Why the Green New Deal Will Send Uranium Price Through the Roof

Commodities / Uranium Mar 14, 2019 - 04:35 PM GMTBy: Stephen_McBride

Have you heard of Alexandria Ocasio-Cortez?

Have you heard of Alexandria Ocasio-Cortez?

At 29 years old, she’s the youngest Congressperson in history.

Also known as “AOC,” Cortez is quite a sensation among young left-leaning folks. No surprise, she’s often referred to as the Democratic version of Trump. 2.4 million fans follow her on Twitter.

Like any socialist, AOC is full of “ideas.” Most of them involve taking money from one group of people and giving it to another.

She’s calling for a 70% top tax rate, for example. And free college. And giving free money to those “unwilling to work.”

But I want to set politics aside to tell you about her silliest idea of all. She doesn’t know it, but this idea will send one beaten down stock through the roof…

One that soared 3,000% the last time it was in a bull market.

AOC’s Big Idea Is Called the Green New Deal

The Green New Deal aims to have America running on 100% clean energy by 2030.

AOC has called climate change her “World War II.” She wants to get rid of dirty energy like coal, oil, and gas that pollute the air.

Sounds pretty good, right? A clean environment is important for all of us. I certainly want my young daughter to grow up breathing clean air.

But there’s one big problem with AOC’s plan.

The Green New Deal Excludes the Cleanest Energy Source of All

According to AOC "there is no place for nuclear power” in America’s future.

Many folks think nuclear power is dirty and dangerous. They associate it with big smokestacks and nuclear bombs.

These people could not be more wrong. Nuclear is the best source of renewable, clean energy we have.

It doesn’t cause any pollution. The steam drifting out of nuclear plants is as harmless as the steam from your shower.

In fact, the International Panel on Climate Change found nuclear power produces less air pollution than solar, wind, or hydro.

It is also the safest energy source on the planet, according to the World Health Organization.

The Green New Deal Can’t Succeed Without Nuclear

There are 99 nuclear reactors in the US. They generate twice as much clean energy as every solar panel, wind turbine, and other clean energy source combined.

Excluding nuclear, clean energy sources like solar and wind make up 17% of America’s energy needs. Getting that to 100% by 2030 without nuclear is impossible.

For one, it would cost trillions of dollars.

Also, we need energy sources that are dependable and “always on.” This is a major problem for solar and wind.

Solar power is interrupted by darkness and clouds. Wind turbines only work when the wind blows. That’s why solar generates power only 25% of the time and wind 35% of the time.

This Is How the Uranium Sector Collapsed

As you likely know, nuclear power plants use uranium as fuel to produce electricity.

But the uranium sector has collapsed since 2011.

It began with the freak accident in Fukushima, Japan. First, the most powerful earthquake in Japan’s history caused a reactor to shut down. Then a tsunami disabled the emergency generators.

This caused a disastrous nuclear meltdown that contaminated a large area and killed and injured many people.

Japan shut down all but two of its reactors after the Fukushima disaster. Many other countries followed suit.

Germany moved to phase out nuclear power completely. And plans to build four new reactors in America were shelved.

Uranium Demand Plunged and Its Price Cratered 86%

This led to the vast majority of uranium companies shutting their doors.

In 2011, there were 585 uranium companies. Just 40 remain operational today. And most of the survivors have seen their stocks plunge 90% or worse.

Last year, uranium production in the US dropped to its lowest level since the 1950s. That’s because almost no producer can make money at today’s depressed prices.

Uranium Has Nowhere to Go but Up

It’s a total bloodbath. But as I explained last year, the uranium market is poised to surge higher. You can review my whole case for uranium here.

In short, nuclear use around the world is growing. 57 new reactors are now being built. And uranium demand is expected to rise 23% by 2025.

Yet uranium stocks are priced as if nuclear energy is being phased out altogether.

Despite what the Green New Deal says, it’s not. I guarantee nuclear power will be a big part of America and the world’s clean energy future.

Cameco (CCJ) Is Hands Down My Favorite Uranium Stock

Cameco is the world’s biggest uranium producer. In fact, it’s one of my top picks for 2019, period.

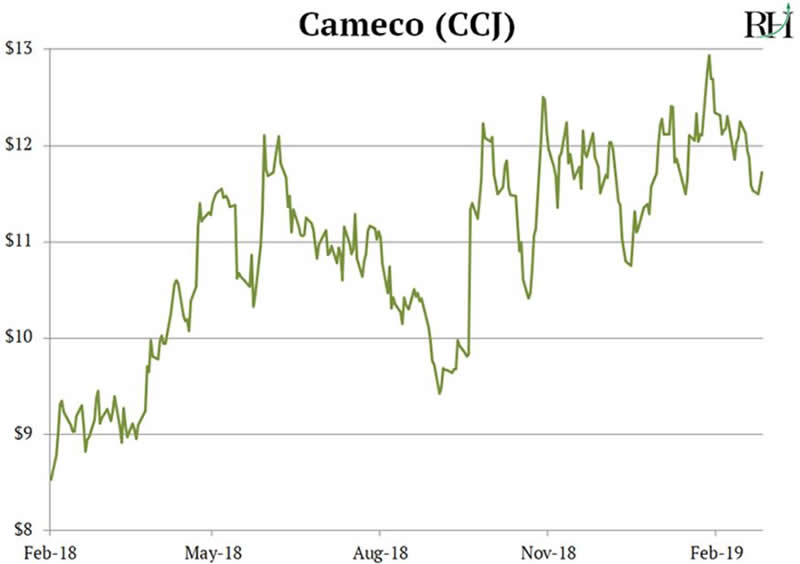

I recommended Cameco to you in August. It has climbed 10% since then. And it’s up 30% in the past year:

Cameco produces around 15% of the world’s uranium. It operates two of the highest-quality uranium mines in the world. Both are located in Canada’s Athabasca Basin. And the quality of the uranium there is 100x better than the global average.

This allows Cameco to produce uranium for less than its competitors. Most companies mine it for $50–$60/lb. Cameco does it for around $35/lb.

A key thing to know about uranium stocks is they move in massive cycles. The “up” part of the cycle can produce some of the biggest gains you’ll ever see.

For example, when the uranium price ran from $10/lb to $136/lb between 2000 and 2007, Cameco shot up over 3,000%.

Over the next few years, as reality dawns on the markets, we have a great shot to triple our money or better in Cameco.

And given that it rocketed 30x in the last uranium bull market, it could easily go a lot higher.

By Stephen McBride

© 2019 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.