Rampaging Stock Bear Markets WorldWide vis-à-vis CHRISTMAS

Stock-Markets / Stock Markets 2018 Dec 25, 2018 - 03:59 PM GMTBy: I_M_Vronsky

All major stock indices WORLDWIDE are presently in a Bear Market mode. In fact there is no exception: Stocks are trending downward in the North America, Asia, Europe and Mexico…without exception. This analysis will consist of mainly the stock charts of 16 major exchanges of the three continents (i.e. the Americas, Asia and Europe):

-

North America (USA and Canada)

-

Asia (China, Hong Kong, India and Japan)

-

Europe (Germany, France and Euro FTSE)

-

Mexico

-

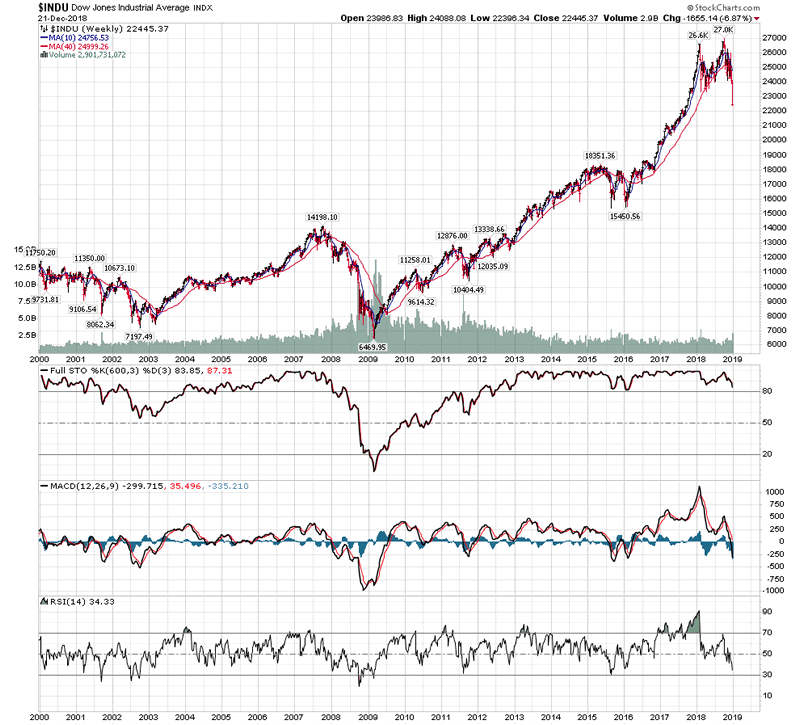

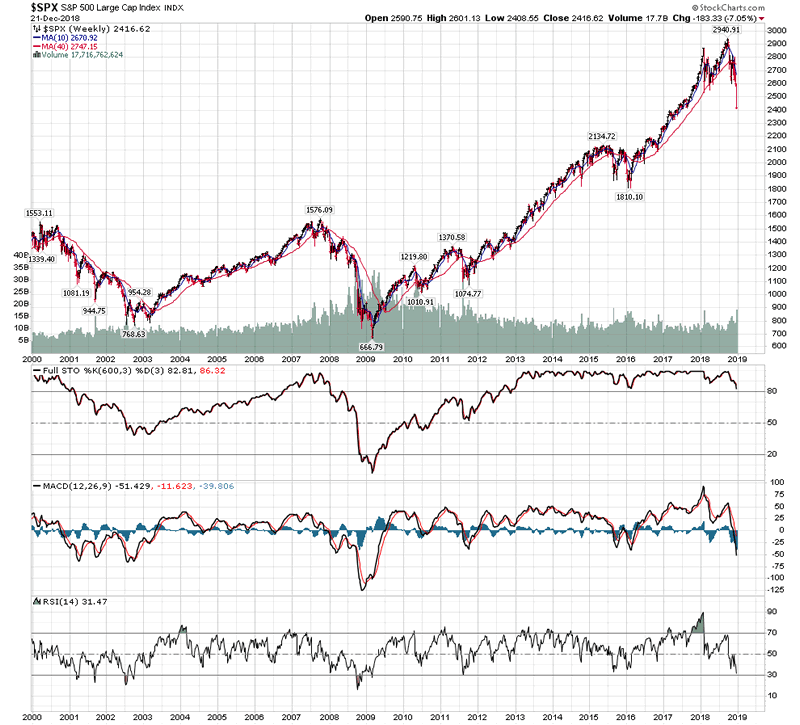

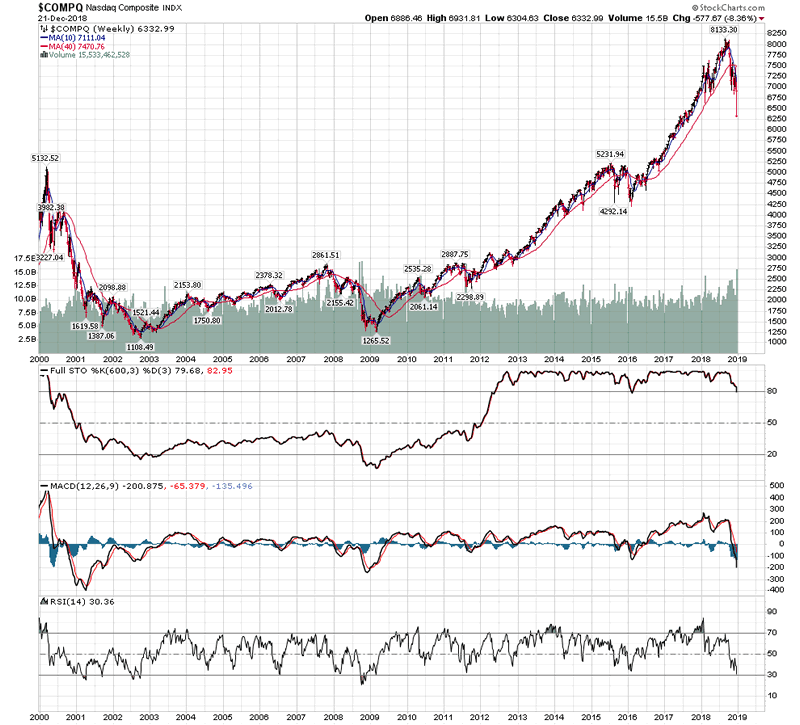

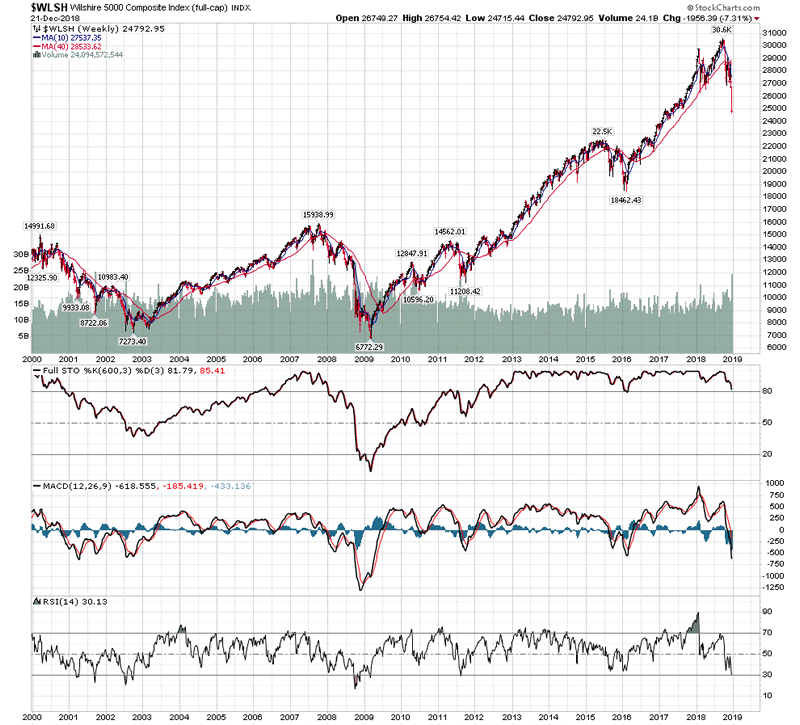

Dow Jones Global And World Indices

The prime signal used to call these stock indices in a Bear Market mode is the fact each has suffered the Death Cross price pattern, where the 50 day moving average (dma) has crossed down below its 200 dma…just as they did in the global bear markets of 2000-2001 and 2007-2008 (when most indices lost about 50% of their previous peak values). With a view to make the 16 charts more readable, I have converted the Daily charts into Weekly charts. CONSEQUENTLY, the Death Cross Daily Moving Average (dma) was converted to Weekly charts where the Death Cross is 10 wma and 40 wma. The dire significance is the same…to wit: a Bear Market is approaching. Moreover, it’s important to notice each chart shows three predictive Technical Indicators. Namely, Full Stochastics, MACD and RSI. The status of these 3 Technical Indicators has reached bear market levels…further confirming the Bear Market forecast of the Death Cross (similar to the global bear market periods of 2000-2001 and 2007-2008). Remember, The Death Cross is the prelude overture to the Concert of the Bears to be played out in 2019.

THEREFORE, take appropriate protective action to protect your wealth.

North America (Dow Jones Index, S&P500, NASDAQ, Wilshire 5000, Russell 2000 and Canada Index)

DOW JONES INDEX

(Source: https://stockcharts.com/... )

S&P500 INDEX

(Source: https://stockcharts.com/h-sc/ui?s=%24SPX&p=W&yr=19&mn=0&dy=0&id=p0957280208c&listNum=1&a=636913895 )

NASDAQ

(Source: https://stockcharts.com/h-sc/ui?s=%24COMPQ&p=W&yr=19&mn=0&dy=0&id=p8155472774c&listNum=1&a=636914943 )

WILSHIRE 5000 INDEX

(Source: https://stockcharts.com/h-sc/ui?s=%24WLSH&p=W&yr=19&mn=0&dy=0&id=p3496620658c&listNum=1&a=636915294 )

INDUBITABLY, the bears are amassing…WORLDWIDE….just listen to their angry growling

By I. M. Vronsky

Editor & Partner - Gold-Eagle

www.gold-eagle.com

Founder of GOLD-EAGLE in January 1997. Vronsky has over 40 years’ experience in the international investment world, having cut his financial teeth in Wall Street as a Financial Analyst with White Weld. He believes gold and silver will soon be recognized as legal tender in all 50 US states (Utah and Arizona having already passed laws to that effect). Vronsky speaks three languages with indifference: English, Spanish and Brazilian Portuguese. His education includes university degrees in Engineering, Liberal Arts and an MBA in International Business Administration – qualifying as Phi Beta Kappa for high scholastic achievement in all three.

© 2017 Copyright I. M. Vronsky - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.