Yield Curve Has Inverted. Will Gold Rally Now?

Interest-Rates / Inverted Yield Curve Mar 27, 2019 - 10:22 AM GMTBy: Arkadiusz_Sieron

The yield curve followed suit of the Fed and also inverted. Inverted yield curve is a sign of an incoming recession, they say. However, what is the background of this yield inversion and how will gold react to its emerging story?

The yield curve followed suit of the Fed and also inverted. Inverted yield curve is a sign of an incoming recession, they say. However, what is the background of this yield inversion and how will gold react to its emerging story?

Red alert! Or, actually, a yield alert! After months of worries, the yield curve has finally inverted. Well, maybe not the whole yield curve, but one of its segment. As one can see in the chart below, the spread between US 10-year Treasury and 3-Month Treasury dived on Friday to its lowest since 2007.

Chart 1: Spread between US 10-year Treasury and 3-Month Treasury from March 2018 to March 2019

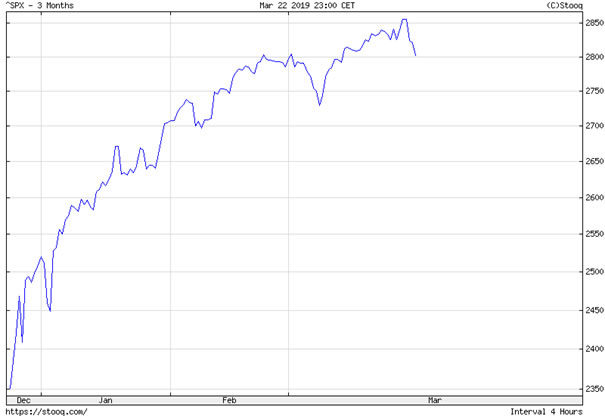

The fact that long-term bond yields fell below the short-term interest rates rattled investors. The S&P 500 dropped 0.8 percent to 2,801 on Friday, the biggest plunge since January, as the chart below shows. The reason is that, as we explained in the March edition of the Market Overview, the inversion of the yield curve is considered to be one of the most reliable recession indicators.

Chart 2: S&P 500 Index from December 2018 to March 2019

Indeed, the yield curve inversions have preceded each of the last seven recessions, including the Great Recession. Therefore, it is not surprising that investors panicked and that the VIX surged.

But are these fears really justified? Is a recession coming? Well, not necessarily. Although the yield curve inversion is relatively reliable, it still produced a few false positives (for example, an inversion in late 1966).

Moreover, because of the international capital flows and quantitative easing, the underlying determinants of the yield spread today are materially different from the determinants that generated yield spreads during prior decades. We mean here that without the central banks’ purchases of assets (the BoJ and the ECB still buy or reinvest maturing securities into new bonds), the yield curve would be steeper and it would not signal a recession.

However, the most important is the reason behind the recent inversion. Investors should always be careful when interpreting economic indicators and dig into their underlying drivers. You see, the yield curve may invert either because the short-term rates are running high or because the long-term rates are running low. Historically speaking, the yield curve inverted when the Fed tightened its monetary policy by raising the short-term interest rates which triggered recessions at some point.

But the yield curve inverted on Friday after the dovish FOMC meeting on Wednesday, when the US central bank signaled longer pause in further tightening (no hikes this year) and announced the end of shrinking its balance sheet as early as in September. The Fed’s volte-face scared investors who followed suit and cut their outlook for future economic growth. Consequently, the long-term rates declined. After all, if the Fed can really see around corners, and it doubled down on its dovish stance, it is better to move from risky assets and allocate funds into Treasuries (or other safe havens, such as gold).

In others words, the latest yield curve inversion did not fit the classical story when the Fed raises the short-term interest rates to combat inflation. This is why we believe that the yield curve has lost some of its prediction power. Precious metals investor should take this into account in their investment decisions.

Implications for Gold

The bottom line is that the yield curve has inverted. It should add to the fears of recession, which should help the yellow metal in the near future. However, the effect might be temporary. In the March edition of the Market Overview, we have analyzed several other recession indicators (such as the unemployment rate) and they do not blink red. And in the April report we will present important arguments in favor of the view that the current global slowdown will be only temporary. So, we believe that it’s probably premature to press the panic button.

For us, one of the two scenarios is true. The first one is that Mr. Powell just made an error. He wanted to please the Wall Street, but he over-delivered on a dovish side, raising unnecessary fears. When the US central bank realizes its mistake, it will adjust its stance and calm the markets. The positive effects on gold will vanish, then.

Second, the Fed knows something we are not aware of. We signaled this possibility on Thursday edition of the Gold News Monitor. If it sees recession around the corner, gold could shine for longer. However, given the solid state of the US economy, it’s more probable that Mr. Powell and his colleagues noticed something scary – but unfolding outside America, for example, in the Eurozone or China. In such a scenario, gold may still benefit from safe-haven demand, but gains will be limited by the US dollar’s appreciation.

Hence, gold is likely to go up in the short-term and end the year with better results than in 2018. But it should not rally until we see a US recession. It is still premature to herald it, so medium-term gold bulls should hold their horses. We will monitor carefully the situation and we are ready to change our stance as soon as we will see a sustained yield curve inversion and other recession indicators also blinking red. Stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.