How Waymo Will Destroy Uber

Companies / Self Driving Cars Jan 09, 2019 - 04:31 PM GMTBy: Stephen_McBride

Google’s Waymo has officially launched the world’s first self-driving, ride-sharing service! Residents in four Phoenix suburbs can now ride around in its robo-taxis for a small fee.

Google’s Waymo has officially launched the world’s first self-driving, ride-sharing service! Residents in four Phoenix suburbs can now ride around in its robo-taxis for a small fee.

It’s one of the biggest disruptive forces in America.

In RiskHedge, I recently explained why self-driving cars are going to gut the auto industry like a fish. And Phoenix is only the first step in Waymo’s domination of American roads.

Here’s why.

Waymo Is at Least Three Years Ahead of Its Peers

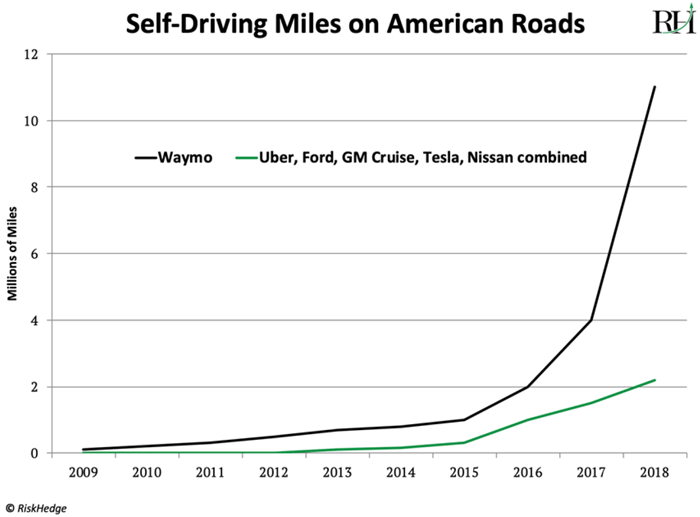

Waymo’s cars have driven 11 million miles already. And they’re clocking up roughly 1 million more every month.

Its five biggest rivals have only covered about two million miles combined, based on Department of Motor Vehicles data.

Waymo is crushing them, as you can see from this chart:

Right now, Waymo is running tests in 25 US cities. And it’s the only company allowed to test fully driverless cars in California because of its first-class safety record.

My research suggests Waymo is at least three years ahead of its peers.

But Gaining Public Trust Is Key

Making self-driving cars a success isn’t just about the technology. It’s also about gaining public trust. Waymo leads the way in both.

It’s important to note that human error causes 94% of road crashes.

In fact, 40,000 Americans died on the roads last year. Worse yet, 10,000 of those died in alcohol-impaired crashes.

Robo-taxis will save thousands of lives a year at a minimum. Once governments figure this out, they’ll be begging Waymo to come to their city next.

But Waymo understands a single fatality involving its cars could set it back several years.

That’s why it’s put safety front and center. Ahead of last week’s launch, it hired the former chair of the National Transportation Safety Board to become its chief safety officer.

It’s cozying up to local governments too. It’s partnered with Phoenix’s public transport to connect people with the city’s bus and rail services. It’s also bringing retirees to Walmart to buy their groceries.

Waymo Will Make Uber Obsolete

By far the biggest cost of operating a car today is the driver. Roughly 80% of the Uber fare goes to the drivers.

Waymo’s self-driving cars slash this to near zero. And so they can offer a far cheaper service.

This is Waymo’s big opportunity.

Around 60% of all car trips in 2017 were under six miles, according to the Department of Energy.

Whether dropping the kids at school, commuting to work, or buying groceries… these short trips are ideal for ride-sharing. But who wants to pay $10 each way for an Uber?

In the not-too-distant future, depending on where you live, you’ll be able to grab a Waymo for a fraction of what Uber costs.

I Recommend Google

As regular RiskHedge readers know, Waymo is tucked inside Google (GOOG), the world’s fourth-largest public company.

That’s important because Waymo’s technology comes from Google. It uses Google’s machine-learning tools to teach its centralized “brain” how to drive.

This gives it a gigantic advantage over its rivals. You see Google is the unquestioned leader in machine learning.

Over the past decade it’s spent four times as much in this space as anyone else. Along with teaching computers to drive, it used machine learning to slash costs in its data centers by 30%.

Analysts at Morgan Stanley value Waymo at $175 billion today. But because you can’t buy Waymo stock individually, investors are completely overlooking its potential.

Google trades at 22 times forward earnings today, its lowest valuation in over a year.

That’s a fair price just for its core business, which as you probably know, holds a near-monopoly on the internet search market. 92 out of every 100 internet searches flow through Google.

Bottom line: buying Google stock at today’s prices is a bit like getting Waymo for free.

I recommended buying Google at $1,070 a few weeks back. It’s trading right around there today, and it’s still a strong buy.

By Stephen McBride

© 2019 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.