Is the Global Debt Crisis About to be Reborn in 2020? - PART II

Stock-Markets / Global Debt Crisis 2020 Jul 08, 2019 - 03:35 PM GMTBy: Chris_Vermeulen

There are some key elements of political and economic Super-Cycles that all traders must stay aware of listed below. But if you have not yet read PART I do so now.

There are some key elements of political and economic Super-Cycles that all traders must stay aware of listed below. But if you have not yet read PART I do so now.

_ Very often, 12+ months before a major US political election cycle, the US stock market typically enters a Bearish trend phase that lasts until 8+ month before the actual election date.

_ The Transportation Index has not recovered to levels from the September 2018 peak. This lower price rotation in the Transportation Index suggests the global economy is not expecting growth in the near future.

_ Other than Precious Metals, the Commodities sector has rebounded off of recent lows but has yet to see any real price advancement – suggesting that demand for raw commodities is rather weak.

_ The Real Estate sector in the US is starting to falter near a current high price level. We are seeing price decreases hit the markets as sellers are desperate to attract buyers. This could be a warning that a price revaluation event is about to unfold in the US.

_ Super-Cycles suggest a moderately sized price rotation between now and early 2020 (likely greater than 20% in size). This rotation, should it happen, will become a price revaluation event that could attempt to “shake loose” some of the sector pricing and forward expectations we’ve mentioned (above).

Our bigger concern is the localized state and federal pension and retirement issues that continue to respond with higher levels of financial commitments and greater levels of annual budgets as related to ongoing capacity and operational activities in the US.

If an unwinding event was to unfold in or near 2020, it is our belief that a pricing revaluation event related to any of the core economic factors above (particularly with Real Estate, Economic Cycles, the US Presidential Elections, and a soft/weakening US economy) could result in a much larger price revaluation event taking place. This would create extended pressures on local State and Federal expenses and highlight debt issues that can often be hidden behind “creative accounting” tricks.

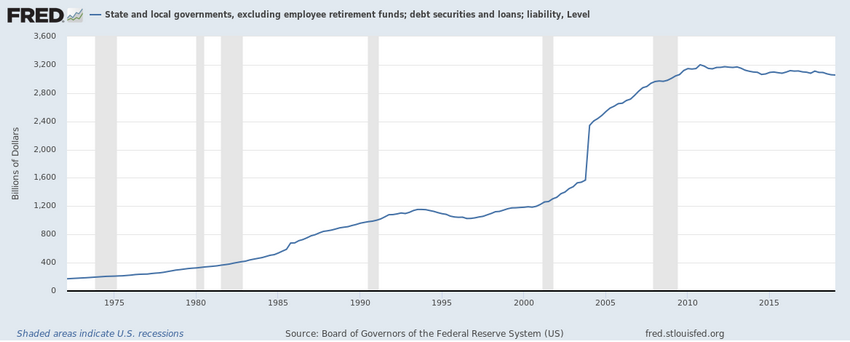

State and Local Government Debt Securities and Loan Liability levels have stayed elevated, yet somewhat flat over the past 10+ years. It is very likely that these debt levels have been contained because of the US easy money policies of the past 10+ years. When the US Dollar is cheap and easy to repay, these debt levels don’t look so difficult.

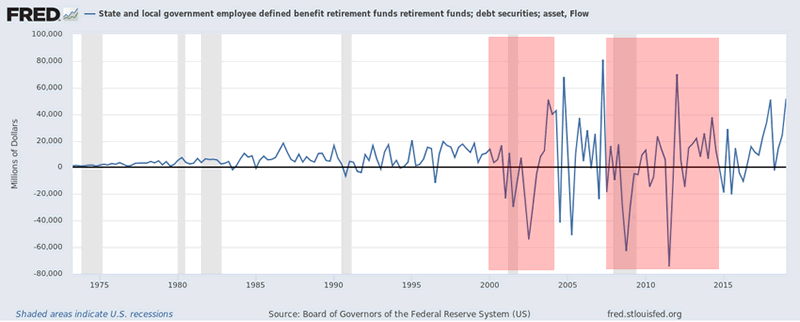

Pension and retirement systems/fund are a completely different story for State and Local government agencies. Asset flows have dramatically increased in volatility after 2000. Additionally, the depth and magnitude of asset outflows have become quite dangerous while price revaluation events were unfolding (2000 to 2004 and 2008 to 2015). Outflows in state and federal pension and retirement funds create large forward operational pressures and shortfalls in expected funding levels. These decreases in funding should be made whole by the State or City – but they are rarely ever repaid in full.

As these “wholes” in the pension and retirement systems continue to fester (resulting in decreased funds for pensioners and decrease fund to be deployed as investment assets), the problems begin to compound over time. More and more retirees and pensioners start drawing benefits while the system continues to take in less and less – never actually catching up in total value.

One big revaluation event, or possibly two, from now and we believe the entire system will create a multiple Trillion Dollar debt crisis within the US and possibly throughout the modern world. We believe the under-estimated state and federal pension/retirement funding issue is the next shoe to drop and that it will take a price revaluation event to expose the risks that are evident within this failed “Ponzi” scheme. Read the recent news about Chicago and Illinois to learn just how dangerous these entitlement contraptions really are.

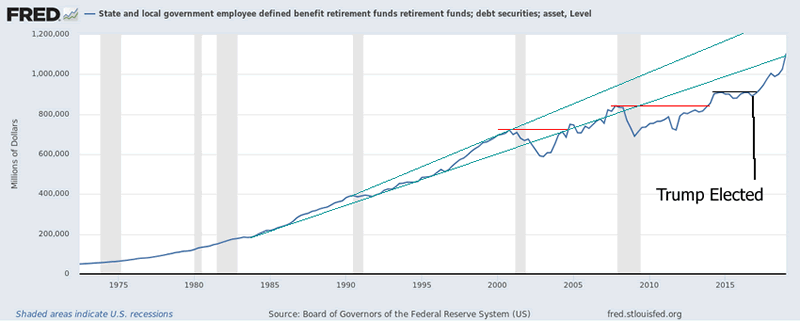

Let’s assume that a revaluation event does take place within the next 5 to 10+ years – this would be something like a Real Estate price correction or some type of stock market, asset market price correction related to local or global economic issues. Could these massive asset funds handle an extended DRAWDOWN from their funds while Cities, States, and Federal agencies attempt to deal with declining revenues? How much time would it take for these pension and retirement funds to fall into crisis or insolvency?

By our estimates, the current asset levels in the US retirement/pension system have just started to breach the lower asset level channel originating from 1970 to 1999 attribution levels. It has taken 20+ years of US Fed and global Central Bank market manipulation, as well as President Trump’s incredible US economic and stock market rally, to recover to these levels.

Overall, skilled technical traders must be aware of the risks that are ever-present for another crisis event or what we are calling a “price revaluation event” that could create havoc on anyone’s retirement accounts, trading portfolios and/or simple family life/future. We’re trying to help to highlight what we believe will be the future 16 to 24 months of pricing activity within the US Stock market based on our research tools and our experience/knowledge.

I urge you visit my Wealth Building Newsletter and if you like what I offer, join me with the 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis. Join Now and Get a Free 1oz Silver Round or Gold Bar!

I can tell you that huge moves are about to start unfolding not only in metals, or stocks but globally and some of these super cycles are going to last years. A gentleman by the name of Brad Matheny goes into great detail with his simple to understand charts and guide about this. His financial market research is one of a kind and a real eye-opener. PDF guide: 2020 Cycles – The Greatest Opportunity Of Your Lifetime

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.