This Tobacco Stock Is a Big Winner from E-Cigarette Bans

Companies / Investing 2019 Jul 11, 2019 - 03:53 PM GMTBy: Robert_Ross

In late June, San Francisco banned e-cigarette sales completely. That means no brick and mortar sales. And no e-cigarette deliveries for online purchases.

In late June, San Francisco banned e-cigarette sales completely. That means no brick and mortar sales. And no e-cigarette deliveries for online purchases.

Many cities already restrict vaping and e-cigarette sales. But San Francisco is the first major US city to ban sales outright.

Granted, it’s a cultural and political outlier. But other cities are already considering similar laws. So this looks like the start of a bigger trend that could weigh heavily on certain tobacco companies.

Despite this thread, tobacco companies are still a great, recession-proof investment. And there’s one tobacco stock that will benefit from the crackdown on e-cigs big time.

The 800-Pound Gorilla of E-Cigs

E-cigarettes hit the US a little over a decade ago. Now it’s a $25-billion market.

The e-cig explosion has been a big boon for certain tobacco companies.

That’s especially true for Altria Group (MO), which also makes Marlboro cigarettes. In 2018, Altria bought a 35% stake in Juul Labs, the world’s largest e-cigarette company.

Juul is the 800-pound gorilla of the e-cigarette world. It has a 70% market share. (Ironically, it’s based in downtown San Francisco.)

Juul expects sales to grow by 160% to $3.4 billion in 2019. But if other cities follow San Francisco’s lead, this figure—and Altria’s 35% cut—could shrink dramatically.

It would hurt other e-cig-dependent tobacco companies as well, like UK-based Imperial Brands (IMBBF). Imperial generates around 3% of sales from its e-cigarette line. That sounds small. But e-cigs made up 40% of the company’s sales growth over the last two years.

Then there’s British American Tobacco (BAT). The company created its own vapor brands, including Vuse and Vype. While British American’s core tobacco sales were flat in 2018, the vapor segment grew 19% over the last year.

More e-cig bans would certainly slow this rapid growth. But income investors should still take a close look at tobacco stocks…

A Catalyst for Traditional Cigarettes

Governments will likely continue to restrict vaping and e-cigarette sales. This shouldn’t be all that surprising.

E-cigarette use among minors has doubled since 2017, according to a recent survey from the National Institute on Drug Abuse. It was the largest year-over-year jump for any substance ever measured by the 44-year-old survey.

That sort of thing makes parents panic. And panicked parents can push local governments to “do something,” even if the overall public health benefit is questionable.

As Dr. Steven A. Schroeder, a professor of health at the University of California, San Francisco, put it, “It’s really smart politics but dubious public health.”

Nevertheless, more e-cig restrictions could stifle a major growth driver for tobacco companies. But that’s not the end of the world for Big Tobacco.

Most tobacco companies still make most of their money from traditional cigarettes. In fact, traditional cigarettes accounted for 95% of all tobacco sales in 2018.

And there’s a good reason for that: Cigarettes are highly addictive. That’s one of the reasons tobacco stocks are such a great any-weather investment.

You only have to look back to the global financial crisis to see this.

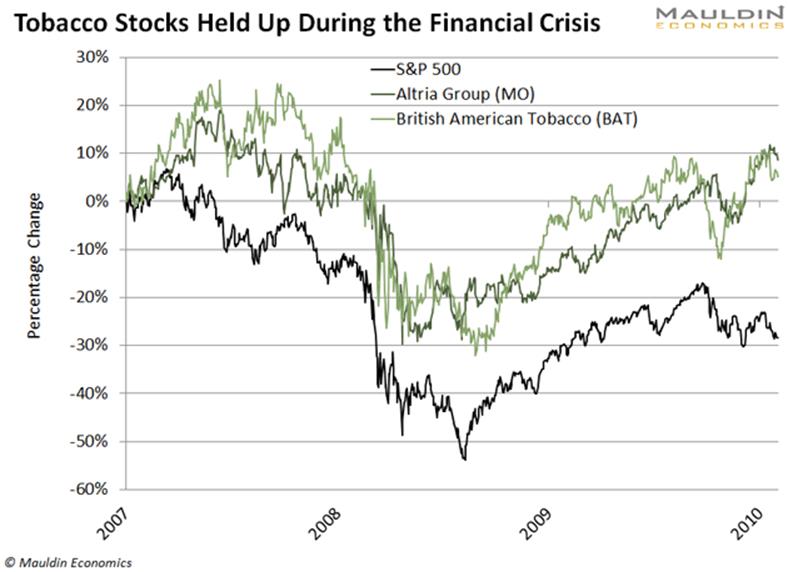

US stocks fell 27% between August 2007 and August 2010. But tobacco stocks held up remarkably well.

Altria and British American, which are a good proxy for tobacco stocks, grew 7.9% over the same period, as you can see in the chart below.

This wasn’t a fluke, either.

They also grew during the 2001 recession, rising 5.5% while the overall stock market dropped 15.5%.

In other words, while vaping bans don’t bode well for certain tobacco companies, that doesn’t necessarily matter for us. Many tobacco stocks are still great, recession-resistant investments.

E-Cig Bans Can’t Touch This Company

This might sound counterintuitive, but vaping bans could actually boost a company like Universal Corporation (UVV).

That’s because this century-old Virginia-based company does one thing: sell raw tobacco leaf to major players like China National Tobacco, Altria Group, and British American Tobacco.

It doesn’t have so much as a toe in the e-cigarette market. So e-cigarette regulations can’t hurt the company. (Perversely enough, they might even help, as smokers return to traditional cigarettes if and when e-cigarettes become harder to buy.)

Investors took notice of Universal’s unique position last week. Shares jumped 4.1% after the San Francisco ban was announced.

This is part of the reason Universal Group is the best tobacco company to buy right now. And for dividend investors like us, it offers a safe 5% dividend yield.

Don’t Get Smacked on the Way Down

Here at The Weekly Profit, we’re focused on finding safe and stable dividend-paying stocks. These are companies you want to own no matter what’s happening in the economy or the market.

Frankly, most investors take on too much risk. This leaves them vulnerable when the market heads south.

That’s especially true right now. As you likely know, the stock market is near all-time highs. And the US economy is nearing the end of a decade-long expansion.

Meanwhile, several closely watched indicators are pointing to a recession in the coming months.

That’s why you should start preparing your portfolio now. After all, nothing goes up forever. And you don’t want to get smacked on the way down.

The right tobacco stocks can help. Remember, people who buy cigarettes buy them no matter what. That makes tobacco stocks very resilient.

Yes, I know tobacco companies make addictive, unhealthy products. So does Coca-Cola (KO). And Pfizer (PFE). And a slew of other companies.

My job is to help you find the best dividend-paying stocks—not to play morality cop. We’re all grown-ups here. You can decide for yourself if investing in tobacco is something you’re comfortable with.

But bear in mind, the industry’s profits are almost guaranteed. So it’s at least worth a look.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.