The May FOMC Meeting Is Over. They Say Every Cloud Has a Silver Lining...

Interest-Rates / US Interest Rates May 03, 2019 - 05:03 PM GMTBy: Arkadiusz_Sieron

The May FOMC statement didn’t bring much of a surprise. Fed Chair Powell remained upbeat in his assessment of the U.S. economy while dismissing low inflation as transitory. Gold has initially jumped, only to keep declining later. What has actually happened yesterday, then?

The May FOMC statement didn’t bring much of a surprise. Fed Chair Powell remained upbeat in his assessment of the U.S. economy while dismissing low inflation as transitory. Gold has initially jumped, only to keep declining later. What has actually happened yesterday, then?

FOMC Statement Acknowledges Lower Inflation

Yesterday, the FOMC published the monetary policy statement from its latest meeting that took place on April 30-May 1. In line with expectations, the US central bank unanimously kept its policy rate unchanged. As previously, the inaction reflected the new patient approach adopted by the Fed in January. So, the federal funds rate remained at the target range of 2.25 to 2.50 percent:

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.

Did we get anything new? First of all, not all interest rates were unchanged. The Fed set the interest rate paid on required and excess reserve balances at 2.35 percent, or 15 basis points below the top of the target range for the federal funds rate. Officially, the third cut by 5 basis points was intended to foster trading in the federal funds market at rates well within the target range. However, some analysts argue that the move was a direct response to the relatively increasing scarcity of reserves amid the quantitative tightening.

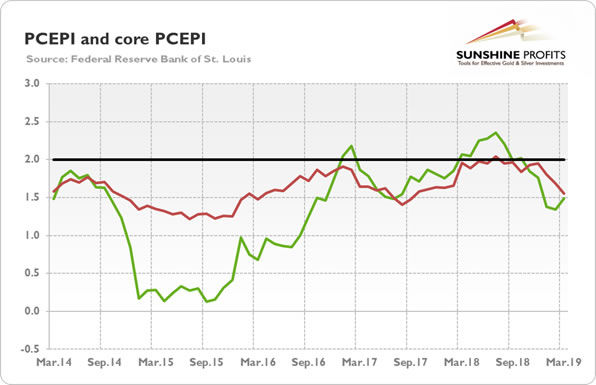

Second, the US central bank acknowledged the recent drop in both overall and core inflation below 2 percent. Indeed, the chart below shows that both the PCEPI and its core version are now around 1.5 percent.

Chart 1: Personal Consumption Expenditures Price Index (green line, in %) and Personal Consumption Expenditures Excluding Food and Energy (red line, in %)

In March, the statement still saw the core inflation near the target. But this time, the FOMC changed its tone:

On a 12-month basis, overall inflation and inflation for items other than food and energy have declined and are running below 2 percent.

The modification can be seen as just reflection of the current data, but it is a dovish change, which suggests that the Fed’s patience may last a while longer. Weaker inflation is not good for gold, which is considered to be an inflation hedge, but a passive US central bank should support it. On the other hand, the Fed characterized economic growth and job gains as solid, an upward revision compared to March meeting.

Apart from these changes, the policy statement was virtually kept the same as it was in March. The Fed is still reluctant to signal the next move, or the direction, despite that the financial markets projecting an interest rate cut. So, the statement should not significantly affect the gold market.

Mr. Powell Spoils the Party

Let’s now move to Mr. Powell’s press conference. His introductory remarks were less dovish than the statement itself. First, Mr. Powell admitted that risks to the outlook have eased (as we have expected them to):

At the start of the year, a number of cross currents presented risks to the outlook, including weak global growth, particularly in China and Europe; the possibility of a disruptive Brexit; and uncertainty around unresolved trade negotiations. While concerns remain in all of these areas, it appears that risks have moderated somewhat. Global financial conditions have eased, supported in many places around the world by an accommodative shift in monetary policy, and in some cases fiscal policy. Recent data from China and Europe show some improvement, and the prospect of a disorderly Brexit has been pushed off for now. Further, there are reports of progress in the trade talks between the United States and China.

This is another hint that the current inaction is not a change in the stance, but a pause in the unfinished tightening cycle. The implications of diminished risks would not help safe haven assets such as gold.

Second, Mr. Powell said that muted inflationary pressure might be temporary, which make the interest rate cut even less probable:

We suspect that some transitory factors may be at work. Thus, our baseline view remains that, with a strong job market and continued growth, inflation will return to 2 percent over time and then be roughly symmetric around our longer-term objective.

Indeed, Mr. Powell admitted that the FOMC doesn’t see a strong case for a rate move in either direction.

Implication for Gold

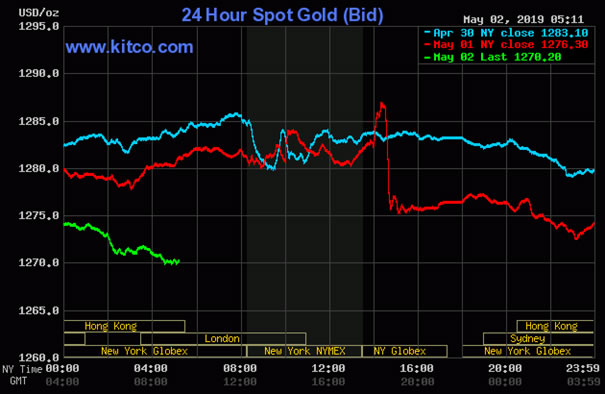

The statement was little changed. However, the wording seems dovish. This is why gold pumped initially. But Powell sounded more hawkish during the press conference – and more hawkish than expected. So the price of the yellow metal dropped eventually, as the chart below shows.

Chart 2: Gold prices from April 30 to May 2, 2019.

This is because Mr. Powell sounded optimistic on the economy and dismissed concerns about low inflation, saying that this is a transitory development. And he dashed hopes of a near-term rate cut, saying that the US central bank does not see a strong case for a rate move either way. So, investors adjusted their expectations: the market odds of the interest rate cut by December 2019 declined from above 60 to around 50 percent.

This is exactly what we expected – and we warned investors that the markets seem to be too pessimistic. In the Gold News Monitor published on April 11, we wrote that “there is little in the minutes that warrants a rate cut by December. If the market expectations adjust, gold may struggle.” We reiterated our view on April 23:

The FOMC may pause for a few months, but given the strong labor market and frothy valuations of certain assets, it shouldn’t cut interest rates. Such a move would unsettle markets, which closely follow how the Fed sees the economy, while leaving the US central bank with less ammunition when the next economic crisis hits the economy. Therefore, when we get more positive economic reports, the market participants could change their views. This is bad news for the gold bulls, as the revised expectations of the future path of the federal funds rate would make gold struggle.

And this is what is happening. Gold struggled yesterday. Looking at the fundamentals only, a downward move shouldn’t surprise us given the current level of market expectations. Especially, if the upcoming data paints an upbeat picture of the economy. You have been warned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the link between the U.S. economy and the gold market, we invite you to read the August Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.