MP's Vote UK Government Behaving like a Dictatorship, in Contempt of Parliament

Politics / BrExit Dec 04, 2018 - 05:05 PM GMTBy: Nadeem_Walayat

Theresa May's government is now in a full blown crisis following the MP's today voting to find UK Government Ministers in contempt of Parliament for the first time ever, which is basically MP's sending a message to the Government that they are no longer acting in a democratic manner, instead are acting as a dictatorship! In contempt over the failure to publish the full legal advice given to the Government by the Attorney General, Geoffrey Cox on the consequences of the "May Backstop BrExit Deal". This is an unprecedented event that put's Theresa May's government let alone her premiership teetering on the brink of collapse in the run down to the Vote on her Brexit Deal on the 11th of December.

Theresa May's government is now in a full blown crisis following the MP's today voting to find UK Government Ministers in contempt of Parliament for the first time ever, which is basically MP's sending a message to the Government that they are no longer acting in a democratic manner, instead are acting as a dictatorship! In contempt over the failure to publish the full legal advice given to the Government by the Attorney General, Geoffrey Cox on the consequences of the "May Backstop BrExit Deal". This is an unprecedented event that put's Theresa May's government let alone her premiership teetering on the brink of collapse in the run down to the Vote on her Brexit Deal on the 11th of December.

Are government ministers in contempt of Parliament?

- Yes 311

- No 293

- Majority 18

The government is teetering on the brink of collapse, expect more commons defeats in the countdown to the vote on the EU Withdrawal Act.

Subverting BrExit - UK Can NEVER LEAVE the EU!

Today's events are just the latest saga in the attempts by Britain's political and corporate establishment to subvert the settled will of the British people who voted to LEAVE the European Union, which was supposedly to be achieved via the May 'backstop deal'. A plan that Britain's Attorney General yesterday confirmed would mean that Britain could NEVER actually LEAVE the European Union without the EU's permission, which as Donald Tusk late last work reminding the UK of there being a stark choice of either the "May Deal or NO Brexit". Which means that the EU is determined to KEEP Britain shackled to the European super state in perpetuity.

In a 43 page document titled "EU Exit Legal Position", Attorney General Geoffrey Cox confirmed that the UK would be indefinitely committed to the EU customs rules under the May backstop deal.

In fact the document and an earlier leaked document contradict virtually everything that has spewed out of Theresa May's mouth concerning her Brexit plan as EU law would continue to be applied across the spectrum of trade and governance.

- EU law will apply during the TIP [transition or implementing period], but essentially without formal UK participation in its making;

- EU law will apply after the TIP to protect the rights of EU citizens in the UK. This could extend for some considerable period.

- EU law also will apply after the TIP in relation to the Separation Issues and the Financial Settlement. Again, this could extend for a considerable period.

- EU law will apply extensively, particularly in Northern Ireland, under the “Backstop” found in the Ireland/Northern Ireland Protocol.

- EU law in relation to goods, turnover taxes, agriculture and fisheries as well as veterinary and phytosanitary rules will apply in the Sovereign Base Areas of Cyprus.

- After the end of the TIP the CJEU will continue to determine the interpretation of EU law applicable under the WA by the mandatory reference procedure from the arbitration panel.

“The UK will conform to specific EU legislation on customs, including with respect to third countries. To provide a ‘level playing-field’ the UK commits to non-regression (from the law as it stands at the end of the TIP) on EU environmental protection, labour and social standards, state aid and competition and state-owned undertakings in respect of administration of tax…. On the UK side of the customs union, in the ‘United Kingdom in respect of Northern Ireland’, specific additional EU legislation applies on customs, certain VAT and excise, and certain technical standards relating to goods”.

“Both UK and EU are represented on the Joint Committee, so no decision may be made without the UK’s agreement. This may not be the same thing as the two parties having equal power, as the aims of the parties will matter. If the Joint Committee is unable to reach a decision, in some circumstances, that will block next steps. The party that wants those next steps to occur, will then be at a practical disadvantage. By way of example, i) the Joint Committee sets the limits of state aid that can be authorised by the UK for agriculture. If limits are not agreed, state aid may not be authorised.”

“This raises the prospect of a decision adverse to the UK on the view of the EU appointed panel members and the jointly appointed chairperson outvoting the view of the UK appointed panel members.”

“This document identifies and explains many of the very serious legal problems for the UK that would emerge from the Prime Minister’s proposed Withdrawal Agreement, should it be approved. It is wishful thinking and irresponsible to accept the Government’s spin of this damaging legal reality, or to think it could be used as a basis for successful further negotiation. I don’t believe any MP in possession of these facts could in good conscience ignore them and support the Withdrawal Agreement.

“The EU and UK have a great future as friends, but this is not the way to achieve it. Let’s waste no more time, prepare for all eventualities, and work constructively for an advanced but regular Free Trade Agreement which respects the independence and integrity of our jurisdictions while making trade and community relations smooth, effective and efficient. We have set out how to do this, contrary to the Government’s attempt to say otherwise, and there is no reason a plan and schedule for ratification of such an agreement cannot be agreed by the end of March so conditions remain smooth from the end of March until that happens. That is the way to preserve the faith the people of the UK have in their politics, and we need a Government that will ask for it.”

Which Brian Cox confirmed in a statement to the House of Commons :

“Let me make no bones about the Northern Ireland protocol. It will subsist, we are indefinitely committed to it if it came into force.”

“There is no point in my trying or the government trying to disguise that fact.”

"The main calculation was the political imperative of either entering into the agreement or not. That is a calculated risk that each member of this house is going to have to weigh up against different alternatives.” he said.

So this is just further confirmation if any were needed that Theresa May, a REMAINER Prime Minister has spent the past 18 months to deliver a PLAN at the last minute that would PERMANENTLY KEEP THE UK WITHIN THE EUROPEAN UNION, a BrExit in name only, not in practice.

On the 11th of December MP's will vote either for or against the May plan, following today's defeat there is virtually zero chance that MP's will vote of the May Plan, following which my view is that the most probable outcome is for a Tory Leadership challenge to remove this inept disastrous Prime Minister and put a BREXITEER in charge who can finally start the real EXIT negations for a DEAL or NO deal BrEXIT on 29th March 2019.

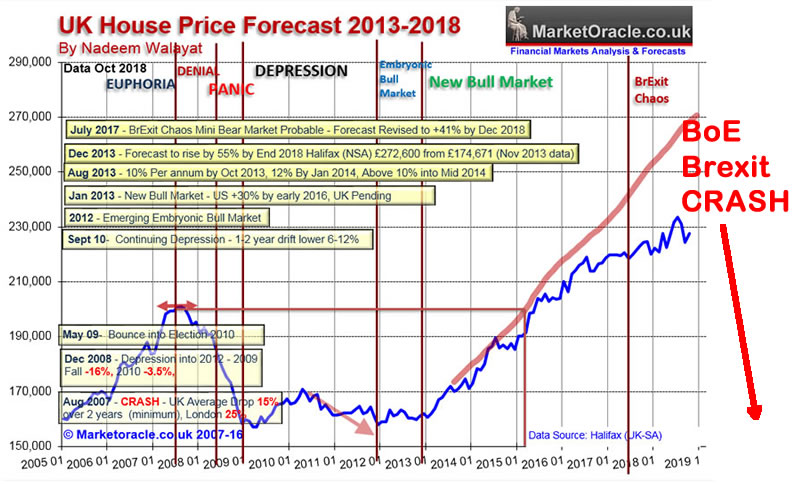

Meanwhile last week the Bank of England was out in force pushing anti-Brexit propaganda to a new extreme with a string of economic apocalypse warnings, with a 30% CRASH in UK house prices at the top of the doom list.

The following graph illustrates what the Bank of England's 30% crash in house prices would look like if it were to materialise post Brexit.

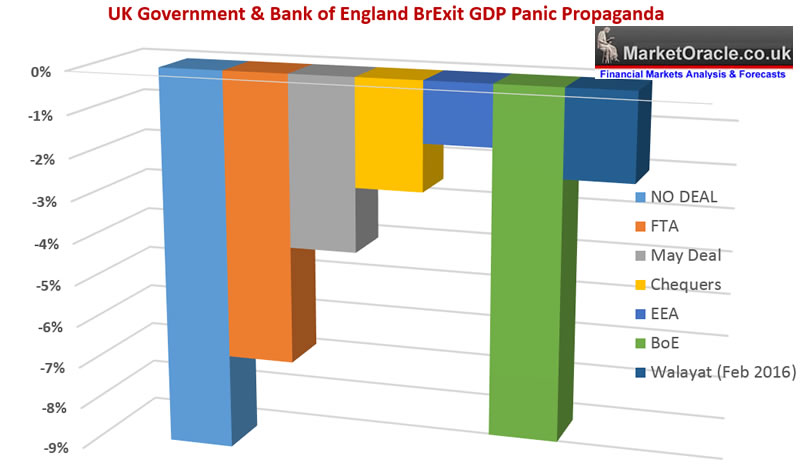

And here's a summary of all of the Bank of England's No Deal CRASH warnings.

And here's a summary of all of the Bank of England's No Deal CRASH warnings.

- Economic crash, GDP 8% drop

- UK house prices 30% crash

- Sterling 25% crash

- Commercial property 50% crash

- Unemployment soars to 7.5%

- Inflation soars to 6.5%

- Bank of England raises interest rates to 5.5%

The bottom line is that Britain's establishment elite (80% of MP's) remain determined to subvert BrExit through use of insidious, undemocratic measures that of engineering an outcome that means the UK FAILS to LEAVE the European Union. THIS IS SUBVERSION! And possibly sows the seeds for even a British revolution!

For immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Nadeem Walayat

Copyright © 2005-2018 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.