United States Becomes Toxic Debt Waste Dump to Stop Financial Armageddon

Stock-Markets / Financial Markets Sep 20, 2008 - 06:36 PM GMT The camel's nose got in the tent when Bear Stearns was bailed out. The question is, when will it end? The U.S. government moved to cleanse banks of troubled assets and halt an exodus of investors from money markets in the biggest expansion of federal power over the financial system since the Great Depression.

The camel's nose got in the tent when Bear Stearns was bailed out. The question is, when will it end? The U.S. government moved to cleanse banks of troubled assets and halt an exodus of investors from money markets in the biggest expansion of federal power over the financial system since the Great Depression.

A toxic waste dump.

``We're talking hundreds of billions,'' Treasury Secretary Henry Paulson said in a press conference. ``This needs to be big enough to make a real difference and get to the heart of the problem.'' Paulson said Friday that a planned government entity that will buy illiquid mortgage assets from financial institutions must be "sufficiently large" in order to have "maximum impact." He didn't provide details of the type of new agency or program he has in mind, saying only that he will work over the weekend with key members of Congress to examine all approaches.

The question is who gave Paulsen the authority to authorize this? Do the taxpayers have anything to say about it? What about the moral hazard that exists in the financial institutions being bailed out? The problem isn't going away because the banks know how bad their portfolios are, so why would they trust other banks to be any better? So the lender of the last resort is the only game in town. I suggest that any effort to curtail Fed lending will mean the end for more financial institutions. The problem is, it is all on the backs of the taxpayer. When do we cry uncle?

Can they stop Armageddon in the money markets?

The U.S. will insure money-market funds against losses for the next year as it seeks to prevent a run on $3.35 trillion of assets that average investors and institutions rely on as a safe alternative to bank deposits.

The Treasury will use an existing $50 billion emergency pool to offset losses incurred by investors as fund managers cope with the worst financial crisis since the Great Depression. The plan is similar to federal insurance on U.S. bank accounts, though it's temporary and doesn't carry the same $100,000 limit on reimbursed losses, a Treasury official said today on a conference call. Folks, it looks like there are a lot of holes in the dike.

Is this a rescue or just a reprieve?

Wall Street threw a party yesterday, but not everyone was happy. Call them party crashers, short sellers got nailed as the trading desks were overwhelmed at many large brokerage firms, leaving them unable to get out. In addition, the SEC has halted the short selling of financial stocks to combat “market manipulation.” Its claim is that short selling “ is contributing to the recent, sudden price declines in the securities of financial institutions unrelated to true price valuation.” Can they blame the price decline on “manipulators” or is it really mismanagement?

Wall Street threw a party yesterday, but not everyone was happy. Call them party crashers, short sellers got nailed as the trading desks were overwhelmed at many large brokerage firms, leaving them unable to get out. In addition, the SEC has halted the short selling of financial stocks to combat “market manipulation.” Its claim is that short selling “ is contributing to the recent, sudden price declines in the securities of financial institutions unrelated to true price valuation.” Can they blame the price decline on “manipulators” or is it really mismanagement?

Treasuries don't like the bailout.

Treasuries plunged Friday, sending yields on benchmark notes up by the most in at least two decades, amid investor relief that the U.S. government is planning a broader solution to the financial crisis. Bond portfolio managers are running scared because the losses cannot be hidden. Somewhere, sometime the losses in bonds and mortgage securities must be realized. Who will take the fall? I suggest that holders of long-term treasuries may be one set of victims.

Treasuries plunged Friday, sending yields on benchmark notes up by the most in at least two decades, amid investor relief that the U.S. government is planning a broader solution to the financial crisis. Bond portfolio managers are running scared because the losses cannot be hidden. Somewhere, sometime the losses in bonds and mortgage securities must be realized. Who will take the fall? I suggest that holders of long-term treasuries may be one set of victims.

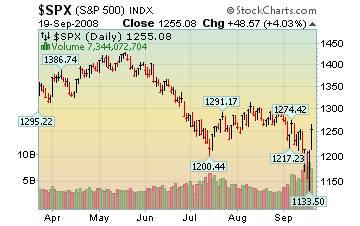

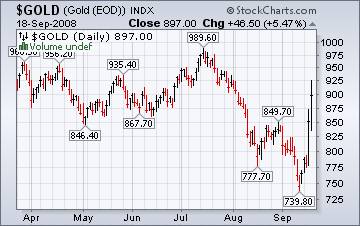

What a bounce!

Last week I suggested that gold may bounce. Frankly, I hadn't quite expected this! It appears that investors may be set up for even more volatility going forward. Gold futures plummeted Friday -- at one point falling 7.6%, the biggest percentage drop in more than 25 years -- as speculation that a Washington-engineered rescue plan could avert financial crisis reduced demand for gold as an investment haven.

Last week I suggested that gold may bounce. Frankly, I hadn't quite expected this! It appears that investors may be set up for even more volatility going forward. Gold futures plummeted Friday -- at one point falling 7.6%, the biggest percentage drop in more than 25 years -- as speculation that a Washington-engineered rescue plan could avert financial crisis reduced demand for gold as an investment haven.

Is the plunge in the Nikkei ending?

Japanese stocks rebounded from a 3-year low as the markets cheered the bailout of AIG and the money markets in the U.S. Investors were mainly interested in defensive stocks, while insurers in Japan caught the rebound from AIG's buyout. ``Investors are reluctant to buy shares that are sensitive to economic shifts and are instead moving their funds to defensive stocks, such as food and drugmakers,'' said Kazuyuki Terao , who helps oversee about $1.7 billion as chief investment officer of RCM Japan Ltd. in Tokyo. ``The outlook for the global economy remains hazy.''

Japanese stocks rebounded from a 3-year low as the markets cheered the bailout of AIG and the money markets in the U.S. Investors were mainly interested in defensive stocks, while insurers in Japan caught the rebound from AIG's buyout. ``Investors are reluctant to buy shares that are sensitive to economic shifts and are instead moving their funds to defensive stocks, such as food and drugmakers,'' said Kazuyuki Terao , who helps oversee about $1.7 billion as chief investment officer of RCM Japan Ltd. in Tokyo. ``The outlook for the global economy remains hazy.''

China tries a stimulus package, too.

China's benchmark stock index rallied the most since the gauge was created in April 2005 after the government said it will buy shares in three of the largest state-owned banks and scrapped the tax on equity purchases to halt a slide that erased $2.64 trillion of market value. The government may consider other provisions to restore confidence in the markets. However, many analysts are suggesting that investors sell into the rally.

China's benchmark stock index rallied the most since the gauge was created in April 2005 after the government said it will buy shares in three of the largest state-owned banks and scrapped the tax on equity purchases to halt a slide that erased $2.64 trillion of market value. The government may consider other provisions to restore confidence in the markets. However, many analysts are suggesting that investors sell into the rally.

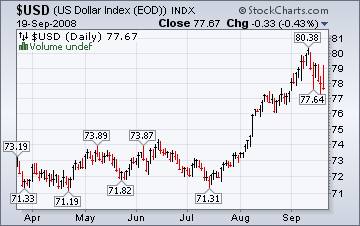

The “bailout dollar” is scorned by other currencies.

The dollar slipped against most major rivals Friday, erasing sharp earlier gains, as investors pondered the possibly negative aspects of a nascent U.S. government plan to take on the toxic assets plaguing the financial sector . But the massive size of the bailout will likely have a negative impact on the U.S. fiscal position and even raises fears of an eventual U.S. sovereign downgrade, wrote currency analysts at Action Economics.

"The dollar has moved to or near intra- day lows versus virtually all major currencies, as the foreign exchange market is apparently taking a bigger picture look at the greenback," they said.

Why is the housing index rallying?

Housing starts for August posted another hefty decline, the Census Bureau reports. The 6.2% drop in annualized starts last month vs. July isn't the biggest decline on record, but it's still hefty. More troubling is the fact that the declines just keep coming, as our chart below shows. Starts are now at a 17-1/2-year low. Investors have been looking for a bottom in starts, and the bounce in June gave hope to some, including this editor, who thought maybe, just maybe, the carnage was behind us. But the optimism was premature -- again. Today's numbers reconfirm the bearish tone in housing.

Housing starts for August posted another hefty decline, the Census Bureau reports. The 6.2% drop in annualized starts last month vs. July isn't the biggest decline on record, but it's still hefty. More troubling is the fact that the declines just keep coming, as our chart below shows. Starts are now at a 17-1/2-year low. Investors have been looking for a bottom in starts, and the bounce in June gave hope to some, including this editor, who thought maybe, just maybe, the carnage was behind us. But the optimism was premature -- again. Today's numbers reconfirm the bearish tone in housing.

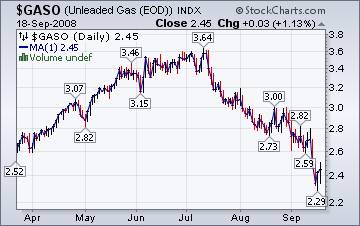

Not much damage to gasoline prices prices.

The Energy Information Administration reports that, “ The United States took a one-two punch to the petroleum sector from back-to-back early-September Hurricanes Gustav and Ike. Before the industry could recover from Gustav, Hurricane Ike swept through the Gulf Coast, making landfall at Galveston, Texas on September 13. At this point, in contrast to the impacts of Hurricanes Katrina and Rita, it appears that the petroleum industry did not experience much damage. Nevertheless, supplies have been affected.”

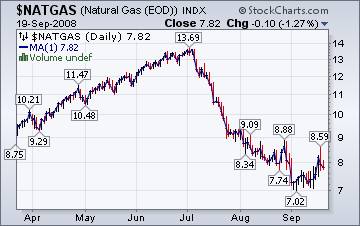

Energy prices going lower.

The Energy Information Agency's Natural Gas Weekly Update tells. “ Spot natural gas prices moved lower this week in most regions of the Lower 48, despite severe reductions in supplies from the Gulf of Mexico offshore as the industry continued its efforts to recover from Hurricane Ike.”

The largest beneficiary of lower prices was the Mid-West, where warm temperatures moderated as Ike's storm system went through.

There he goes again!

Steven M. Davidoff in the New York Times has a pretty concise explanation of the AIG buy-bail-out. It is very interesting to see the games that are played skirting around the letter of the law. Now we know that other companies won't step in to bail out the next crisis because the Paulsen/Bernanke team will. Not a pretty picture.

Mr. Paulson and company have now backed themselves into a corner. They can allow the Lehmans of the world — those that fail to collapse quickly enough or are unfortunately too small — to go under, but they can't let companies like A.I.G. go. And after Bear, Fannie and Freddie, the private sector knows that, too.

People will throw around the word “moral hazard” a lot today. But this is not about that concept: this is what we call free riding. The private financial companies are letting their good neighbor do the clean-up, and they're not helping because they know the neighbor will do it anyway.

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.