupiah will be

needed to pay the original debts. The larger the external debt the bigger the obligation. See below.

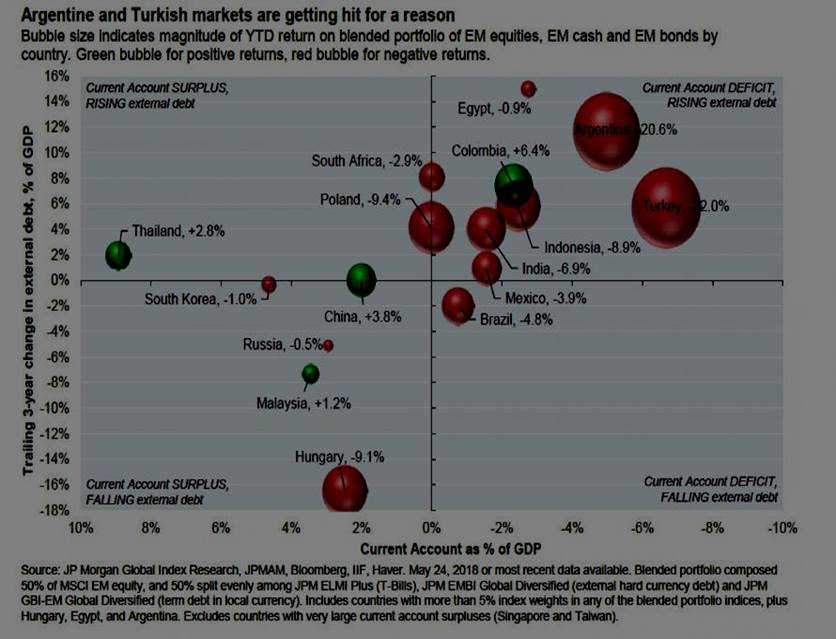

In short, both high external debt coupled with chronic Current Account deficits makes Indonesia an

ideal candidate for speculative currency attacks. The chart below summaries it perfectly.

Another main factor that attracts currency speculators is the amount of foreign exchange reserves a

country has. Indonesia's foreign exchange reserves fell to USD 118 billion in July from the high of

USD 132 billion in January 2018. In other words USD 14 billion has been depleted in 6 month due

to open market operations to defend the Rupiah and the Indonesian stock market. It is not an uncommon

view if one takes a look at how the Indonesian Plunge Protection Team manipulates it's Composite

Index also known as IHSG. The Plunge Protection Team began buying blue chip during the last couple

minutes of trading and hence will push up the index. At times it can cause the Composite Index to

rise by 50 points as the authorities viewed it is crucial to support the psychological level of 6000 points.

See below chart on foreign exchange reserves.

To a layman, USD 118 billion in reserves might be a lot but if you compare it to the GDP it is only

about 11%. This is not a nice cushion for a USD 1 trillion economy. A firm threshold should be at least

20% of GDP. That means it is not saving enough for rainy days like currently. The burn rate of the

foreign exchange reserve depletion from January to July is about USD 2.5 billion a month. I am sure it has

intensifies since the month of August as the authorities intervene heavily in the Rupiah and stock market.

So, now the question is how long can this intervention go on as it depletes the dollar reserves. The

following chart best sums up how much longer before Indonesia's dollar reserves eventually runs out.

The above coverage ratio is the the amount of export earnings needed to pay the annual interest rate and

principle payments towards it's external debts. From above, we can conclude it is about 9 months.

In respective to whatever solutions the Indonesian Government is implementing at the moment such as

curbing imports, promoting bio diesel, raising interest rates and so on. I am afraid time is running

out because turning around a country's finances need time. It won't happen in a matter of months.

In view of the above analysis, I reckon I am not too bearish to see the Rupiah plunging towards

the 16,800 level by year end. For your information the 16,800 level was the lowest during the

Asian Financial Crisis in 1998 when Indonesia opt for IMF bailout.

In retrospect, I also believe that the current divergence between the stock market and currencies

in Emerging Markets will not prolong much longer. Most of the Emerging Market stock markets

have yet to plunge amid a sharp depreciation of their currencies. Something will have to give and

I reckon the next round of panic will be the sharp plunge in Emerging Markets stocks.

by Sam Chee Kong

cheekongsam@yahoo.com

© 2018 Copyright Sam Chee Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.