Stock Market Investing Dow Theory Overview.

Stock-Markets / Dow Theory May 03, 2019 - 07:37 AM GMTApplying Dow Theory To Investment Practice.

I first came across Dow Theory in 1989 when I lived in Belmont, San Mateo County, California. I thought its creators Charles Dow and William Hamilton had unique insight into stock market behaviour. Accordingly, for over ten years I developed a course incorporating their fascinating insights and have been solidly teaching their market philosophy for over 12 years; writing my first published on the topic in 2007.

One of the most difficult tasks I have encountered teaching this subject is how to prevent students

becoming too engrossed in trying to “time” short term Dow Theory buy and sell signals rather than focus instead on the long term market fundamentals Dow and Hamilton had discovered. They articulated that the main “trend was your friend” and once this trend was identified, ideally following a recession, the investment task was to stick with this trend until it was exhausted. They were not supporters of short term trading. This is more difficult to apply than it sounds but practice makes the challenge easier with each passing year. So, like a baseball coach, my main job is motivating students to believe in themselves and apply the knowledge received and stay the course. Dow and Hamilton advised their readers that if one managed to “catch” just four or five main stock market investment trends in one’s investment career one could retire comfortably investing a reasonable initial grub-stake. Case in point: if you caught our current bull trend, which commenced in March 2009, had you invested in the Dow Industrials you would now be experiencing a gain (all figures approx.) of 280%; the S & P 500 has provided a rise of 315% and the NASDAQ has exploded to the tune of 575%. Once you get this picture you quickly realise that Dow Theory type investing is the only way to go and can make you seriously wealthy or at least financially comfortable at the end of an investment life-cycle of 20 - 30 years. Applying standard margin (normally allowing you double investment capital) and using leveraged ETFs such as TQQQ (3 times NASDAQ Index), OPRO (3 times S & P 500 Index) and UDOW (3 times Dow Industrial Index) your potential future gain could be hyper-charged, if you know what you need to do and when you need to do it. The current bull market is “long in the tooth”, and a significant correction or recession is due within the next 2 – 3 years, based on historical precedent. For those who are prepared and in a position to apply Dow Theory strategies such a recession, while catastrophic for most, will be a boon to a the initiated few.

Given the above, I am constantly asked why more investors do not follow the Dow Theory investment strategy. The answer: PATIENCE. Most folk just don’t have it. They equate investment performance with trading action and nothing could be further from the truth, in my experience. One of the greatest exponents of this fact is the famous guide and mentor Warren Buffett. He is often quoted expounding the truths of Dow Theory, though he may not give just reference. In one of his recent missives he stated: “in times of over-valuation I drink (invest) with a fork. In times of value I drink with a bathtub”.

Current Market Dow Theory Technicals.

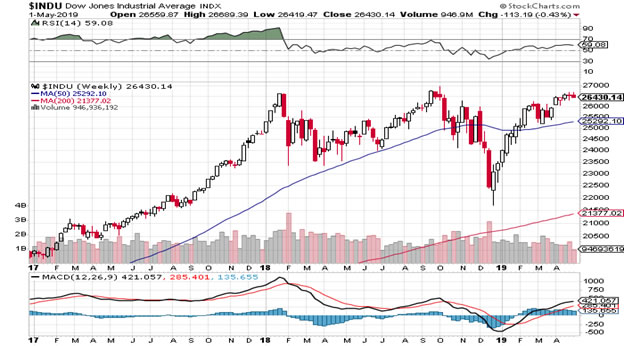

Divergence is developing between the Dow Industrials and the Dow Transports. In addition while the S & P 500 and The NASDAQ have reached previous highs the main Dow Indices have not. Thus there is above average investment risk about. It is also important to keep in mind that while there has been significant rallies following the 2018 winter pull back, since last October the S & P 500 is down .57% (approx half of one per cent), the NASDAQ is up only 1.06% and the Dow 30 has suffered a loss of 1.93%.

From a purely Dow Theory technical analysis point of view The Dow Industrial averages must break the 26,828 price point and the Dow Transports the price level of 11,570 for the March 2009 bull to be back in place. However, on the bearish stance, if the Dow Transports breaks the 9,896 level and the Dow Industrial the 25,450 price point there is a strong possibility that the December lows are going to be retested. I would like to see this retest occur as it would give a much more stable technical picture to overall market technical structure.

Chart: Dow Industrials: Daily.

Chart: Dow Industrials: Weekly.

Chart: Dow Transports: Daily.

Chart: Transports: Weekly.

Chart: S & P 500: Daily.

Chart: S & P 500: Weekly.

Chart: QQQ: Daily.

Chart: QQQ: Weekly.

Charts: Courtesy StockCharts.Com.

Christopher Quiqley

B.Sc., M.M.I.I. Grad., M.A.

http://www.wealthbuilder.ie

Mr. Quigley was born in 1958 in Dublin, Ireland. He holds a Bachelor Degree in Accounting and Management from Trinity College Dublin and is a graduate of the Marketing Institute of Ireland. He commenced investing in the stock market in 1989 in Belmont, California where he lived for 6 years. He has developed the Wealthbuilder investment and trading course over the last two decades as a result of research, study and experience. This system marries fundamental analysis with technical analysis and focuses on momentum, value and pension strategies.

Since 2007 Mr. Quigley has written over 80 articles which have been published on popular web sites based in California, New York, London and Dublin.

Mr. Quigley is now lives in Dublin, Ireland and Tampa Bay, Florida.

© 2019 Copyright Christopher M. Quigley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Christopher M. Quigley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.