Loyalty Still Doesn’t Pay if Savers Stay with Biggest Banks

Personal_Finance / Savings Accounts Mar 27, 2019 - 10:12 AM GMTBy: MoneyFacts

Savers searching for a flexible home for their hard-earned cash will still not find the best rates with the biggest banks*. Despite an increase to the Bank of England base rate in August 2018, many of the largest banks on the high street still fail to beat, or even match, its current level of 0.75%.

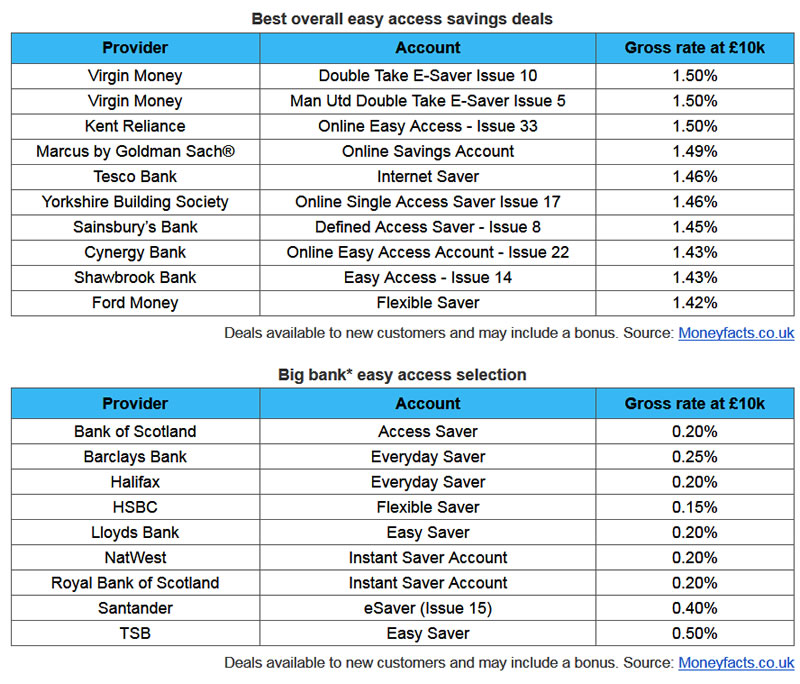

Indeed, the latest analysis by Moneyfacts.co.uk shows that as rates within the easy access market continue to improve, the difference in interest that savers could earn between smaller brands and high street names is widening. Now, the top rate overall pays 10 times more than the lowest big bank rate, which could equate to a difference in interest of £135 a year (based on a £10,000 minimum initial deposit)**.

Rachel Springall, Finance Expert at Moneyfacts.co.uk, said:

“Savers may well be storing up their savings in a flexible pot during times of economic uncertainty, but this shouldn’t mean leaving the money languishing in a poor-paying account. If savers were to instead move their cash to one of the Best Buys, they could earn 10 times more interest on the top deal versus the lowest on offer from a big high street bank*.

“In fact, loyal savers will find that not all brands were generous enough to pass on the 0.25% base rate rise in August 2018. Indeed, a year ago, Barclays Bank paid 0.20% on its Everyday Saver, and it now pays just 0.05% more, at 0.25%. Only Santander increased its eSaver by 0.25% to 0.40%, but even then it doesn’t come close to base rate and will revert to a lower paying account after a year.

“Clearly convenience costs so savers will need to rethink where they are storing their hard-earned cash. Some of the best deals on the market come from building societies or the more unfamiliar challenger banks, with the latter taking firm hold of the Best Buy tables, perhaps to remain consistently in the view of savers to draw in deposits for their future lending.

“The growing distance between the top rates in the market and those on offer from the biggest banks could grow further still, but right now there is little difference between the market leaders. It’s also worth noting that not every easy access account is as flexible at first glance; Virgin Money for example allows two withdrawals on its 1.50% easy access account, whereas Kent Reliance pays the same rate with unlimited withdrawals.

“Mutuals on the other hand are also paying much higher rates than the biggest banks. In fact, savers who have just £100 to invest could get 1.46% from Yorkshire Building Society, which sits firmly in the Best Buys.

“Savers who are preparing to switch must keep in mind that many of the top deals might not be around for long and may well require internet access, as many can only be opened online. For example, ICICI Bank UK launched an online-only rate of 1.54% in January, but it remained on the market for less than a month – so speed is vital to secure some of the best rates seen this year.”

*Banks selected for comparison are considered the biggest on the high street. This comparison looked at Barclays Bank, Bank of Scotland, HSBC, Halifax, Lloyds Bank, NatWest, Royal Bank of Scotland, Santander and TSB. Deals shown are a selection of the lowest rates. **Rate difference between 1.50% with Virgin Money and 0.15% with HSBC.

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.