With Weaker Climate Consensus, Expect Elevated Climate Change

Politics / Climate Change Dec 16, 2018 - 04:24 PM GMTBy: Dan_Steinbock

As the UN climate conference concluded with the expected dissension, efforts to contain global climate change are weakening at the worst historical moment. Emerging and developing countries will pay much of the bill.

As the UN climate conference concluded with the expected dissension, efforts to contain global climate change are weakening at the worst historical moment. Emerging and developing countries will pay much of the bill.

As representatives from more than 100 countries debated climate change in the COP24 - the 24th UN climate change conference – held in Katowice, Poland, the outcome could only be divisive.

In the past, collective consensus by major economic powers - U.S., the EU, Japan and China - fueled success. Now the planned withdrawal of the U.S. from the Paris Accord resulted in a hollow consensus, supported by big-oil opposition.

Like the recent G20 Summit, which welcomed trade but did not reject protectionism that undermines trade, Katowice agreed on a “compromise,” which welcomed the alarming climate UN (IPCC) report, but not its actual findings. The price could be the virtual extinction of small island states as seas rise, followed by soaring costs of climate change in emerging and developing economies.

Katowice’s “administrative” compromise virtually ensures that the extreme urgency required by the “rule book,” which would allow countries to implement the Paris Agreement, will be ignored.

The planned Trump exit from Paris Accord

Risks have escalated since June 1 2017, when President Trump announced his decision to withdraw the U.S. from the Paris Climate Agreement - an international pact intended to reduce the effects of climate change by maintaining global temperatures “well below 2°C above pre-industrial levels.”

The Accord was negotiated by almost 200 parties and adopted by consensus in December 2015. Based on the UN convention on climate change, it focuses on greenhouse gas emissions mitigation, adaptation and finance starting in 2020.

However, Trump calls the pact a “bad deal” for the U.S. and sees the withdrawal as a key piece of the “America First” stance. The White House began to pave the exit path in March 2017, when Trump signed an executive order to start the formal process of repealing President Obama’s climate agenda.

The withdrawal split the White House, the Congress, and the nation. A few powerful lobbying groups, energy giants and billionaires effectively hijacked the fight against climate-change, which most Americans and U.S. cities support.

More recently, the White House ignored a new government report, which concluded that, in the absence of significant steps to subdue global warming, U.S. economy will take severe hits and cause the death of thousands of Americans by 2100.

It is within the U.S. president’s constitutional authority to withdraw from the Paris deal without first receiving congressional or senatorial approval. But legal questions linger as to how the Trump White House can execute the withdrawal and what role the U.S. can play in future international climate meetings.

The role of China, emerging and developing economies

Since the early 2010s, it has often been said that China is the “world’s greatest polluter.” That’s true but only in aggregate terms. By default, big nations pollute more than small ones.

Moreover, emerging economies that are still industrializing generate relatively more pollution than advanced nations, which industrialized over a century ago.

The simple fact remains that, on per capita basis, the U.S. and major European economies remain the greatest polluters by far, however.

According to research, China contributes barely 10-12% of human influence on climate change. That figure has remained fairly steady over the industrial period. It is lower than might be expected for the world’s largest aggregate emitter.

As the major advanced economies, including the U.S. and Europe, have been emitting far longer, their net contribution on climate change remains relatively far higher. Climate change is not just cumulative but accumulative.

If the U.S. exit will materialize, global climate risks will intensify dramatically, particularly in emerging and developing economies.

The 10 countries most affected by climate risk

Between 1998 and 2017, Puerto Rico, Honduras and Myanmar ranked highest among the countries that have been most affected by climate change. Less developed countries are generally more affected than industrialized countries. Yet, even, high income countries feel climate impacts more clearly than ever before.

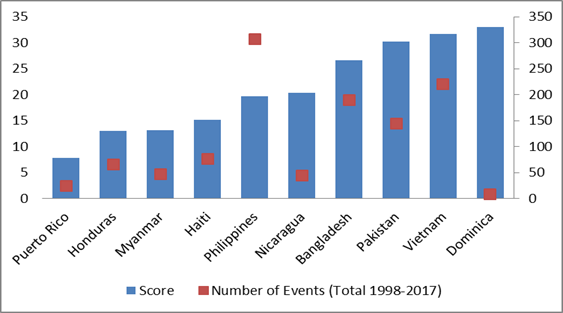

Regarding future climate change, the new Global Climate Risk Index can serve as a red flag for already existing vulnerability that may further increase in regions where extreme events will become more frequent or more severe due to climate change. The 10 countries most affected in the past two decades feature mainly poorer economies in Asia (Myanmar, Philippines, Bangladesh, Pakistan, Vietnam and Thailand) and Americas (Honduras, Haiti, Nicaragua and Guatemala) (Figure).

Figure Long-Term Climate Risk *

* Annual averages, 1998-2017: Climate Risk Index 2019, GermanWatch; Difference Group

The Index measures long-term global risk as a function of death toll, deaths per 100,000 inhabitants, absolute losses in US$ millions, losses per unit GDP in percentage and total number of climate events from 1998 to 2017. In this regard, there are differences among the most affected countries.

In the case of Puerto Rico, the top rank was driven by a very high death toll and costly economic losses, but the number of events was low relative to other countries. In Myanmar, the high death toll explains the score. In Dominica, Puerto Rico and Haiti, the losses per unit GDP drove high rankings.

In international comparison, the Philippines death toll has been relatively high in the past two decades, while its economic losses were among the highest. But it is the number of total events in the Philippines (over 300) that was the highest among the top-10 countries.

Only Vietnam and Bangladesh come close, but even they had just two-thirds of the climate events in the Philippines. And in the top-ranking Puerto Rico and Honduras, total events were less than a 10th and 5th of those in the Philippines.

Toward accelerated climate change

Since the 1980s typhoons that strike East and Southeast Asia have intensified by 12–15%, with the proportion of storms of categories 4 and 5 having doubled, even tripled. Under increasing greenhouse gas forcing, the projected ocean surface warming pattern suggests that typhoons striking Asia will intensify further.

Ironically, global climate change will penalize particularly those economies where living standards remain low and that are most vulnerable to collateral damage. The more poor economies will lose lives, the more that will bespeak about the effective indifference of advanced nations toward real human rights.

Timing matters. Under the agreement, the earliest date of the U.S. withdrawal is November 2020 - the last month of the Trump presidency, in the absence of a prior impeachment. That’s when Americans have to decide whether they really prefer energy profits, at the expense of future generations in the U.S. and elsewhere.

Furthermore, time is running out. According to estimates, current climate policies virtually ensure that the increase in global temperatures is on pace for somewhere around 3.3 degrees Celsius.

That does not bode well for the future.

Dr Steinbock is the founder of the Difference Group and has served as the research director at the India, China, and America Institute (USA) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more information, see http://www.differencegroup.net/

© 2018 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.