Gold Stocks Acting as they Should During Market Stress

Commodities / Gold and Silver Stocks 2018 Dec 09, 2018 - 07:20 PM GMTBy: Gary_Tanashian

The macro has moved through a time of moderately rising inflationary concerns when economies were cycling up, many commodities were firm and risk was ‘on’. Contrary to the views of inflation-oriented gold bugs, that was not the time to buy gold stocks.

The macro has moved through a time of moderately rising inflationary concerns when economies were cycling up, many commodities were firm and risk was ‘on’. Contrary to the views of inflation-oriented gold bugs, that was not the time to buy gold stocks.

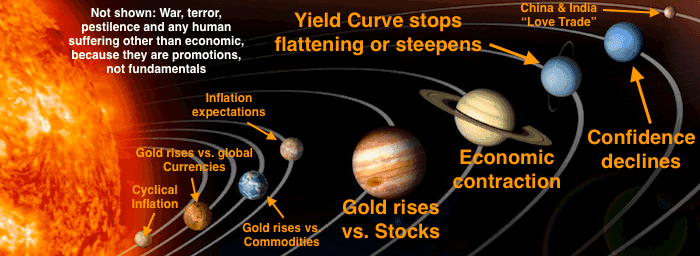

As I have belabored again and again, the right time is when the inflation view is on the outs, gold is rising vs. stock markets, the economy is in question, risks of a steepening yield curve take center stage (the flattening is so mature now that steepening will be a clear and present risk moving forward) and by extension of all of those conditions, confidence declines.

Well?…

In short, the improving sector and macro fundamentals I’ve been writing about for a few months now continue to slam home as the cyclical world pivots counter-cyclical. And what do you know? Gold stocks are reacting as they should. Well, it’s about time, guys!

The technicals had already made some constructive moves as noted in an NFTRH subscriber update on December 4th. The update concluded as follows…

If the precious metals continue bullish in the very short-term the initial targets for all items will be the declining 200 day averages. If the macro fundamentals are proper at such time (and stock markets weaken again) we can improve the view. If not, then that will likely be a sell area, assuming a rally gets going here.

Chief among the sector’s macro fundamentals is the state of gold vs. stock markets. The Gold/SPX ratio has been rising and that is very positive. But for the herds who’ve been taught to revile gold to turn to gold as a refuge, said herds need to be set in motion… by fear (of losing their capital).

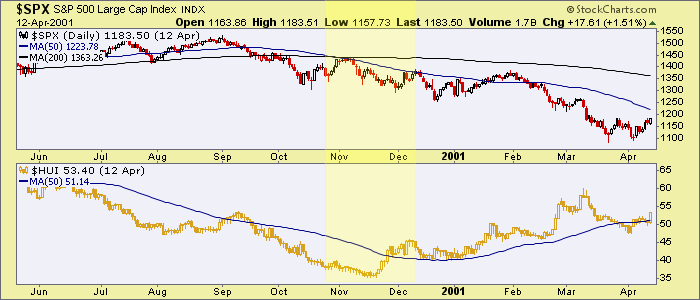

Here is the comparison of SPX and HUI from 2000 that we have been using as a template for the current situation. Very simply, when the S&P 500 bounced and failed into its initial bear market signal HUI bottomed and began its big bull market. The yellow shaded zone tells the story of the stock bull market’s failure (in bouncing to test its Death Cross of the time) and the gold stock sector’s brand new bull in 2000.

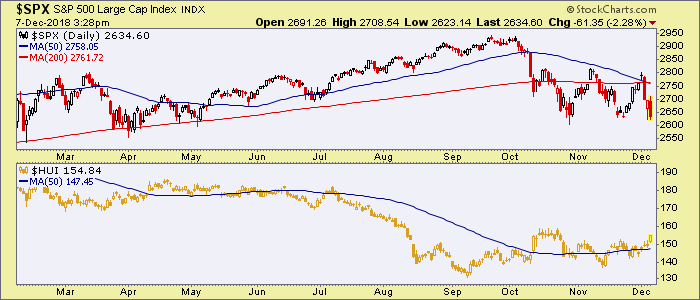

Today we have a failing stock market situation (pending the current grind at key support) and the gold stock sector making a move to go the other way. We’ve simply been noting all along that proper – as opposed to imagined – fundamentals need to be in place, and fear needs to come to conventional stock market participants. Then, almost by definition the counter-cyclical sector can rise.

Well, Thing 1 in the chart above sure does look like a failure in progress and Thing 2 is at least constructive since it rose above its 50 day moving average. On a bloody red day today, gold stocks are acting as I’ve wanted to see them act. Funny isn’t it that it is happening with real fundamentals in line? After all those years of phony, cooked up rationalizations, excuses and promotions; the real fundamentals are being rewarded.

As we’ve been pitched global/China growth, cost-push inflation and war, famine and pestilence as reasons to be gold and gold stock bulls, it appears that the sector is as we’ve been noting all along; counter-cyclical and due to benefit fundamentally when the risk ‘on’ trades start to fail in the eyes of conventional players.

As the process moves forward, now comes the fun part. It has been too many years for gold bugs stuck on the outside looking in at the macro party with a big policy spiked punch bowl right in the center of the room. As the efficacy of the inflated bubble wanes, the gold sector fundamentals only improve. In NFTRH we’ll be charting the sector and the best miners regularly moving forward, because there will be exhilarating runs and rough patches alike along the way. But man, it’ll be fun.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.