The Bitcoin BTC Collapse of 2018, Trend Outlook 2019

Currencies / Bitcoin Dec 31, 2018 - 11:12 PM GMTBy: Nadeem_Walayat

2018 was the year the bitcoin crypto bubble burst that witnessed the bitcoin price first collapse to a floor of $6000, from which each attempted bounce failed to generate any follow through, and the longer the failure for a breakout higher continued then the greater the probability that the price would eventually break lower, below the $6000 floor. Which is what transpired during November that saw Bitcoin plunge to a new low of $3,100 by Mid December, a far cry from the fantasy of first revisiting $20k and then $50k that a naive 'manipulated' Bitcoin community had pinned their hopes and dreams on whilst immersed in an endless feedback loop of perma bull bitcoin pump mania commentary, that was the mainstay of the internet during 2018, whilst the manipulators were dumping their holdings onto the naive players. Just like what the pump and dumpers have been doing with penny stocks for over 100 years!

2018 was the year the bitcoin crypto bubble burst that witnessed the bitcoin price first collapse to a floor of $6000, from which each attempted bounce failed to generate any follow through, and the longer the failure for a breakout higher continued then the greater the probability that the price would eventually break lower, below the $6000 floor. Which is what transpired during November that saw Bitcoin plunge to a new low of $3,100 by Mid December, a far cry from the fantasy of first revisiting $20k and then $50k that a naive 'manipulated' Bitcoin community had pinned their hopes and dreams on whilst immersed in an endless feedback loop of perma bull bitcoin pump mania commentary, that was the mainstay of the internet during 2018, whilst the manipulators were dumping their holdings onto the naive players. Just like what the pump and dumpers have been doing with penny stocks for over 100 years!

And it was an even worse experience for holders of Alt coins such as Ethereum that collapsed from $1000 to $100, and that's before over $1 billion of theft of crypto's straight out of the exchange held wallets of retail investors.

But first a recap of my forecast expectations for 2018 which I published when the crypto was trading at USD 14,000, warning that the Bitcoin price was likely to continue crashing lower towards a target of $5,000, a forecast that at the time was met with much denial from the bitcoin community who were focused on fantasising about the crypto soon revisiting $20k.

02 Jan 2018 - Bitcoin Crash Not Over, Crypto Gamblers Prepare for Spike Down to $5,000

As for what bitcoin could do during 2018, well the price may have recovered by some 30% from the recent $10k low but I doubt that the decline is over, so it looks like bitcoin holders are currently in the calm before the next Bitcoin storm, another down leg to well below $10k, probably a spike down to $5k! Following which I would expect Bitcoin to be pretty much dead for the rest of the year, i.e. don't expect a return to $20k anytime soon! So Bitcoin gamblers beware!

And my update of 5th Feb at BTC $8k reaffirmed expectations for downwards price spiral now towards lower to $4k

05 Feb 2018 - Bitcoin Crypto Currencies Crash 2018, Are We Near the Bottom?

So what does the chart say for the prospects for Bitcoin, well the declines momentum has fallen slightly which suggests that the rate of decent should gradually become milder.

However, the downwards trend / collapse remains in progress so there has been little deviation against my forecast to date which means Bitcoin remains heading for a spike down to $5,000 this year.

With my look at Bitcoin on 19th March warning against getting sucked into a suckers rally at the time which had seen BTC rally from a low $7,200 to $8,600. Where instead I warned that the Bitcoin price rather than recovering could slice through $5k, then $4k and even $3k and that I would not be surprised if Bitcoin went as low as $2,000!

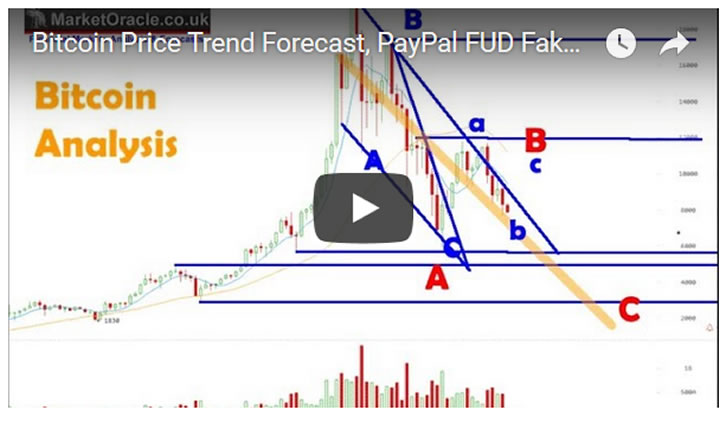

19 Mar 2018 - Can Bitcoin Price Rally Continue After Paypal Fake FUD Attack?

Bitcoin Analysis and Trend Forecast 2019

So here we stand at then end of December 2018 with the Bitcoin price currently trading at $3,680! Mission accomplished in terms of my forecast for 2018.

The rest of this analysis is first being made Patrons who support my work. So for First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Your analyst,

Nadeem Walayat

Copyright © 2005-2018 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.