Prepare For Unknown Stock Market Price Action As New Highs Are Reached

Stock-Markets / Stock Markets 2019 Apr 23, 2019 - 06:54 PM GMTBy: Chris_Vermeulen

The ES and NQ are very close to breaking out to new all-time highs this week and possibly over the next few weeks. The NQ is very close to these new high levels already. Traders must not take this move for granted as increased volatility and a very real chance for a price correction become even greater once we break into “new high territory”.

The ES and NQ are very close to breaking out to new all-time highs this week and possibly over the next few weeks. The NQ is very close to these new high levels already. Traders must not take this move for granted as increased volatility and a very real chance for a price correction become even greater once we break into “new high territory”.

This upside move has taken almost 5 months to climb back from the December 2018 lows. It has been a very dramatic rally to say the least. We’ve seen dozens of professional analysts suggest the markets would rotate lower all the way up this rally. It seems as though everyone wanted to be right that the market top in October 2018 was going to be the start of something big. We were one of the few analysts that called the market accurately. Our September 17, 2018 analysis called for almost every leg of this price swing over the past 7+ months. We stuck by our research while others were skeptical and doubting our research. We stuck to it because we believe in our work and modeling tools.

Now, our modeling tools are suggesting we could be setting up for a pretty big increase in volatility over the next 2~3 months with the potential for bigger price rotation into May/June 2019. As we are reading our modeling system results, the key elements are that price will achieve new all-time highs, the price will increase in volatility and Gold should begin an upside price move over the next 2~5+ weeks. The move in Gold suggests one of two things may happen, or both. The US Dollar may weaken or the US stock market may correct a bit based on some economic event or outside foreign economic event.

Either way, the move in Gold suggests that increased volatility is almost a sure thing over the next 60 to 90 days. The only reason Gold would rise is if there is some increased fear factor throughout the planet in regards to the protection of assets and fear of some unknown event. Therefore, if our analysis is correct and Gold does rise as we have indicated, then something is about to create a big increase in volatility.

The key to all of this is that the ES and NQ will move into NEW HIGH territory before this volatility increase begins to become apparent.

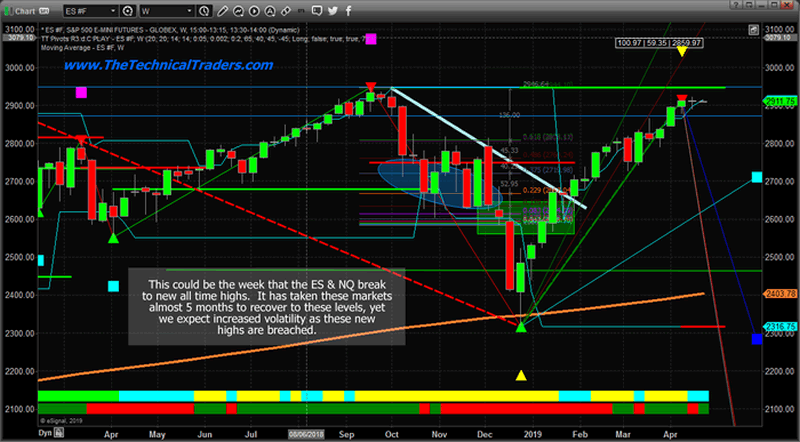

This ES Weekly chart shows just how close the ES (S&P500 Futures) are too new all-time highs. The ES needs to climb another 41 points (+1.41%) before it touches the previous all-time high levels. That is really only one of two good upside days. Once it breaks the 2947 level, then the 3000 psychological level becomes a very real target.

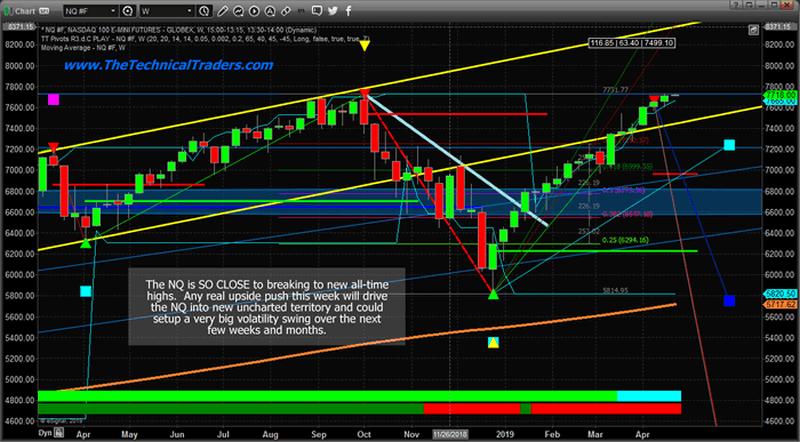

This NQ Weekly chart shows that the NQ is really just inches away from breaking to new all-time highs. The NQ only needs to rally 24.50 points (+0.31%) before the 7731 level is breached. We believe this move will happen very early this week and we could see the NQ push all the way above the 8000 level in short order. Our Fibonacci price modeling system is suggesting 9130 and 9625 levels may become the ultimate highs – but it is still very early to tell at this stage of our research.

Back in July and August 2018, we started warning that the end of 2018 and all of 2019 were going to be very good years for skilled traders. We’ve seen a nearly 3800+ point price swing in the NQ and a +1200 point price swing in the ES. Let’s face it, folks, these are very big moves and if you had been capable of trading these moves efficiently, this is the type of price rotation that makes millionaires out of average traders.

Get ready, because the rest of 2019 and almost all of 2020 are going to be just as exciting to trade so be sure to get our trade signals.

We’ll see you on the other side of “new all-time highs” for the US Stock market here soon.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.