Gold Scores Gains as Draghi and Powel Grow Concerned

Commodities / Gold & Silver 2019 Jun 21, 2019 - 05:28 PM GMTBy: Arkadiusz_Sieron

Super Mario delivered a surprisingly dovish speech. But he was shortly outshined by Super Jerome. Both key central banks have sent new signals to the markets for interpretation. Let’s read the tea leaves and make sense of the initial reaction in the gold market.

Super Mario delivered a surprisingly dovish speech. But he was shortly outshined by Super Jerome. Both key central banks have sent new signals to the markets for interpretation. Let’s read the tea leaves and make sense of the initial reaction in the gold market.

Draghi Repeats ‘Whatever it Takes’ In a Mini Version

As we covered one week ago in the Gold News Monitor, the ECB became more dovish on the June monetary policy meeting. The central bank postponed the possible beginning of the interest rate hiking from the end of 2019 to the mid-2020.

Our assessment was that “the European central bankers are getting more worried about the state of the Eurozone economy and may adopt an even more dovish stance in the near future.” It turned out we were right. We did not have to wait too long for a more forceful signal from the ECB. On Tuesday, Mario Draghi delivered a mini ‘whatever it takes’ speech at the annual conference in Sintra, Portugal. He said:

In the absence of improvement, such that the sustained return of inflation to our aim is threatened, additional stimulus will be required (…) We will use all the flexibility within our mandate to fulfill our mandate — and we will do so again to answer any challenges to price stability in the future (…) We are committed, and are not resigned to having a low rate of inflation forever or even for now. That aim is symmetric, which means that, if we are to deliver that value of inflation in the medium term, inflation has to be above that level at some time in the future.”

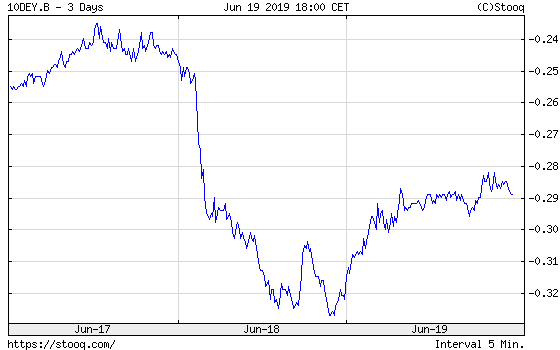

Draghi did not say actually anything new. But his tone and urgency did the job – the markets heard the message this time and reacted accordingly. The collapsing inflation expectations rebounded. The bond yields plunged. For instance, the German 10-year Bund fell from around -0.25 to below -0.32, as the chart below shows.

Chart 1: German 10-year government bonds from June 17 to June 19, 2019.

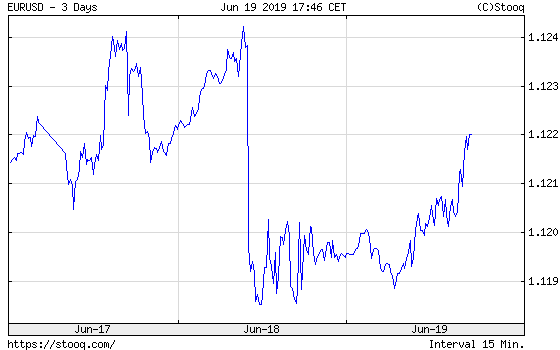

Global stock markets soared, while the euro dropped against the US dollar, as one can see in the chart below.

Chart 2: EUR/USD exchange rate from June 17 to June 19, 2019

The price of gold followed suit and initially declined on Tuesday, only to stabilize later in the day.

Chart 3: Gold prices from June 17 to June 19, 2019

Even President Trump reacted to Draghi’s speech. He apparently did not like Draghi’s dovish comments. Trump tweeted:

Mario Draghi just announced more stimulus could come, which immediately dropped the Euro against the Dollar, making it unfairly easier for them to compete against the USA. They have been getting away with this for years, along with China and others

Fed Stops Being Patient. Instead, It Will Asses Economic Conditions

Just like Tuesday was Draghi’s day, Powell dominated the Wednesday’s headlines. Yesterday, the FOMC published the monetary policy statement from its latest meeting that took place on June 18-19. As we expected on Tuesday edition of the Gold News Monitor, the U.S. central bank kept its interest rates unchanged. The federal funds rate remained at the target range of 2.25 to 2.50 percent:

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent

However, the FOMC altered its statement in a few ways. First, it downgraded the assessment of the economic activity from rising at “solid” to “moderate” rate. The slower pace of the GDP growth should be generally positive for the gold prices, but it was already recognized by the markets.

Second, although the Committee “continues to view sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective as the most likely outcomes”, it added to the statement that “uncertainties about this outlook have increased”.

Third, the Fed dropped its remarks about being patient. Instead,

in determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective.

Although it does not say anything about the future moves of the Fed, the removal of the word “patient” was interpreted by the markets as preparing the ground for a possible rate cut in the near future, given their perceived uncertainty regarding the U.S. - China trade war spillovers into the economy. This subtle, cautious look at the economy’s growth path in general, has been interpreted dovishly by the markets as favorable for gold.

Dot Plot Shows No Cut This Year, But…

The FOMC statement was accompanied by the fresh economic projections. The forecasts for GDP and the unemployment rate were slightly changed compared to the March economic projections. The former was edged up for 2020 by 10 basis points, while latter were revised downward by 10 basis points across the entire forecast horizon. More importantly given the “muted inflation pressure”, the overall PCE inflation rates were revised down from 1.8 percent to 1.5 percent this year and from 2.0 percent to 1.9 percent in 2020. However, the forecasts for 2021 and longer run were unchanged, which indicates that the Fed still believes that it will reach its inflation target over the medium term.

But the most interesting shifts occurred in the dot plot. First of all, the median assessment of appropriate level of the federal funds rate was kept unchanged at 2.4 percent this year. That is contrary to market expectations but in line with our thinking that the Fed is not going to cut interest rates in 2019.

Second, the forecast for the federal funds rate in 2020 was cut from 2.6 to 2.1 percent. It means that instead of one hike, the US central bank is more likely to slash interest rates next year once.

Now, it gets really tricky. The FOMC members adjusted the expected federal funds rate in 2021 from 2.6 percent to 2.4 percent. It implies that a cut in 2019 should be followed by one hike one year later. Does it make any sense for you? For us, it does not.

Last but not least, the expected longer run rate was cut from 2.8 percent to 2.5 percent. It reflects the participants’ view that the current level of interest rates is close to the neutral level (although the unemployment rate is hovering near historic lows, raising questions regarding the natural unemployment rate level).

Implications for Gold

The recent few days were really hot for the markets. Super Mario delivered another dovish speech promising new interest rate cuts or fresh rounds of quantitative easing if needed. Draghi’s remarks have serious implications for the Fed. Now it’s not only the White House that wants Powell to cut interest rates. The stronger dollar will also create pressure on the FOMC to adopt an even more dovish stance. After all, in contrast to the ECB, the consequences of a hawkish disappointment from Powell would be even more significant.

And what does the FOMC fresh monetary policy statement and economic projection imply for the gold market? Well, one could say that if the market expectations of the federal funds rate path adjust to the unchanged level of the dot plot this year, gold may struggle. However, the market bets on an upcoming interest rate cut have increased, not decreased.

Hence, the gold market embraced that speculation enthusiastically, as one can see in the chart below. The price of gold rallied from $1,345 to $1,360 during yesterday’s U.S. session, extending gains during today’s Asian trading hours. It seems that the markets focused on the one expected interest rate cut next year and that the Fed will “closely monitor” the economy given muted inflation and increasing uncertainties to its outlook.

Chart 4: Gold prices on June 19, 2019.

Moreover, the U.S. central bank removed its reference to being “patient”, which can be interpreted as setting the stage for a potential rate cut in the future. Each meeting is now a live meeting with rather a rate cut than a rate hike being bet on. During his press conference, Powell also sent a few dovish signals. For example, he said the case "has strengthened" for more "accommodative" monetary policy. Hence, Super Mario was eclipsed by Super Jerome. Gold did welcome the tone, gapping higher on its daily chart. Will its gains hold?

Thank you.

If you enjoyed the above analysis and would you like to know more about the link between the U.S. economy and the gold market, we invite you to read the August Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.