FT Shows How British Establishment Will Ensure REMAIN Wins a Second EU Referendum

Politics / BrExit Dec 20, 2018 - 12:15 PM GMTBy: Nadeem_Walayat

Calls for a so called "Peoples Vote" are reaching a crescendo in the mainstream press, as grid locked chaos in the Westminister counts down to the BrExit deadline of 29th March 2019, that is resulting cabinet ministers downwards claiming that a Second EU Referendum is necessary so that the people can decide on the terms of exiting from the European Union, a deal or no deal exit, or even for the UK to REMAIN within the European Union.

Calls for a so called "Peoples Vote" are reaching a crescendo in the mainstream press, as grid locked chaos in the Westminister counts down to the BrExit deadline of 29th March 2019, that is resulting cabinet ministers downwards claiming that a Second EU Referendum is necessary so that the people can decide on the terms of exiting from the European Union, a deal or no deal exit, or even for the UK to REMAIN within the European Union.

Unfortunately, the whole "Peoples Vote" exercise is a means by which the Britain's establishment will ensure that REMAIN would WIN a second EU referendum by the way the referendum questions would be worded as illustrated by the Financial Times (FT) latest video titled "BrExit: how to hold a second referendum" :

The FT's proposed design is for the 2nd EU referendum to comprise 3 questions with a 1st and second preference:

- No Deal Brexit

- Deal Brexit

- Remain

The FT's Journalist then goes on to make his selection by choosing REMAIN as his first choice and then DEAL as his second choice which is typical of how one would expect those who voted REMAIN in 2016 to vote:

Therefore under the FT's model for a Second EU Referendum the vast majority of those who voted REMAIN in 2016 would vote for REMAIN again.

However, a significant percentage of those who voted LEAVE would vote for a with DEAL Brexit as a consequence of the intensity of NO DEAL BREXIT DOOM propaganda that the likes of the FT have been perpetuating and would intensify further in the countdown to a second referendum.

Therefore the second referendum would be designed to SPLIT the LEAVE vote and thus by default REMAIN would win a second EU referendum. Despite the fact that REMAIN should not even be a choice at a second referendum as that question was answered in 2016 i.e. it should be a choice between leaving with or without a deal.

Thus a 2nd EU Referendum with REMAIN on the ballot would amount to subversion of the result of the 2016 EU Referendum when the people had a clear choice between either to REMAIN in or LEAVE the European Union. And so any second EU referendum should similarly have a SIMPLE clear choice, of either to REMAIN or LEAVE the EU, instead of which the establishment are clearly determined to SPLIT the LEAVE Vote through tricks such as this so as to ensure that REMAIN wins a Second Referendum, this in my opinion potentially sows the seeds for civil war!

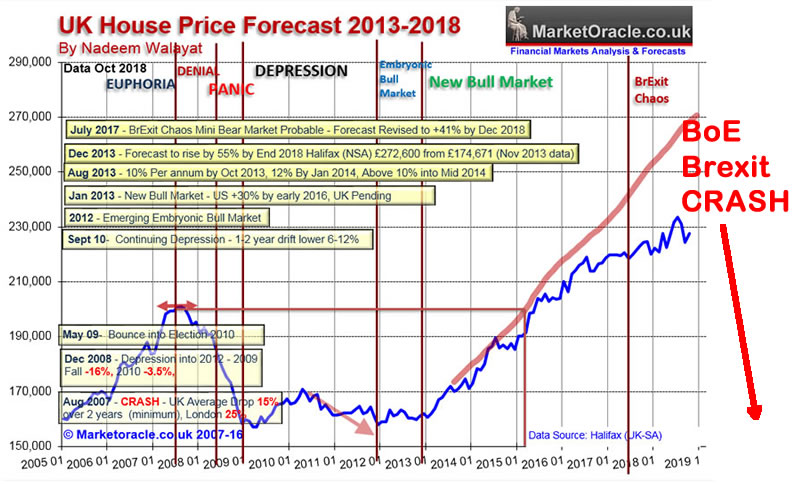

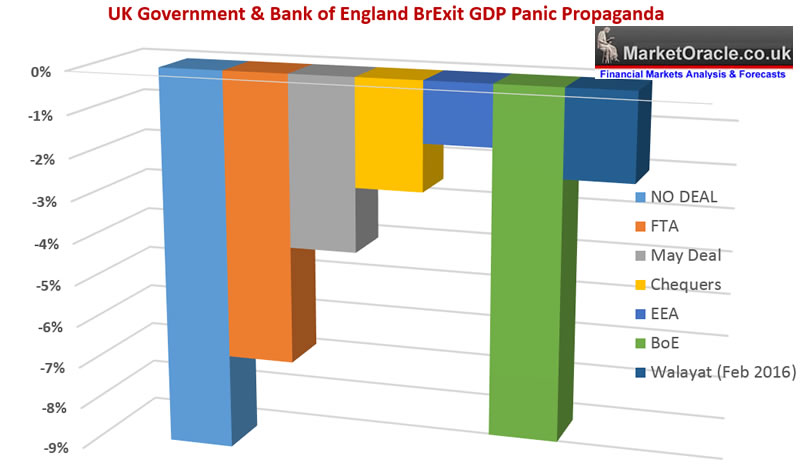

To illustrate the degree to which anti NO Deal Brexit propaganda emanating out of the Government and the Bank of England are the Governments recent reports warning of a loss of 9% of GDP, albeit as a deviation from trend over 15 years. Soon followed by the Bank of England setting forth it's own NO DEAL economic armageddon forecasts, warning of an immediate economic collapse on a scale twice that of the 2008 Financial Crisis. A 25% collapse in sterling, a collapse in GDP of 8%, inflation soaring to over 6.5% and a 30% CRASH in UK house prices. Though it should be noted that none of similar fear mongering pre EU referendum materialised as the UK economy continued to grow on a similar trend trajectory to what it was on as before the EU Referendum BrExit result.

Here's a summary of the Bank of England's No Deal CRASH warnings.

- Economic crash, GDP 8% drop

- UK house prices 30% crash

- Sterling 25% crash

- Commercial property 50% crash

- Unemployment soars to 7.5%

- Inflation soars to 6.5%

- Bank of England raises interest rates to 5.5%

Whilst here's a summary of the of UK Government and Bank of England's forecasts of what they expect to happen to the UK post Brexit coupled with my own forecast as of Feb 2016.

The bottom line is that Britain's establishment is determined to subvert Brexit by ensuring that the only outcome from a Second EU Referendum will be for Britain to vote to REMAIN within the European Union that will not convince the majority of those who voted to LEAVE in June 2016 which sows the seeds for civil conflict.

Therefore there should NOT be a Second EU Referendum, and if there is a second referendum then it should be presented as a binary choice, one of a DEAL or NO DEAL BrExit without any preference to REMAIN in the EU.

As Smeegle would say "Tricksy Remainer's"

Your analyst,

Nadeem Walayat

Copyright © 2005-2018 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.