Is the Stock Market Making a Long Term Top?

Stock-Markets / Stock Markets 2019 May 27, 2019 - 02:22 PM GMTBy: Troy_Bombardia

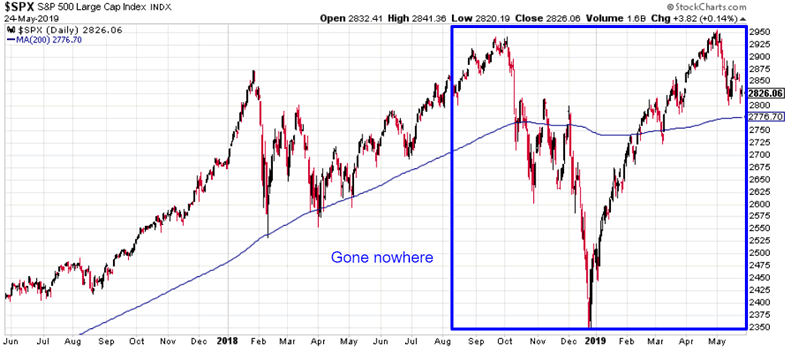

The stock market has been choppy over the past 3 weeks, with trade-related sectors and markets much worse-off than the overall U.S. stock market. From a longer term perspective, the U.S. stock market has gone nowhere since 2018. This begs the question “is the market making a long term top??

The economy’s fundamentals determine the stock market’s medium-long term outlook. Technicals determine the stock market’s short-medium term outlook. Here’s why:

- The stock market’s long term risk:reward is no longer bullish.

- The medium term direction (e.g. next 6-12 months) leans bullish.

- The stock market’s short term is neutral, with trade war news being the biggest short term risk.

We focus on the long term and the medium term.

Long Term

The stock market and the economy move in the same direction in the long run, which is why we pay attention to macro.

U.S. leading economic indicators are decent right now, which suggests that a recession is not imminent.

However, the U.S. economy is also in the vicinity of “as good as it gets”. This means that while the stock market can keep going up for another year, the long term risk on the downside is much greater than the long term reward on the upside.

Let’s recap some of the leading macro indicators we covered:

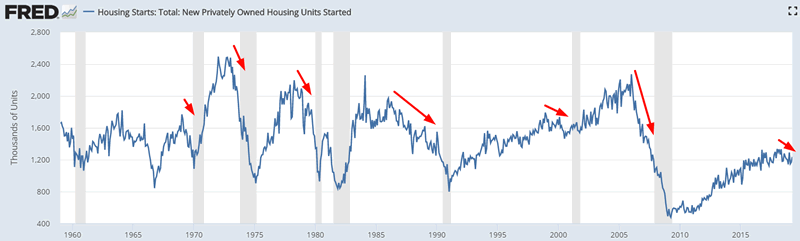

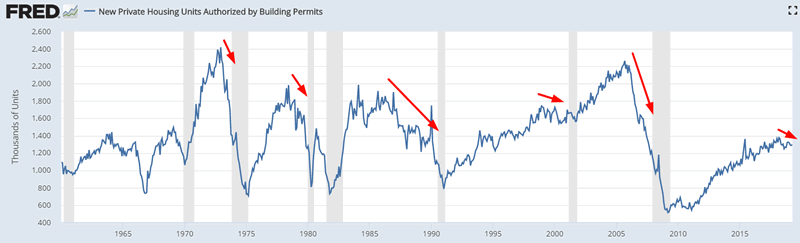

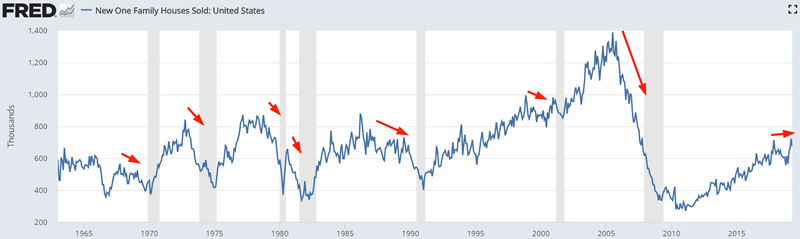

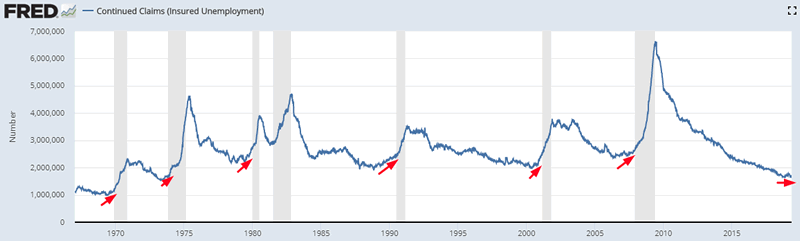

Housing is a slight negative factor, but could improve

Housing – a key leading sector for the economy – remains weak. Housing Starts and Building Permits are trending downwards while New Home Sales is trending sideways. In the past, these 3 indicators trended downwards before recessions and bear markets began.

The deterioration right now in housing is not as severe as it was before historical recessions. Hence why this is a slight negative factor for macro.

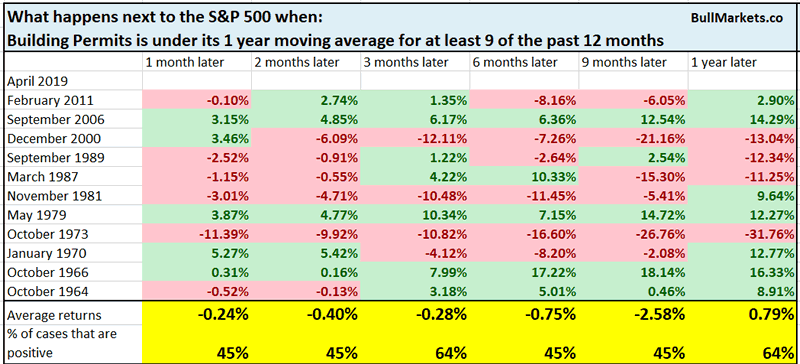

Here’s what happens next to the S&P when Building Permits is under its 1 year moving average for at least 9 of the past 12 months.

Labor market is still a positive factor

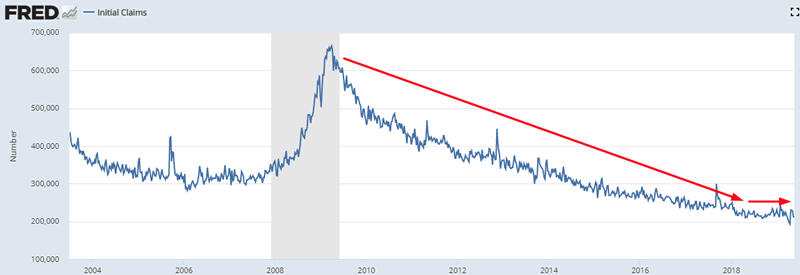

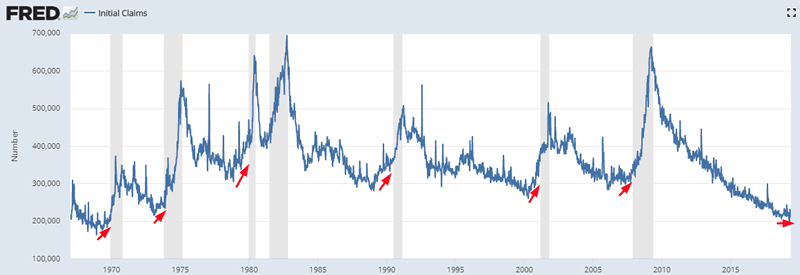

The labor market is still a positive factor for macro. Initial Claims and Continued Claims are trending sideways. In the past, these 2 leading indicators trended higher before bear markets and recessions began.

Here’s Initial Claims.

And here’s Continued Claims

Corporate profits

Inflation-adjusted corporate profits are still trending higher. Corporate profits leads the stock market by approximately 5-6 quarters. This remains bullish for stocks in 2019.

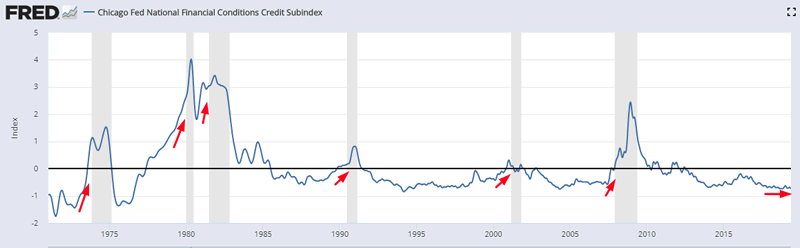

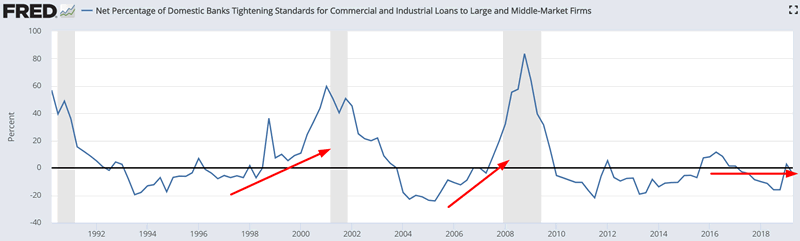

Financial conditions

Financial conditions remain very loose and banks have not significantly tightened their lending standards. In the past, financial conditions tightened along with banks’ lending standards (i.e. trended higher) before recessions and bear markets began.

Here’s the Chicago Fed’s Financial Conditions Credit Subindex

Here’s banks’ lending standards.

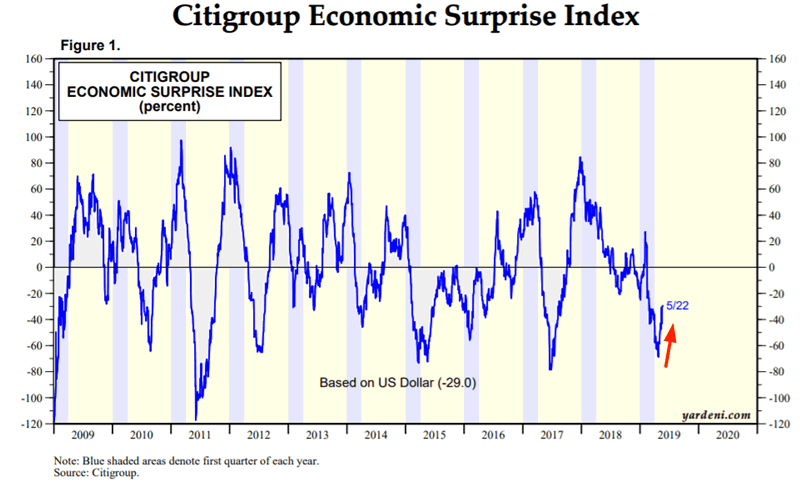

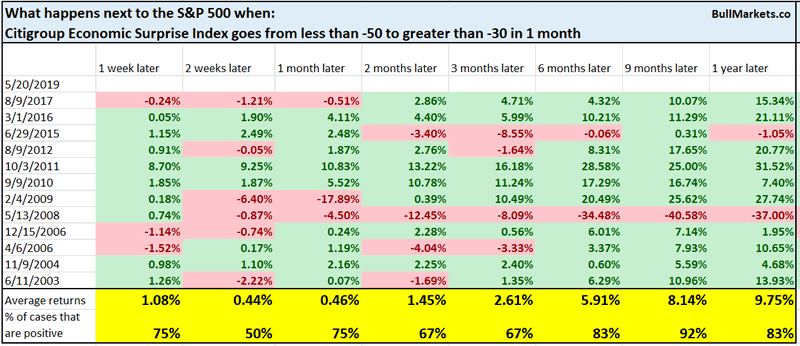

Citigroup Economic Surprise Index

The Citigroup Economic Surprise Index was improving this week. On Wednesday, it climbed to -29.

This is mostly bullish for the S&P 9 months later.

Medium Term

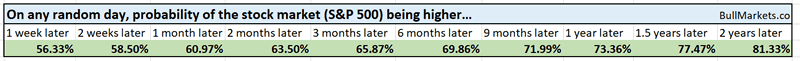

*For reference, here’s the random probability of the U.S. stock market going up on any given day, week, or month.

The stock market’s medium term (next 6-12 months) leans bullish.

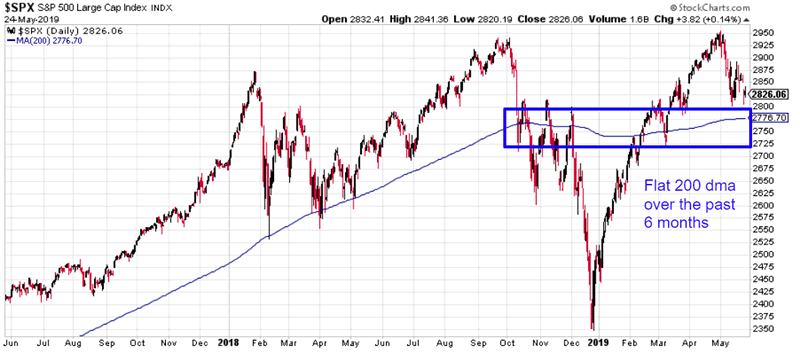

The flat 200 day moving average

The 200 day moving average is used by many technical traders to define the market’s long term trend.

As Patrick Duniwala from The Chart Report mentioned, a lot of technicians are looking at the flat 200 day moving average right now as a sign that there’s no clear trend.

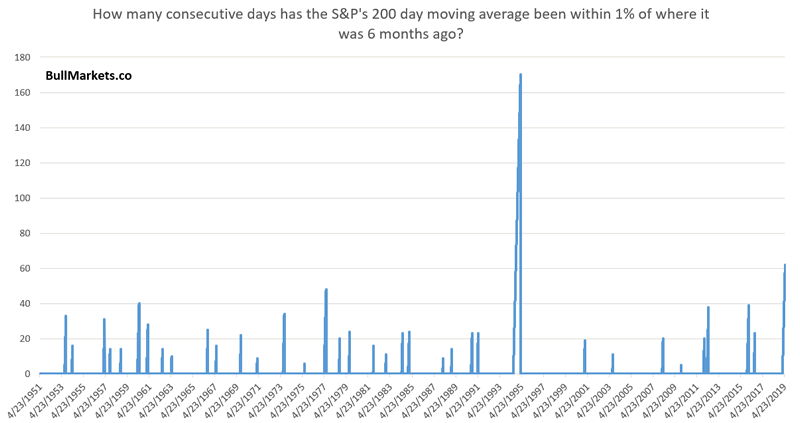

This is the 2nd longest streak of consecutive days in which the S&P’s 200 day moving average has been within 1% of where it was 6 months ago (i.e. flat 200 dma).

Is this a bullish or bearish sign for the stock market?

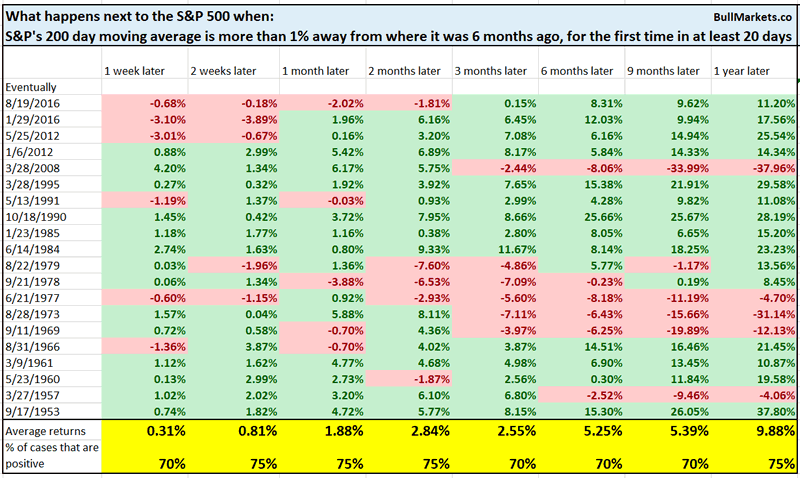

While such streaks aren’t consistently long term bullish or bearish, they are mostly bullish in the short term when the streaks end. Also look at the 1 year forward returns. Although it’s not consistently bullish or bearish, the 1 year forward returns are either terrific or terrible – there is no inbetween. This means that when the market breaks out (either up or down) of its current range, the next move is going to be huge.

Breadth

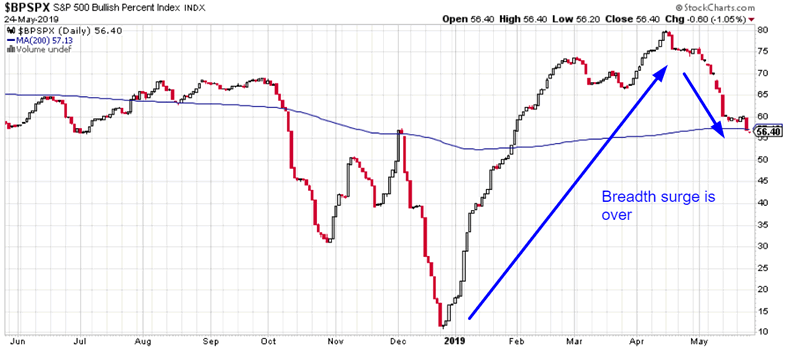

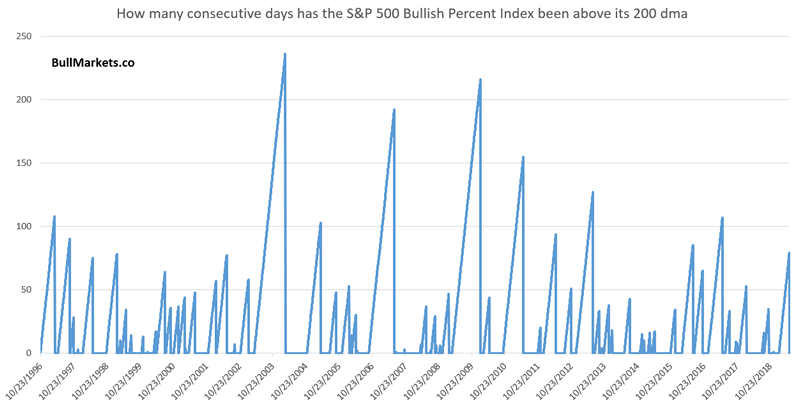

Breadth indicators are weakening as the stock market weakens. Here’s the S&P 500 Bullish Percent Index (breadth indicator), which has closed below its 200 dma for the first time in more than 3 months.

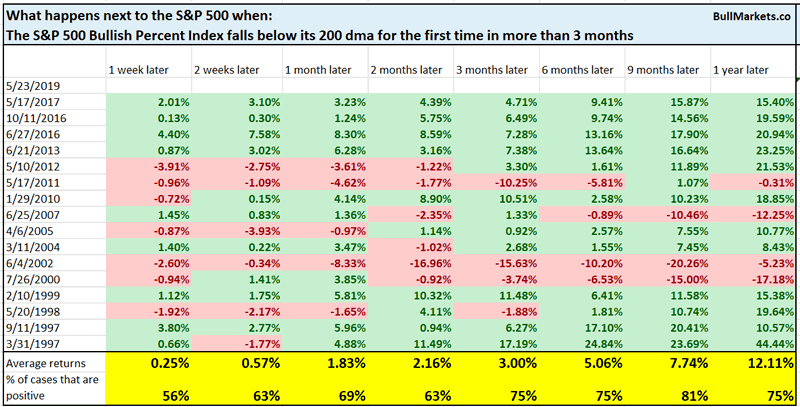

Here’s what happens next to the S&P when the S&P 500 Bullish Percent Index falls below its 200 dma for the first time in more than 3 months.

VIX

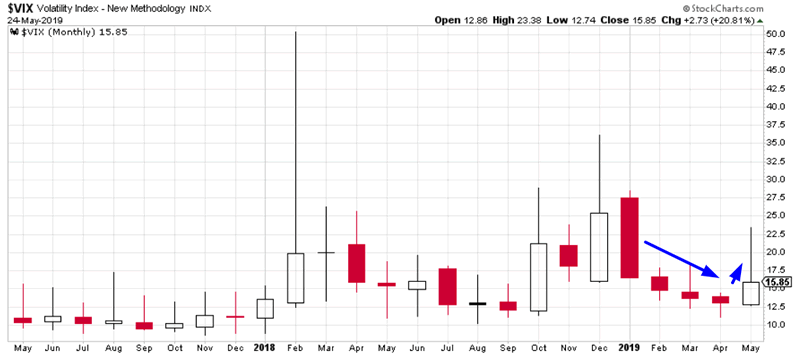

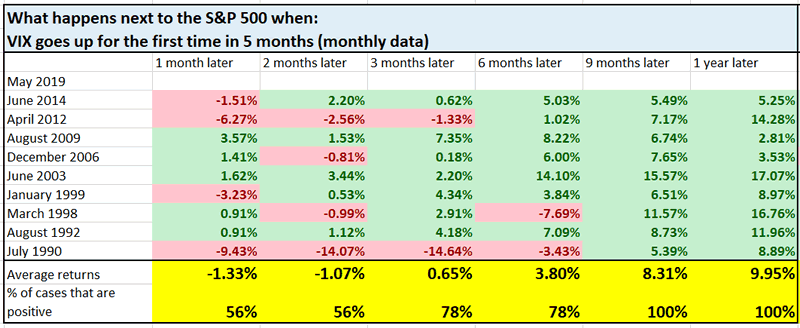

While May is not yet over, VIX will probably close higher in May than it did in April (unless stocks SOAR next week and VIX crashes).

Historically, the first VIX increase in 5 months is mostly bullish for the S&P over the next 9-12 months.

Baa corporate bond yields

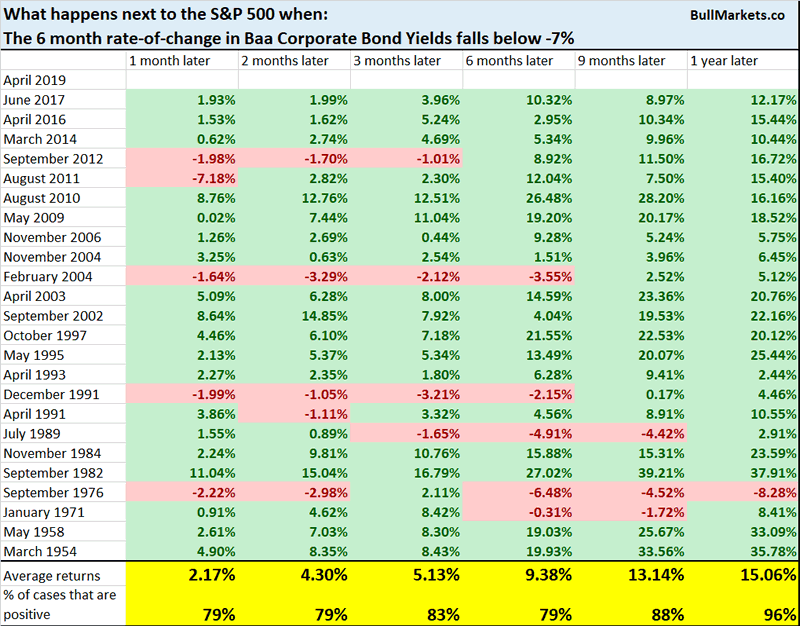

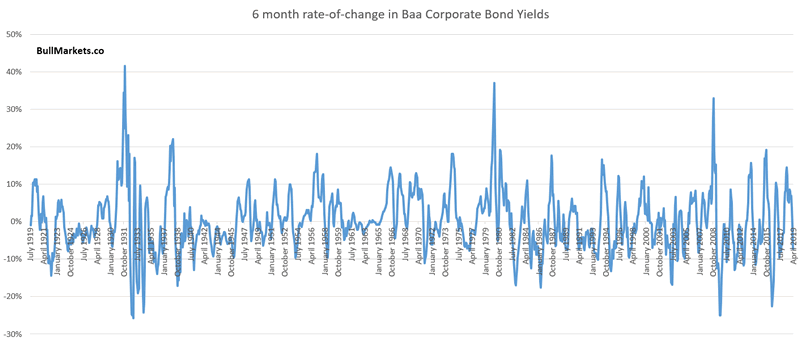

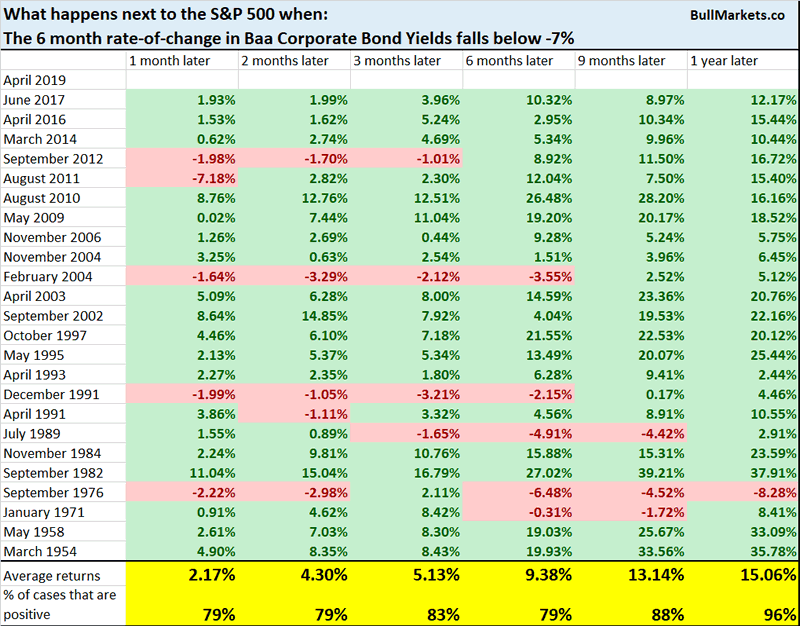

Baa Corporate Bond Yields are falling. This is usually seen as a good thing for stocks.

Here’s the 6 month rate-of-change in Baa Corporate Bond Yields.

Here’s what happens next to the S&P when the 6 month rate-of-change falls below -7%.

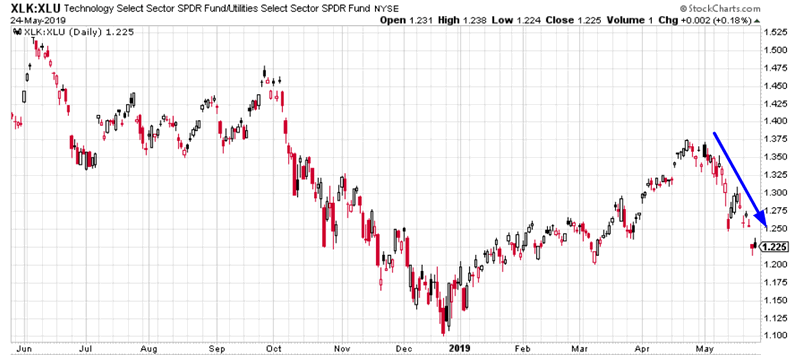

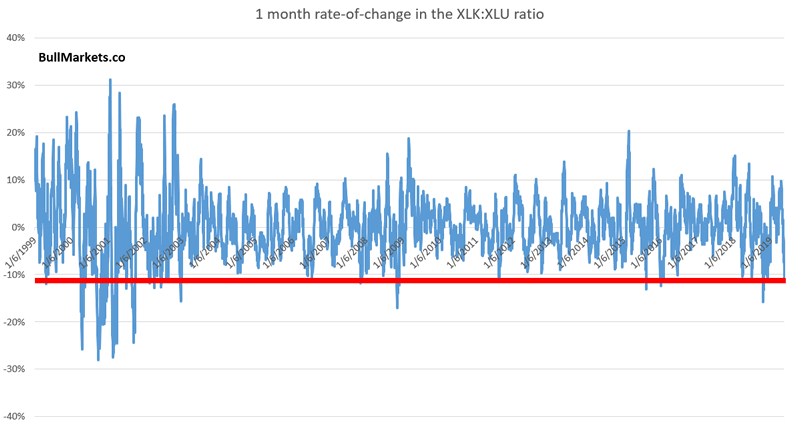

XLK:XLU ratio

The XLK:XLU (tech vs. utilities) ratio has dropped significantly over the past month. Its 1 month rate-of-change recently fell below -10%.

This ratio tends to go up during uptrends and down during downtrends.

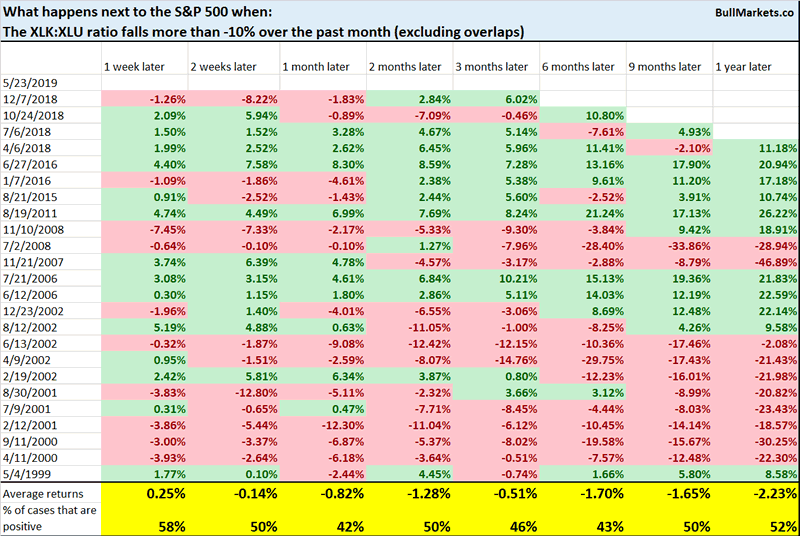

Here’s what happens next to the S&P when this ratio’s 1 month rate-of-change falls below -10%.

Slightly more bearish than bullish over the next 1-6 months, but that’s because of how often the 2000-2002 bear market shows up in this market study.

Short Term

The short term is mixed right now. Certain factors are bullish and other factors are bearish. Added with trade war uncertainty, neither bulls nor bears have a clear edge right now. In particular, it seems that the next few weeks are slightly bearish, whereas the next 3 months are slightly bullish.

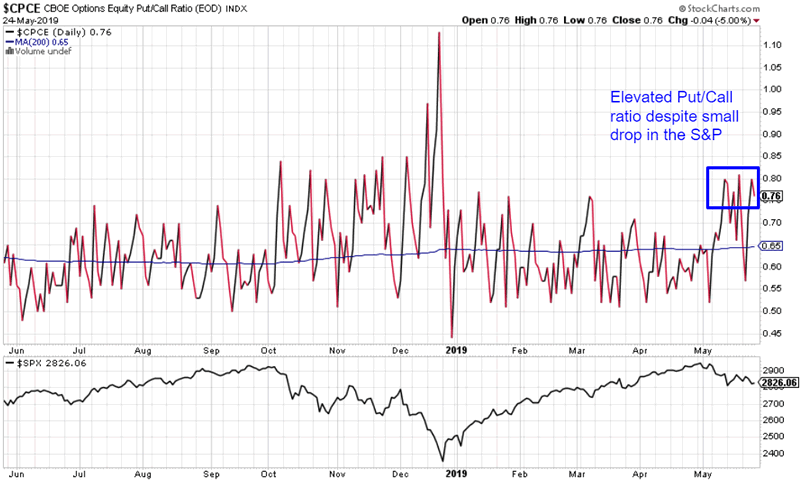

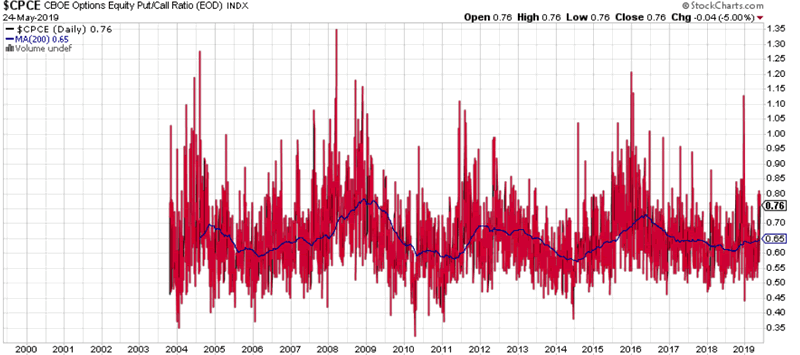

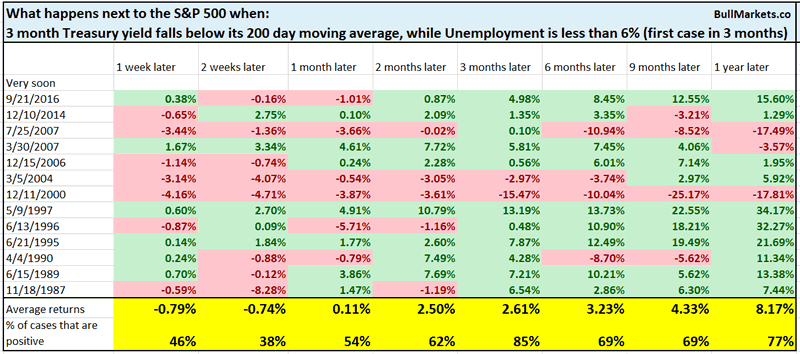

Equity Put/Call ratio

The Equity Put/Call ratio has remained quite elevated over the past 3 weeks, which is uncommon considering that the S&P is still within -5% of an all-time high.

We can’t look at the Equity Put/Call ratio’s absolute value because its range changes over time. Hence we need to look at the Equity Put/Call ratio in relation to its 200 dma.

Here’s what happens next to the Equity Put/Call ratio when it has spent at least 7 of the past 15 days more than 10% above its 200 dma (elevated Put/Call), while the S&P is still within -5% of a 1 year high.

Mostly bullish 3 months later.

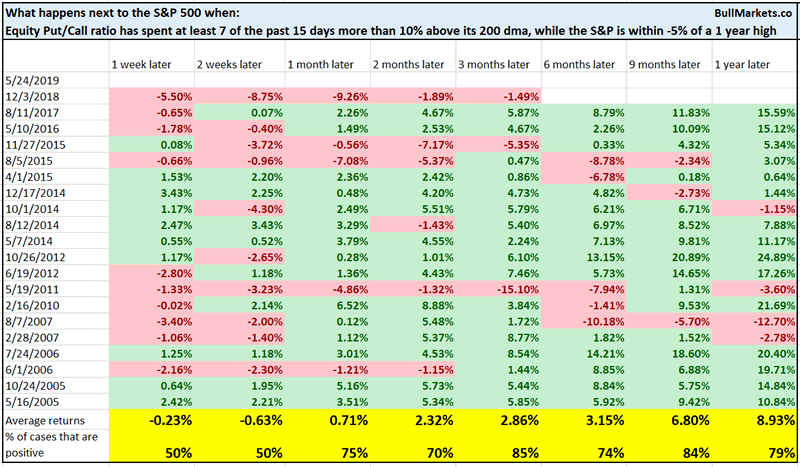

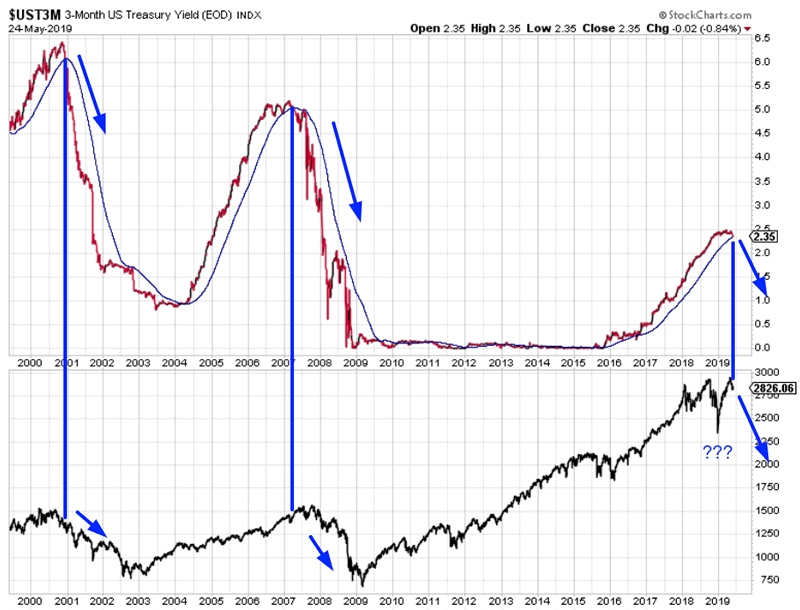

3 month Treasury yield

The 3 month Treasury yield will close below its 200 day moving average sometime in the next few days. While it’s tempting to assume “this is 2000 and 2007 all over again”, we must look at all the historical cases in which the 3 month yield fell below its 200 dma, while the economic expansion was late-cycle.

This is slightly short term bearish for the S&P, and mostly bullish 3 months later.

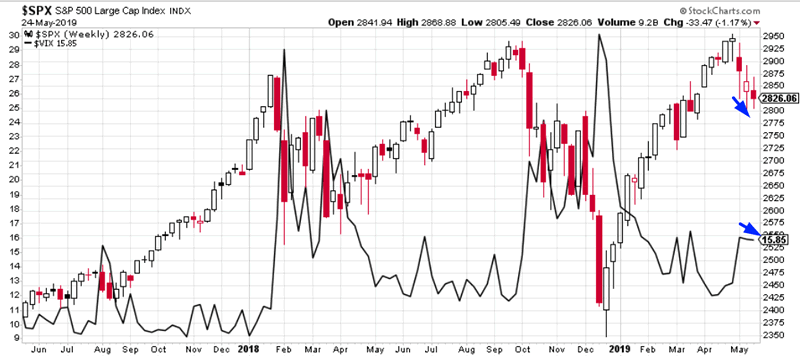

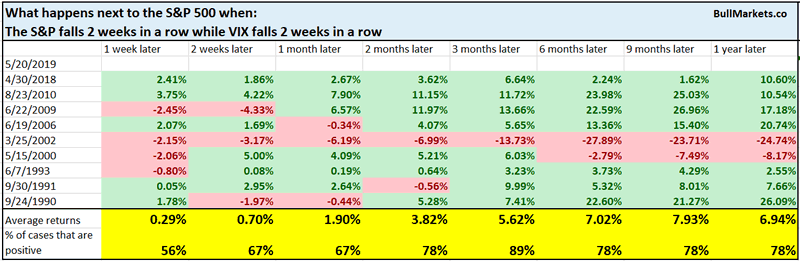

VIX

VIX and the S&P have fallen together over the past 2 weeks. This is quite rare because VIX and the S&P tend to move in different directions.

This is mostly bullish for the S&P 3 months later.

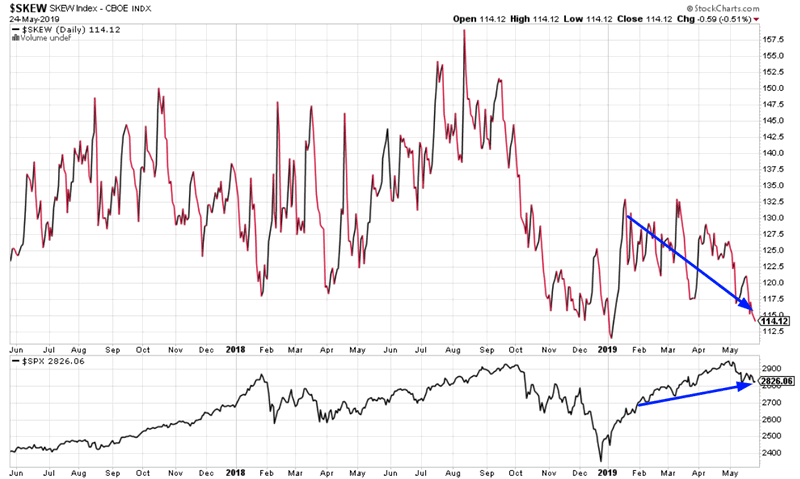

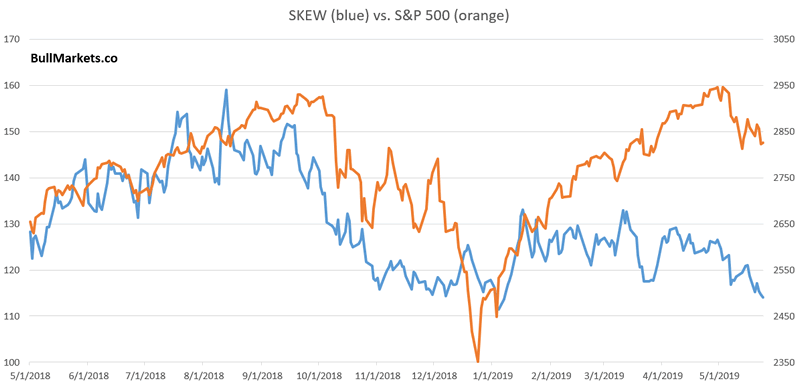

SKEW

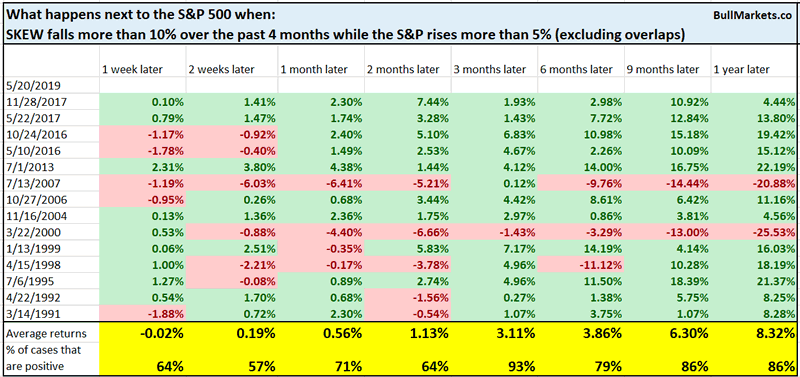

The SKEW Index measures financial risk. It tends to move inline with the S&P. SKEW and the S&P have diverged significantly over the past 4 months.

Contrary to what you might imagine, this divergence is mostly bullish for the S&P 3 months later. Here’s what happens next to the S&P when SKEW falls more than -10% over the past 4 months while the S&P rises more than 5%.

Sentiment

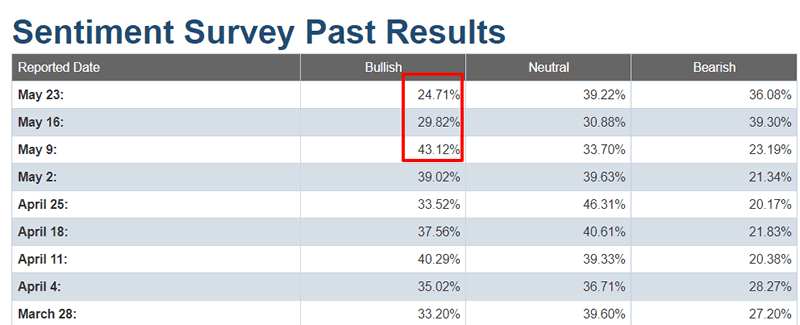

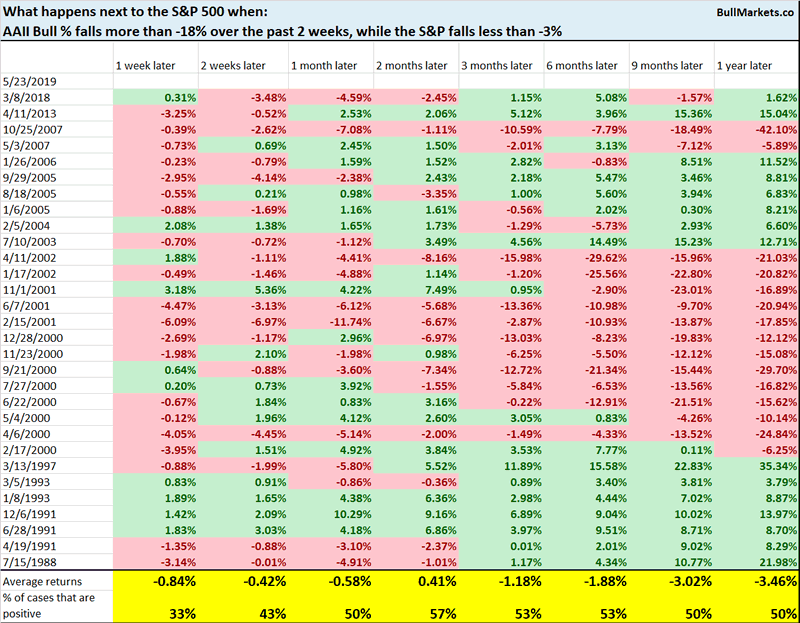

AAII Bullish sentiment has fallen a lot over the past 2 weeks, even though the S&P is only down -2%. This is a rather large drop in sentiment despite a small drop in prices.

Historically, such a rapid drop in bullish sentiment is mostly bearish over the next week.

We don’t use our discretionary outlook for trading. We use our quantitative trading models because they are end-to-end systems that tell you how to trade ALL THE TIME, even when our discretionary outlook is mixed. Members can see our model’s latest trades here updated in real-time.

Conclusion

Here is our discretionary market outlook:

- The U.S. stock market’s long term risk:reward is not bullish. In a most optimistic scenario, the bull market probably has 1 year left.

- Most of the medium term market studies (e.g. next 6-12 months) are bullish.

- The short term (e.g. next 1-3 months) is very noisy right now. There is no clear risk:reward edge in either direction. Some short term market studies are bullish, and others are bearish. We focus on the medium-long term.

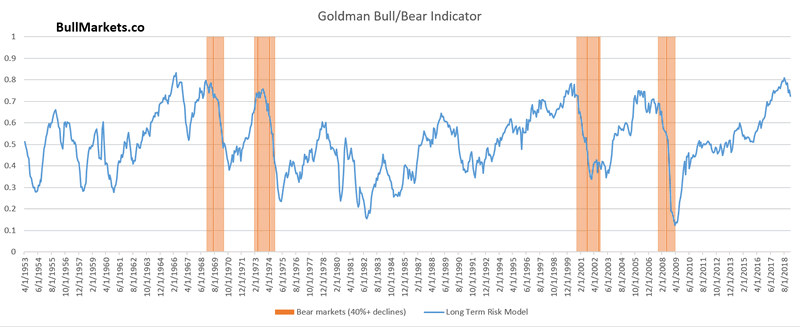

Goldman Sachs’ Bull/Bear Indicator demonstrates that risk:reward does favor long term bears.

Click here for more market analysis

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2019 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Troy Bombardia Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.